ADT 2001 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

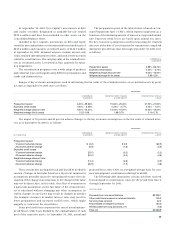

7. SALE OF ACCOUNTS RECEIVABLE

Tyco Industrial has an agreement under which several of its

operating subsidiaries sell a defined pool of trade accounts

receivable to a limited purpose subsidiary of the Company. The

subsidiary, a separate corporate entity, holds these receivables

and sells participating interests in such accounts receivable to

financiers who, in turn, purchase and receive ownership and

security interests in those receivables. As collections reduce

accounts receivable included in the pool, the operating sub-

sidiaries sell new receivables to the limited purpose subsidiary.

The limited purpose subsidiary has the risk of credit loss on the

receivables and, accordingly, the full amount of the allowance

for doubtful accounts has been retained on the Consolidated

Balance Sheets. The availability under the program is $500 mil-

lion. At September 30, 2001 and 2000, $466 million and

$450 million, respectively, was utilized under the program. The

proceeds from the sales were used to reduce borrowings

under TIG’s commercial paper program and are reported as

operating cash flows in the Consolidated Statements of Cash

Flows. The proceeds of sale are less than the face amount of

accounts receivable sold by an amount that approximates

the cost that the limited purpose subsidiary would incur if it

were to issue commercial paper backed by these accounts receiv-

able. The discount from the face amount is accounted for as a

loss on the sale of receivables and has been included in selling,

general, administrative and other costs and expenses in the

Consolidated Statements of Operations. Such discount aggre-

gated $25.3 million, $25.7 million, and $15.7 million, or 5.3%,

6.6% and 5.6% of the weighted-average balance of the receiv-

ables outstanding, during Fiscal 2001, Fiscal 2000 and Fiscal

1999, respectively. The operating subsidiaries retain collection

and administrative responsibilities for the participating inter-

ests in the defined pool.

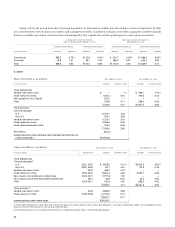

In September 2001, TIG entered into a separate agreement

to sell a defined pool of trade accounts receivable from time to

time to a financial institution in Europe. The terms and condi-

tions of the agreement are substantially similar to the program

discussed above, although in this case there is no limited pur-

pose subsidiary acting as an intermediary. The availability under

this program is $175.0 million. TIG sold certain accounts receiv-

able under this program for net proceeds of $160.0 million,

which is net of a discount of $1.4 million.

Also in September 2001, Tyco Industrial sold certain

accounts receivable to Tyco Capital for net proceeds of approxi-

mately $297.8 million, which is net of a discount of $4.3 million.

This sale is eliminated as an intercompany transaction in Tyco’s

Consolidated Financial Statements.

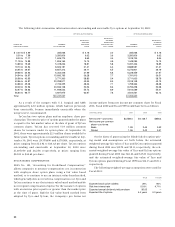

8. FINANCIAL INSTRUMENTS

The Company’s financial instruments consist primarily of cash

and cash equivalents, accounts receivable, finance receivables,

retained interest in securitizations, long-term investments,

accounts payable, debt, derivative financial instruments and

mandatorily redeemable preferred securities. The fair value of

cash and cash equivalents, accounts receivables, retained inter-

ests in securitizations, long-term investments, accounts payable

and mandatorily redeemable preferred securities approximated

book value at September 30, 2001 and 2000. See Notes 4 and 6

for the fair value estimates of finance receivables and debt,

respectively.

In accordance with SFAS No. 133, all derivative financial

instruments are reported on the Consolidated Balance Sheet at

fair value, and changes in a derivative’s fair value are recognized

currently in earnings unless specific hedge criteria are met.

While it is not the Company’s intention to terminate its deriva-

tive financial instruments, based on their estimated fair values

the termination of forward foreign currency exchange con-

tracts, cross-currency swap agreements, forward commodity

contracts and interest rate swaps at September 30, 2001 would

have resulted in a $120.4 million gain, a $93.2 million gain, a

$6.8 million loss and a $103.9 million loss, respectively, and at

September 30, 2000 would have resulted in a $279.0 million

gain, a $15.3 million loss, an $11.1 million gain and a $95.7 mil-

lion loss, respectively. At September 30, 2001 and 2000, the book

values of derivative financial instruments recorded on the Con-

solidated Balance Sheets equaled fair values.

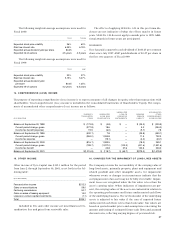

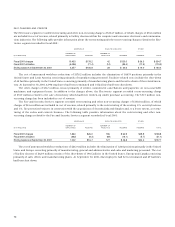

INTEREST RATE EXPOSURES

The Company uses interest rate swaps to hedge its exposure to

interest rate risk by exchanging fixed rate interest on certain of

its debt for variable rate amounts. These interest rate swaps are

designated as fair value hedges. Certain of the Company’s inter-

est rate swaps entered into during Fiscal 2001, as assessed using

the short-cut method under SFAS No. 133, were highly effective.

The ineffective element of the gains and losses on certain other

interest rate swaps during Fiscal 2001, totaling a net gain of

$19.7 million, has been recognized in interest and other financial

charges, along with the effective element of the change in fair

value of the interest rate swaps and the related hedged debt.

Tyco Capital also exchanges variable rate interest on certain

of its debt for fixed rate amounts. These interest rate swaps are

designated as cash flow hedges. Unrealized gains and losses on

the effective portion of derivatives designated as cash flow

hedges are recorded in accumulated other comprehensive

income within the Consolidated Statements of Shareholders’

Equity. Assuming no change in interest rates, $13.5 million

would be credited to earnings in Fiscal 2002 as contractual cash

payments are made. For the period June 2 through Septem-

ber 30, 2001, the ineffective portion of changes in the fair value

of cash flow hedges amounted to $3.9 million and has been

recorded as a reduction to interest expense.