ADT 2001 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

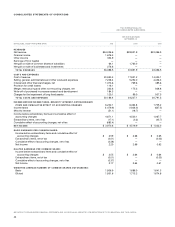

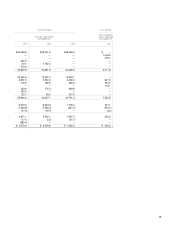

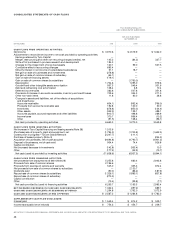

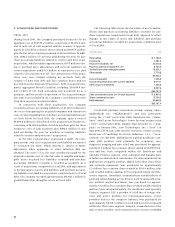

CONSOLIDATED STATEMENTS OF CASH FLOWS

TYCO INTERNATIONAL LTD.

AND CONSOLIDATED SUBSIDIARIES

FOR THE YEAR ENDED

SEPTEMBER 30,

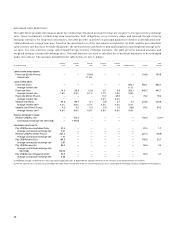

(IN MILLIONS) 2001 2000 1999

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income $ 3,970.6 $ 4,519.9 $ 1,022.0

Adjustments to reconcile net income to net cash provided by operating activities:

Earnings retained by Tyco Capital

———

Merger, restructuring and other non-recurring charges (credits), net 145.2 (84.2) 327.7

Write-off of purchased in-process research and development 184.3

——

Charges for the impairment of long-lived assets 120.1 99.0 507.5

Cumulative effect of accounting changes 683.4

——

Minority interest in net income of consolidated subsidiaries 51.1 18.7

—

Net gain on sale of businesses and investments (276.6)

——

Net gain on sale of common shares of subsidiary (64.1)

——

Gain on sale of financing assets (119.1)

——

Gain on sale of common shares by subsidiary

—

(1,760.0)

—

Depreciation 1,704.6 1,095.0 979.6

Goodwill and other intangible assets amortization 957.3 549.4 331.6

Debt and refinancing cost amortization 108.4 6.8 10.4

Deferred income taxes 382.6 507.8 351.6

Provisions for losses on accounts receivable, inventory and credit losses 709.6 354.3 211.5

Other non-cash items 11.8 60.0 26.6

Changes in assets and liabilities, net of the effects of acquisitions

and divestitures:

Accounts receivable (434.1) (992.4) (796.0)

Proceeds from accounts receivable sale 192.8 100.0 50.0

Inventories (678.8) (850.0) (124.4)

Other assets (352.3) 129.1 488.1

Accounts payable, accrued expenses and other liabilities (910.7) 496.8 269.9

Income taxes 370.7 896.4 (10.2)

Other (91.5) 128.4 (96.1)

Net cash provided by operating activities 6,665.3 5,275.0 3,549.8

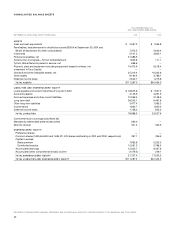

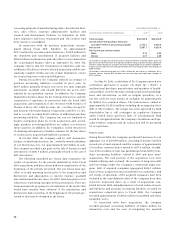

CASH FLOWS FROM INVESTING ACTIVITIES:

Net increase in Tyco Capital financing and leasing assets (Note 28) 1,513.6

——

(Purchase) sale of property, plant and equipment, net (1,794.3) (1,703.8) (1,632.5)

Construction in progress—TyCom Global Network (2,247.7) (111.1)

—

Purchase of leased property (Note 3)

——

(234.0)

Acquisition of businesses, net of cash acquired (9,694.6) (4,790.7) (4,901.2)

Disposal of businesses, net of cash sold 904.4 74.4 926.8

Capital contribution

———

Net (increase) decrease in investments (142.8) (353.4) 10.5

Other (177.2) (52.9) (13.7)

Net cash (used in) provided by investing activities (11,638.6) (6,937.5) (5,844.1)

CASH FLOWS FROM FINANCING ACTIVITIES:

Net proceeds from (repayments of) debt (Note 28) 5,255.6 680.4 2,943.8

Proceeds from sale of common shares 2,196.6

——

Proceeds from exercise of options and warrants 545.0 355.3 872.4

Net proceeds from sale of common shares by subsidiary

—

2,130.7

—

Dividends paid (90.0) (86.2) (187.9)

Repurchase of common shares by subsidiary (1,326.1) (1,885.1) (637.8)

Repurchase of common shares of subsidiary (270.0)

——

Capital contribution

———

Other (15.4) (29.8) (7.1)

Net cash provided by (used in) financing activities 6,295.7 1,165.3 2,983.4

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS 1,322.4 (497.2) 689.1

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 1,264.8 1,762.0 1,072.9

CASH AND CASH EQUIVALENTS AT END OF PERIOD $ 2,587.2 $ 1,264.8 $ 1,762.0

SUPPLEMENTARY CASH FLOW DISCLOSURE:

Interest paid $ 1,549.4 $ 814.2 $ 509.1

Income taxes paid (net of refunds) $ 754.3 $ 454.7 $ 209.7

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS AND, IN PARTICULAR, SEE NOTE 1 FOR DEFINITIONS OF TYCO INDUSTRIAL AND TYCO CAPITAL.