ADT 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

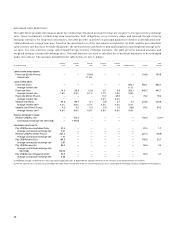

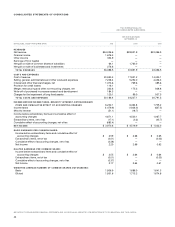

EXCHANGE RATE SENSITIVITY

The table below provides information about Tyco Industrial’s financial instruments that are sensitive to foreign currency exchange

rates. These instruments include long-term investments, debt obligations, cross-currency swaps and forward foreign currency

exchange contracts. For long-term investments, the table presents cash flows of principal payments related to a subordinated, non-

collateralized zero coupon loan note, based on the amortized cost of the investment at September 30, 2001, and the associated fair

value interest rate discount. For debt obligations, the table presents cash flows of principal repayment and weighted-average inter-

est rates. For cross-currency swaps and forward foreign currency exchange contracts, the table presents notional amounts and

weighted-average contractual exchange rates. Notional amounts are used to calculate the contractual payments to be exchanged

under the contract. The amounts included in the table below are in U.S. dollars.

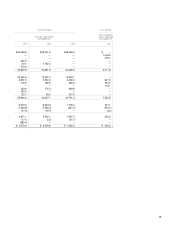

FISCAL FISCAL FISCAL FISCAL FISCAL FAIR

($ IN MILLIONS) 2002 2003 2004 2005 2006 THEREAFTER TOTAL VALUE

LONG-TERM INVESTMENT:

Fixed rate (British Pound)

——

134.8

———

134.8 134.8

Interest rate 11.5%

LONG-TERM DEBT:

Fixed rate (Euro)

—————

550.1 550.1 562.7

Average interest rate 6.1%

Fixed rate (Yen) 74.5 39.9 10.6 6.1 3.5 306.1 440.7 440.7

Average interest rate 1.9% 2.3% 2.1% 1.7% 1.9% 3.8%

Fixed rate (British Pound)

———

13.7 65.5

—

79.2 79.2

Average interest rate 4.4% 5.2%

Variable rate (Euro) 94.6 89.7 6.1 3.8 3.7 5.7 203.6 203.6

Average interest rate (1) 4.2% 4.6% 4.7% 4.5% 4.4% 5.0%

Variable rate (French Franc) 4.2 5.0 5.3 5.9 7.0 26.8 54.2 54.2

Average interest rate (1) 4.9% 4.9% 4.9% 4.9% 4.9% 4.9%

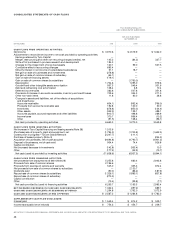

CROSS-CURRENCY SWAP:

Receive US$/Pay Yen

—

150.0

————

150.0 (0.1)(2)

Contractual exchange rate (Yen/US$)

—

119.65

————

FORWARD CONTRACTS:

Pay US$/Receive Australian Dollar 20.4

—————

20.4 1.7

Average contractual exchange rate 0.51

—————

Receive US$/Pay British Pound 227.4

—————

227.4 (18.9)

Average contractual exchange rate 1.41

—————

Pay US$/Receive Euro 146.3

—————

146.3 20.7

Average contractual exchange rate 0.87

—————

Pay US$/Receive Yen 96.4

—————

96.4 4.4

Average contractual exchange rate

(Yen/US$) 123.04

—————

Pay US$/Receive Singapore Dollar 50.5

—————

50.5 0.7

Average contractual exchange rate 0.56

—————

(1) Weighted-average variable interest rates are based on applicable rates at September 30, 2001 per the terms of the contracts of the related financial instruments.

(2) The fair value of cross-currency swap included in the table reflects the portion of the fair value of the contract that is attributable to the foreign currency component of the contracts.