ADT 2001 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

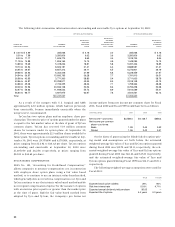

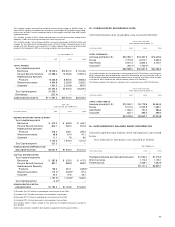

The projected benefit obligation, accumulated benefit

obligation, and fair value of plan assets for U.S. pension plans

with accumulated benefit obligations in excess of plan assets

were $1,986.3 million, $1,921.6 million and $1,550.8 million,

respectively, at September 30, 2001 and $30.3 million, $29.3 mil-

lion and $9.3 million, respectively, at September 30, 2000.

The projected benefit obligation, accumulated benefit oblig-

ation, and fair value of plan assets for non-U.S. pension plans

with accumulated benefit obligations in excess of plan assets

were $1,078.8 million, $938.7 million and $603.9 million, respec-

tively, at September 30, 2001 and $543.8 million, $464.0 million

and $256.1 million, respectively, at September 30, 2000.

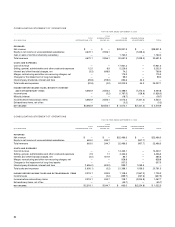

The Company also participates in a number of

multi-employer defined benefit plans on behalf of certain

employees. Pension expense related to multi-employer plans

was $6.4 million, $8.2 million and $7.5 million for Fiscal 2001,

Fiscal 2000 and Fiscal 1999, respectively.

DEFINED CONTRIBUTION RETIREMENT PLANS

The Company maintains several defined contribution retirement

plans, which include 401(k) matching programs, as well as qual-

ified and nonqualified profit sharing and share bonus retirement

plans. Pension expense for the defined contribution plans is com-

puted as a percentage of participants’ compensation and was

$157.4 million, $132.7 million and $73.2 million for Fiscal 2001,

Fiscal 2000 and Fiscal 1999, respectively. The Company also main-

tains an unfunded Supplemental Executive Retirement Plan

(“SERP”). This plan is nonqualified and restores the employer

match that certain employees lose due to IRS limits on eligible

compensation under the defined contribution plans. Expense

related to the SERP was $9.0 million, $10.8 million and $6.9 mil-

lion in Fiscal 2001, Fiscal 2000 and Fiscal 1999, respectively.

POSTRETIREMENT BENEFIT PLANS

The Company generally does not provide postretirement bene-

fits other than pensions for its employees. Certain of the Com-

pany’s acquired operations provide these benefits to employees

who were eligible at the date of acquisition.

AMP provides postretirement health care coverage to qual-

ifying U.S. retirees. As a result of the merger with the Company,

a $13.7 million adjustment was recorded to conform AMP’s

accounting method for postretirement benefits to the Com-

pany’s method regarding the initial recognition of such benefits

upon adoption of SFAS No. 106 “Employers’ Accounting for

Postretirement Benefits Other Than Pensions.”

In the second quarter of Fiscal 1999, AMP offered enhanced

postretirement benefits to terminated employees totaling

$16.0 million, which was recorded as part of AMP’s second quar-

ter restructuring charge. This amount has not been included in

the determination of net periodic benefit cost presented below.

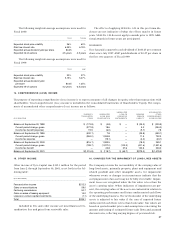

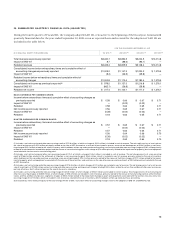

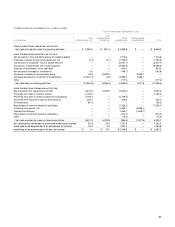

Net periodic postretirement benefit cost reflects the follow-

ing components:

($ IN MILLIONS) 2001 2000 1999

Service cost (with interest) $ 3.7 $ 1.1 $ 3.5

Interest cost 23.6 12.7 12.0

Expected return on assets (0.3)

——

Amortization of prior service cost (2.5) (1.9) (2.2)

Amortization of net gain (1.6) (1.6) (0.7)

Curtailment loss (gain) 0.4 (3.2) (5.8)

Net periodic postretirement

benefit cost $23.3 $ 7.1 $ 6.8

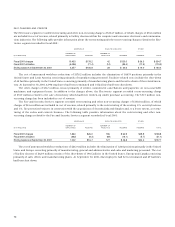

The components of the accrued postretirement benefit

obligation, all of which are generally unfunded, are as follows:

SEPTEMBER 30,

($ IN MILLIONS) 2001 2000

CHANGE IN BENEFIT OBLIGATION

Benefit obligation at beginning of year $ 167.6 $ 168.2

Service cost 3.7 1.1

Interest cost 23.6 12.7

Amendments (19.5) (3.1)

Actuarial loss (gain) 42.4 (1.7)

Acquisition 184.7 8.4

Curtailment loss 0.4 1.7

Expected net benefits paid (30.4) (19.6)

Currency fluctuation gain (0.3) (0.1)

Benefit obligation at end of year $ 372.2 $ 167.6

CHANGE IN PLAN ASSETS

Actual return on plan assets $ 0.3 $

—

Acquisition 4.9

—

Fair value of plan assets at end of year $ 5.2 $

—

Funded status $(367.0) $(167.6)

Unrecognized net loss (gain) 14.3 (29.6)

Unrecognized prior service cost (28.2) (11.1)

Accrued postretirement benefit cost $(380.9) $(208.3)

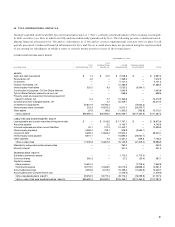

For measurement purposes, in Fiscal 2001, a 9.0% compos-

ite annual rate of increase in the per capita cost of covered health

care benefits was assumed. The rate was assumed to decrease

gradually to 5.0% by the year 2008 and remain at that level

thereafter. The health care cost trend rate assumption may have

a significant effect on the amounts reported. A one-percent-

age-point change in assumed healthcare cost trend rates would

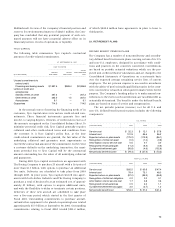

have the following effects:

1-PERCENTAGE- 1-PERCENTAGE-

($ IN MILLIONS) POINT INCREASE POINT DECREASE

Effect on total of service and interest

cost components $ 1.6 $ (1.4)

Effect on postretirement benefit obligation 16.2 (14.0)

The combined weighted average discount rate used in

determining the accumulated postretirement benefit obligation

was 7.5% at September 30, 2001 (8.0% at September 30, 2000).