ADT 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

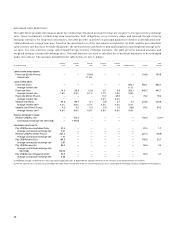

Since the fourth quarter of Fiscal 2000, when we began

construction of the transatlantic portion of the TGN, TyCom’s

revenues have decreased due to lower third-party contract sales,

while fixed costs have generally increased due to our building

the infrastructure to support the TGN, including network oper-

ations, sales and marketing, research and development and

administration. The 26.6% decrease in revenue in Fiscal 2001 as

compared to Fiscal 2000 reflects generally the downturn in the

telecommunications industry and specifically a decrease in

third-party contract sales for undersea communication systems.

In addition, certain revenues were deferred pending customer

financing. TyCom may continue to experience softness in demand

if the current downturn in the telecommunications industry con-

tinues. However, TyCom believes that its technological capabilities

and contraction in the number of competitors should mitigate the

negative effects of industry trends on its results in the longer term.

The 56.4% increase in revenue in Fiscal 2000 over Fiscal

1999 resulted primarily from increased demand for third-party

sales of undersea communications systems and, to a much lesser

extent, the acquisition in May 1999 of Telecomunicaciones

Marinas, S.A. (“Temasa”). Excluding the effect of Temasa, the

revenue increase for the segment in Fiscal 2000 was an esti-

mated 54.0%.

The 21.7% decrease in operating income, before certain

charges, in Fiscal 2001 compared with Fiscal 2000 was princi-

pally due to the decrease in the volume of undersea cable com-

munications systems sales and services to others. The increase

in operating margins was primarily due to project completions

and certain reduced accruals due to lower profitability levels for

Fiscal 2001 and certain contractual settlements.

The substantial increase in operating income, before and

after certain charges, in Fiscal 2000 compared with Fiscal 1999

was primarily due to higher sales volume, and to a lesser extent,

the Temasa acquisition. The increase in operating income, after

certain charges, was offset by a non-recurring charge of

$13.1 million incurred in connection with the TyCom initial

public offering.

FOREIGN CURRENCY

The effect of changes in foreign exchange rates for Fiscal 2001

compared to Fiscal 2000 was a decrease in revenue of approxi-

mately $1,053.6 million and a decrease in operating income of

approximately $199.5 million. The effect of changes in foreign

exchange rates for Fiscal 2000 compared to Fiscal 1999 was a

decrease in revenue of approximately $528.6 million and a

decrease in operating income of approximately $105.9 million.

CORPORATE EXPENSES

Corporate expenses, excluding a net gain on sale of businesses

and investments of $276.6 million, a net non-recurring credit of

$163.4 million, primarily for the settlement of litigation, and a

net gain of $64.1 million on the sale of common shares of a sub-

sidiary, were $191.9 million in Fiscal 2001 as compared to

$187.4 million in Fiscal 2000 and $122.9 million in Fiscal 1999.

These increases were due principally to higher compensation

expense under our equity-based incentive compensation plans

and an increase in corporate staffing and related costs to sup-

port and monitor our expanding businesses and operations.

AMORTIZATION OF GOODWILL

Amortization of goodwill, a non-cash charge, increased

$193.0 million to $537.4 million in Fiscal 2001 compared with

Fiscal 2000. Fiscal 2000 amortization of goodwill increased to

$344.4 million from $216.1 million in Fiscal 1999. The increases

in goodwill amortization expenses were due to net increases in

goodwill balances of $10,066.2 million in Fiscal 2001 and

$3,764.4 million in Fiscal 2000, all due to acquisitions. In accor-

dance with recently adopted accounting rule changes, goodwill

will no longer be amortized beginning with our Fiscal 2002 year.

See Accounting and Technical Pronouncements within Note 1 to our

Consolidated Financial Statements for a discussion of these

accounting rule changes.

INTEREST EXPENSE, NET

Interest expense, net, increased $6.9 million to $776.5 million

in Fiscal 2001, as compared to Fiscal 2000, and increased

$284.0 million to $769.6 million in Fiscal 2000, as compared to

Fiscal 1999. These increases were due primarily to higher aver-

age debt balances, resulting from borrowings to finance acqui-

sitions and our share repurchase program, offset by lower

interest rates during Fiscal 2001. The increase in borrowings was

mitigated in part by the generation of a substantial amount of

free cash flow. The weighted-average rates of interest on Tyco

Industrial’s long-term debt outstanding at September 30, 2001

and 2000 were 4.2% and 6.6%, respectively.