ADT 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

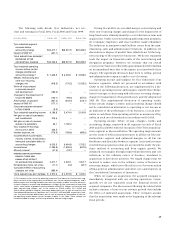

TYCO INDUSTRIAL BACKLOG

At September 30, 2001, Tyco Industrial had a backlog of unfilled

orders of $10,999.1 million, compared to a backlog of

$10,418.2 million as of September 30, 2000. We expect that

approximately 76% of our backlog at September 30, 2001 will be

filled during Fiscal 2002. Backlog by reportable industry seg-

ment is as follows:

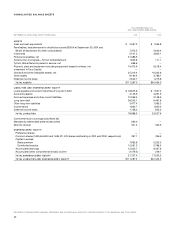

SEPTEMBER 30,

($ IN MILLIONS) 2001 2000

Fire and Security Services $ 8,010.9 $ 4,888.3

Electronics 1,943.9 2,497.1

Telecommunications 865.9 2,941.7

Healthcare and Specialty Products 178.4 91.1

$10,999.1 $10,418.2

Backlog for Fire and Security Services includes recurring

“revenue in force,” which represents one year’s fees for security

monitoring and maintenance services under contract. The

amount of backlog as of September 30, 2000 has been restated

to include recurring revenue in force at that date of $2,203.4 mil-

lion. The amount of recurring revenue in force at September 30,

2001 is $3,099.6 million. Within the Fire and Security Services

segment, backlog increased due to the following: the deferral of

$1,453.5 million of net revenue as a result of the adoption of

SAB 101, an increase in services contracts of the security busi-

ness, an increase in contract bookings at Tyco Infrastructure

and, to a lesser extent, the effect of acquisitions.

Within the Electronics segment, backlog decreased due to

the cancellation and/or delay of orders by customers in certain

end-markets, such as the computer and consumer electronics

and communications industries. The decrease in backlog within

the Telecommunications segment reflects generally the down-

turn in the telecommunications industry and specifically a

decrease in third-party contracts for undersea communications

systems, partially offset by contracts signed for capacity sales on

the TGN. In addition, a $710.5 million contract previously

booked was removed from backlog pending customer financing.

The increase in backlog in Healthcare and Specialty Products is

due to the deferral of $71.6 million of net revenue as a result of

the adoption of SAB 101. Backlog in the Healthcare and Specialty

Products segment represents unfilled orders which, in the

nature of the business, are normally shipped shortly after pur-

chase orders are received. We do not view backlog in the health-

care industry to be a significant indicator of the level of future

sales activity.

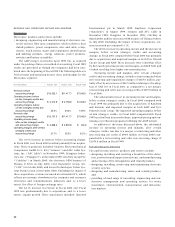

TYCO CAPITAL

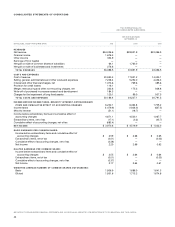

Tyco Capital maintains committed bank lines of credit aggregat-

ing $8.5 billion to provide back-stop support of its commercial

paper borrowings and approximately $252.4 million of local

bank lines to support international operations. Tyco Capital’s

primary bank line agreements include a minimum equity

requirement of $3.8 billion. Included as part of Tyco Capital’s

securitization programs are committed asset-backed commer-

cial paper programs in the U.S. and Canada aggregating approx-

imately $4.6 billion. To ensure uninterrupted access to capital at

competitive interest rates, Tyco Capital maintains strong invest-

ment grade ratings.

As part of Tyco Capital’s continuing program of accessing

the public and private asset-backed securitization markets as

an additional liquidity source, general equipment finance

receivables of $2.2 billion were securitized during the Four

Month Period.

As part of Tyco Capital’s initiative to address businesses

that did not fit strategically, or portfolios that did not meet prof-

itability requirements, during the Four Month Period, approxi-

mately $1.8 billion of assets were sold and a total of $3.6 billion

of managed assets were either sold, liquidated or placed in liq-

uidation status. In addition, Tyco Capital received $898.3 million

in capital contributions from Tyco Industrial to partially offset

the impact to tangible capital from push-down accounting. As

a result, tangible equity to managed assets and total debt to

tangible equity were 8.55% and 8.13%, respectively.

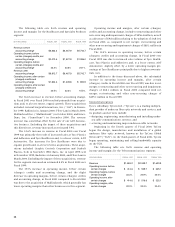

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK

TYCO INDUSTRIAL

We are subject to market risk associated with changes in inter-

est rates, foreign currency exchange rates and certain commod-

ity prices. In order to manage the volatility relating to our more

significant market risks, we enter into forward foreign currency

exchange contracts, cross-currency swaps, foreign currency

options, commodity swaps and interest rate swaps. We do not

anticipate any material changes in our primary market risk

exposures in Fiscal 2002.

We utilize risk management procedures and controls in exe-

cuting derivative financial instrument transactions. We do not

execute transactions or hold derivative financial instruments for

trading purposes. Derivative financial instruments related to

interest rate sensitivity of debt obligations, intercompany

cross-border transactions and anticipated non-functional cur-

rency cash flows, as well as commodity price exposures, are used

with the goal of mitigating a significant portion of these expo-

sures when it is cost effective to do so. Counter-parties to deriv-

ative financial instruments are limited to financial institutions

with at least an AA long-term credit rating.