ADT 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

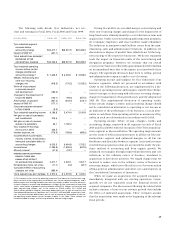

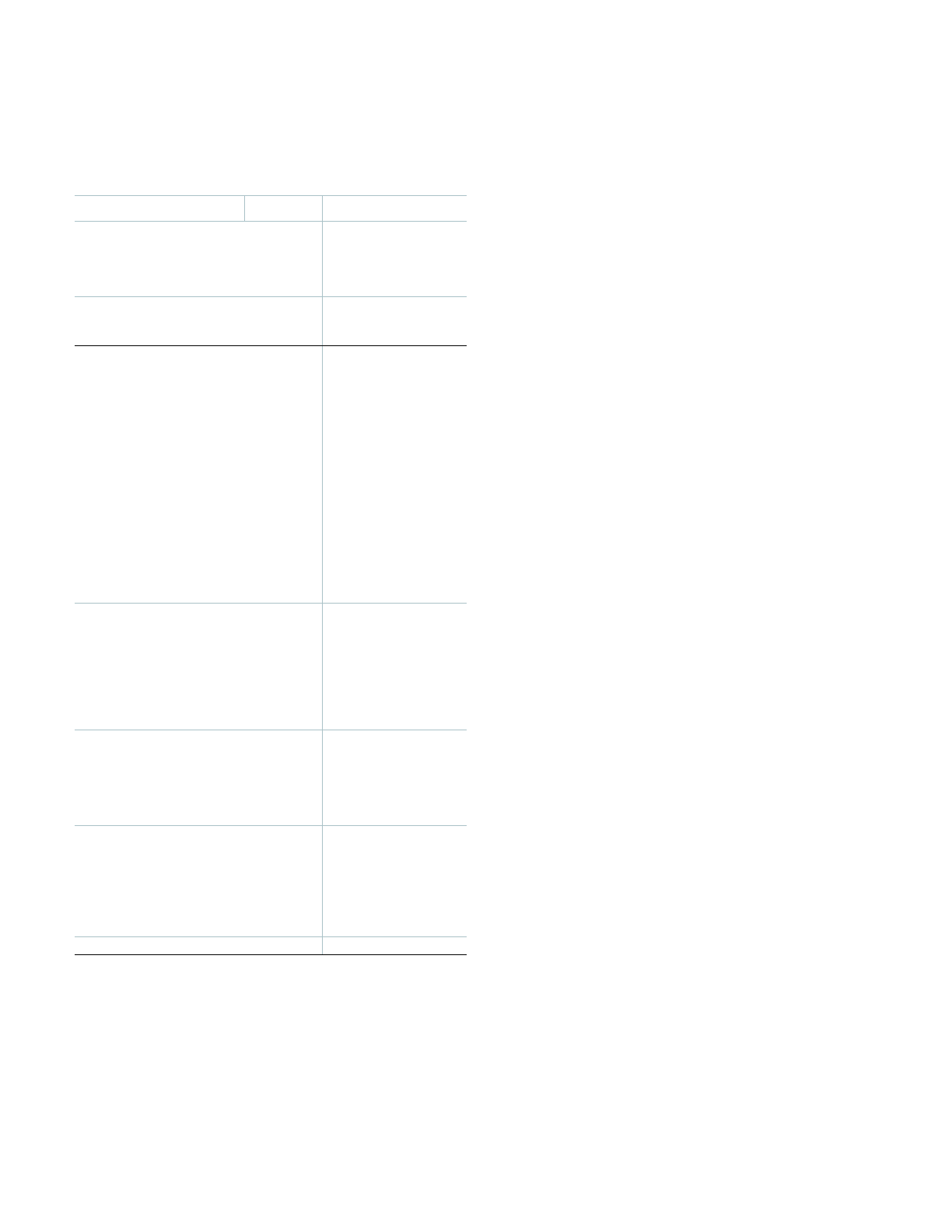

The following table details Tyco Industrial’s net rev-

enue and earnings in Fiscal 2001, Fiscal 2000 and Fiscal 1999:

($ IN MILLIONS) FISCAL 2001 FISCAL 2000 FISCAL 1999

Tyco Industrial segment

revenues before

accounting change $34,277.7 $28,931.9 $22,496.5

Impact of SAB 101 (241.1)

——

TYCO INDUSTRIAL SEGMENT

REVENUES AFTER

ACCOUNTING CHANGE $34,036.6 $28,931.9 $22,496.5

Tyco Industrial operating

income, before certain

charges (credits) and

accounting change(1) $ 7,623.5 $ 6,094.1 $ 3,949.6

Merger, restructuring and

other non-recurring

charges, net (418.5) (176.3) (1,035.2)

Write-off of purchased

in-process research

and development (184.3)

