ADT 2001 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

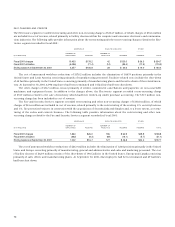

72

the Healthcare business and $1.2 million for other non-recurring

charges. In Fiscal 2001, the Company recorded a credit of

$166.8 million related to the settlement of litigation in which the

Company was provided with an ongoing OEM arrangement val-

ued at $166.8 million. At September 30, 2001, $35.5 million of the

$275.0 million non-recurring charge remains in accrued

expenses and other current liabilities on the Consolidated Bal-

ance Sheet.

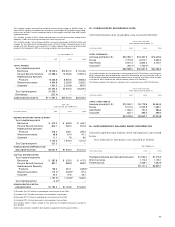

1999 CHARGES AND CREDITS

In Fiscal 1999, the Electronics segment recorded net merger,

restructuring and other non-recurring charges of $643.3 mil-

lion, of which charges of $106.4 million are included in cost of

revenue, related primarily to the merger with AMP and costs

associated with AMP’s profit improvement plan. These charges

include the cost of workforce reductions of $433.7 million for the

elimination of 16,139 positions primarily in the United States

and Europe, consisting primarily of manufacturing and distri-

bution, administrative, research and development and sales and

marketing personnel, and the cost of facility closures of

$68.6 million relating to the shut-down and consolidation of 87

facilities primarily in the United States and Europe. It also

includes other charges of $141.0 million consisting of $88.1 mil-

lion related to the write-down of inventory; transaction costs of

$67.9 million for direct expenses related to the AMP merger;

other costs of $25.4 million relating primarily to the consolida-

tion of certain product lines and other non-recurring charges

related to the AMP merger; lease termination costs following

the merger of $9.6 million; and a credit of $50.0 million related

to a litigation settlement with AlliedSignal Inc. At Septem-

ber 30, 2001, these restructuring activities were substantially

completed. The remaining balance of $13.6 million at Septem-

ber 30, 2001 relates to payments on non-cancelable lease oblig-

ations and is included in other long-term liabilities on the

Consolidated Balance Sheet.

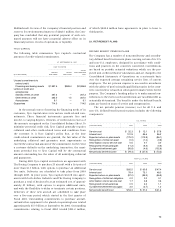

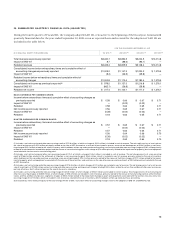

In Fiscal 1999, the Healthcare and Specialty Products seg-

ment recorded net merger, restructuring and other non-recurring

charges of $419.1 million, consisting of a $423.8 million charge

related primarily to the merger with U.S. Surgical and a $4.7 mil-

lion credit representing a revision of estimates related to the

Company’s 1997 restructuring and other non-recurring accruals.

The $423.8 million charge includes workforce reductions of

$124.8 million for the elimination of 1,467 positions primarily in

the United States and Europe, consisting primarily of manufac-

turing and distribution, sales and marketing, administrative and

research and development personnel. In addition, these charges

include the cost of facility closures of $51.8 million for the

shut-down and consolidation of 45 facilities primarily in Europe

and the United States. The charges also include other charges

of $247.2 million consisting of lease termination costs follow-

ing the merger of $156.8 million relating to the U.S. Surgical

North Haven facility that was purchased by the Company sub-

sequent to the merger (see Note 3); transaction costs of

$53.3 million related to the U.S. Surgical merger; and other costs

of $37.1 million relating to the consolidation of certain product

lines and other non-recurring charges related primarily to the

U.S. Surgical merger. At September 30, 2001, these restructuring

activities were completed.

In Fiscal 1999, the Company recorded a credit of $31.9 mil-

lion, including $27.2 million in the Fire and Security Services

segment and $4.7 million in the Healthcare and Specialty Prod-

ucts segment referred to above, representing a revision of esti-

mates related to the Company’s 1997 restructuring and other

non-recurring accruals. The actions under the Company’s 1997

restructuring plans have been completed.

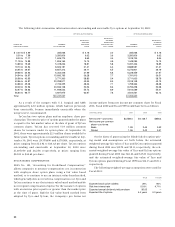

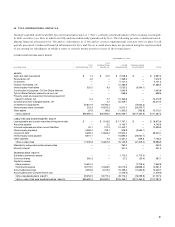

22. COMMITMENTS AND CONTINGENCIES

The Company occupies certain facilities under leases that expire

at various dates through the year 2031. Rental expense under

these leases and leases for equipment was $652.5 million,

$442.7 million and $381.0 million for Fiscal 2001, Fiscal 2000 and

Fiscal 1999, respectively. At September 30, 2001, the minimum

lease payment obligations under noncancelable operating leases

were as follows: $666.6 million in Fiscal 2002, $590.3 million in

Fiscal 2003, $471.5 million in Fiscal 2004, $350.3 million in Fis-

cal 2005, $286.3 million in Fiscal 2006 and an aggregate of

$1,499.0 million in Fiscal years 2007 through 2031.

In the normal course of business, the Company is liable for

contract completion and product performance. In the opinion of

management, such obligations will not significantly affect the

Company’s financial position or results of operations.

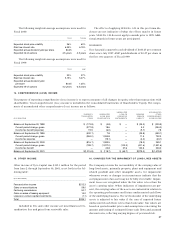

The Company is a defendant in a number of other pending

legal proceedings incidental to present and former operations,

acquisitions and dispositions. The Company does not expect the

outcome of these proceedings, either individually or in the

aggregate, to have a material adverse effect on its financial posi-

tion, results of operations or liquidity.

TYCO INDUSTRIAL

Tyco Industrial is involved in various stages of investigation

and cleanup related to environmental remediation matters at a

number of sites. The ultimate cost of site cleanup is difficult to

predict given the uncertainties regarding the extent of the

required cleanup, the interpretation of applicable laws and

regulations and alternative cleanup methods. Based upon Tyco

Industrial’s experience with environmental remediation mat-

ters, Tyco Industrial has concluded that there is at least a

reasonable possibility that we will incur remedial costs in the

range of $186.0 million to $492.1 million. As of September 30,

2001, Tyco Industrial concluded that the best estimate within

this range is $268.5 million, of which $206.2 million is included

in accrued expenses and other current liabilities and $62.3 mil-

lion is included in other long-term liabilities on the Consolidated

Balance Sheet. The increase in the environmental remediation

reserve at September 30, 2001 compared to the $68.3 million

reserve at September 30, 2000 is due to the acquisition of