ADT 2001 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

TYCO INDUSTRIAL

In November 2000, Tyco Industrial completed a private place-

ment offering of $4,657,500,000 principal amount at maturity of

zero coupon convertible debentures due 2020 for aggregate net

proceeds of approximately $3,374,000,000. In December 2000,

Tyco filed a registration statement registering the securities for

resale by the holders. Each $1,000 principal amount at maturity

debenture was issued at 74.165% of principal amount at matu-

rity, accretes at a rate of 1.5% per annum and is convertible into

10.3014 Tyco common shares if certain conditions are met. The

Company may be required to repurchase the securities at the

accreted value at the option of the holders on November 17,

2003, 2005, 2007 or 2014. The net proceeds were used to finance

acquisitions and to repay borrowings under the commercial

paper program of Tyco International Group S.A. (“TIG”), a

wholly-owned subsidiary of Tyco and Tyco’s corporate finance

subsidiary, which is included as part of Tyco Industrial.

In December 2000, in accordance with the terms of the orig-

inal issuance, TIG exchanged its 6.125% euro denominated pri-

vate placement notes due 2007 for public notes. The form and

terms of the public notes are identical in all material respects to

the form and terms of the outstanding private placement notes of

the corresponding series, except that the public notes are not sub-

ject to restrictions on transfer under United States securities laws.

In February 2001, TIG issued $1.0 billion 6.375% notes due

2006 and $1.0 billion 6.75% notes due 2011 in a public offering. The

notes are fully and unconditionally guaranteed by Tyco. The net

proceeds of approximately $1,982.1 million were used primarily to

repay borrowings under TIG’s commercial paper program.

In February 2001, TIG completed a private placement offer-

ing of $3,035,000,000 principal amount at maturity of zero

coupon convertible debentures due 2021, which are guaranteed

by Tyco, for aggregate net proceeds of approximately

$2,203,400,000. In April 2001, Tyco filed a registration statement

registering the securities for resale by the holders. Each $1,000

principal amount at maturity debenture was issued at 74.165%

of principal amount at maturity, accretes at a rate of 1.5% per

annum and is convertible into 8.6916 Tyco common shares if cer-

tain conditions are met. TIG may be required to repurchase the

securities at the accreted value at the option of the holders on

February 12, 2003, 2005, 2007, 2009 or 2016. If the February 12,

2003 option is exercised, TIG may elect to repurchase the secu-

rities for cash, Tyco common shares, or some combination

thereof. The net proceeds were used primarily to repay borrow-

ings under TIG’s commercial paper program.

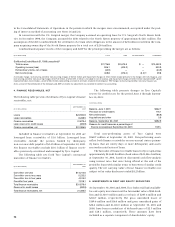

In February 2001, TIG replaced its $4.5 billion and $0.5 bil-

lion revolving credit facilities with a $3.855 billion facility expir-

ing on February 6, 2002, with an option to extend to February 6,

2003, and a $2.0 billion facility expiring on February 6, 2006.

These credit facilities are guaranteed by Tyco. Under the terms

of the facilities, the Company is required to meet certain

covenants, none of which is considered restrictive to its opera-

tions. Also, in May 2001, TIG increased the borrowing capacity

under its commercial paper program from $5.0 billion to

$5.855 billion. TIG plans to use the credit facilities to support

borrowings under its commercial paper program and therefore

expects these facilities to remain largely undrawn.

In July 2001, TIG issued $500 million floating rate notes due

2003, $600 million 4.95% notes due 2003 and $700 million 5.8%

notes due 2006 in a public offering. The notes are fully and

unconditionally guaranteed by Tyco. The net proceeds of

approximately $1,787.9 million were used to repay borrowings

under TIG’s commercial paper program.

In August 2001, Tyco and TIG filed a shelf registration state-

ment to enable TIG to offer from time to time unsecured debt

securities guaranteed by Tyco at an aggregate initial offering

price not to exceed $6.0 billion.

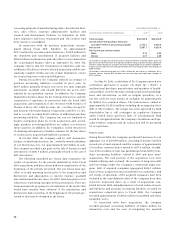

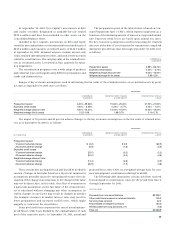

The fair value of debt of Tyco Industrial was approximately

$21,895.0 million (book value of $21,619.0 million) and

$10,851.6 million (book value of $10,999.0 million) at Septem-

ber 30, 2001 and 2000, respectively, based on discounted cash

flow analyses using current market interest rates.

The impact of Tyco Industrial’s interest rate swap activities

on its weighted-average borrowing rate was not material in any

year. The impact on Tyco Industrial’s reported interest expense

was a reduction of $9.7 million, $6.6 million and $0.9 million for

Fiscal 2001, Fiscal 2000 and Fiscal 1999, respectively.

TYCO CAPITAL

In June 2001, Tyco Capital Corporation filed a shelf registration

statement to enable it to offer from time to time debt securities at

an aggregate initial offering price not to exceed $16.2 billion. In

August 2001, Tyco Capital sold $1,000.0 million of debt in a public

offering under this registration statement. The fair value of debt of

Tyco Capital (including accrued interest) was approximately

$36,465.6 million (book value of $36,013.5 million including

accrued interest of $315.8 million) at September 30, 2001, based on

discounted cash flow analyses using current market interest rates.

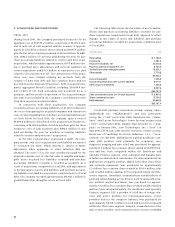

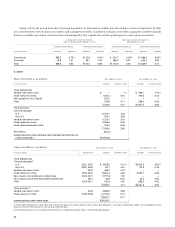

The aggregate amounts of total debt maturing during the next five years are as follows:

($ IN MILLIONS) FISCAL 2002 FISCAL 2003 FISCAL 2004 FISCAL 2005 FISCAL 2006

Tyco Industrial $ 2,023.0 $3,190.5 $ 99.4 $1,253.2 $3,785.5

Tyco Capital 17,050.6 6,778.6 4,391.9 4,593.6 1,175.8

Eliminations (200.0)

————

$18,873.6 $9,969.1 $4,491.3 $5,846.8 $4,961.3