——

Charges for the impairment of

long-lived assets (120.1) (99.0) (507.5)

Amortization of goodwill (537.4) (344.4) (216.1)

Impact of SAB 101 (171.1)

——

Corporate expense allocated

to Tyco Capital (5.3)

——

Tyco Industrial operating income 6,186.8 5,474.4 2,190.8

Net gain on sale of businesses

and investments 276.6

——

Net gain on sale of common

shares of a subsidiary 64.1 1,760.0

—

Tyco Capital net earnings

(from June 2, 2001) 252.5

——

Interest expense, net (776.5) (769.6) (485.6)

Income before income taxes,

minority interest, extraordinary

items and cumulative effect of

accounting changes 6,003.5 6,464.8 1,705.2

Income taxes (1,284.9) (1,926.0) (637.5)

Minority interest (47.5) (18.7)

—

INCOME BEFORE EXTRAOR-

DINARY ITEMS AND

CUMULATIVE EFFECT

OF ACCOUNTING CHANGES 4,671.1 4,520.1 1,067.7

Extraordinary items, net of tax (17.1) (0.2) (45.7)

Cumulative effect of accounting

changes, net of tax (683.4)

——

TYCO INDUSTRIAL NET INCOME $ 3,970.6 $ 4,519.9 $ 1,022.0

(1) This amount is the sum of the operating income of Tyco Industrial’s four business seg-

ments set forth in the segment discussion below, less certain corporate expenses, and is

before merger, restructuring and other non-recurring charges (credits), the write-off of pur-

chased in-process research and development, charges for the impairment of long-lived

assets, amortization of goodwill and the adoption of SAB 101. Merger, restructuring and

other non-recurring charges, net, in the amount of $184.9 million, $1.0 million and

$106.4 million related to inventory have been deducted as part of cost of revenue in the

Consolidated Statements of Operations for Fiscal 2001, 2000 and 1999, respectively. How-

ever, they have not been deducted as part of cost of revenue for the purpose of calculat-

ing operating income before certain charges (credits) in this table. These charges are

instead included in merger, restructuring and other non-recurring charges.

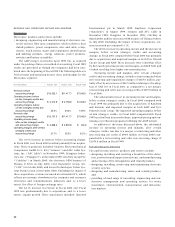

During Fiscal 2001, we recorded merger, restructuring and

other non-recurring charges and charges for the impairment of

long-lived assets related primarily to cost reduction actions and

acquisitions. Under our restructuring and integration programs,

we terminate employees and close facilities made redundant.

The reduction in manpower and facilities comes from the man-

ufacturing, sales and administrative functions. In addition, we

discontinue or dispose of product lines which do not fit the long-

term strategy of the respective businesses. We do not separately

track the impact on financial results of the restructuring and

integration programs. However, we estimate that our overall

cost structure has been reduced by approximately $300.0 million

on an annualized basis due to the impact associated with these

charges. The significant decreases have been to selling, general

and administrative expenses and to cost of revenue.

Operating income and margins for Tyco Industrial’s four

business segments, which are presented in accordance with

GAAP in the following discussion, are supplemented by a dis-

cussion of operating income and margins stated before deduc-

tions for merger, restructuring and other non-recurring charges,

charges for impairment of long-lived assets and the adoption of

SAB 101. This supplemental discussion of operating results

before certain charges (credits) and accounting change should

not be considered an alternative to operating or net income as

an indicator of the performance of our business, or as an alter-

native to cash flows from operating activities as a measure of liq-

uidity, in each case determined in accordance with GAAP.

Operating income, before certain (charges) credits and

accounting change, improved in all segments in each of Fiscal

2001 and Fiscal 2000, with the exception of the Telecommunica-

tions segment as discussed below. The operating improvements

are the result of both increased revenues in all but our Telecom-

munications segment and enhanced margins in all but our

Healthcare and Specialty Products segment. Increased revenues

resulted from acquisitions that are accounted for under the pur-

chase method of accounting and from organic growth. We

enhanced our margins through improved productivity and cost

reductions in the ordinary course of business, unrelated to

acquisition or divestiture activities. We regard charges that we

incurred to reduce costs in the ordinary course of business as

recurring charges, which are reflected in cost of revenue and in

selling, general, administrative and other costs and expenses in

the Consolidated Statements of Operations.

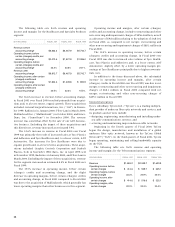

When we make an acquisition, the acquired company is

immediately integrated with our existing operations. Conse-

quently, we do not separately track the financial results of

acquired companies. The discussions following the tables below

include estimates of year-to-year revenue growth that exclude

the effects of indicated acquisitions. These estimates assume

that the acquisitions were made at the beginning of the relevant

fiscal periods.