ADT 2001 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

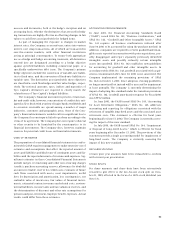

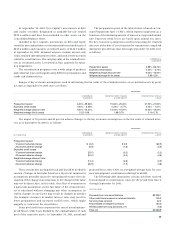

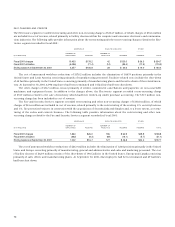

Charge-offs for the period from June 2 through September 30, 2001 and receivables past due 60 days or more at September 30, 2001

are set forth below, for both finance receivables and managed receivables. In addition to finance receivables, managed receivables include

finance receivables previously securitized and still managed by Tyco Capital, but exclude operating leases and equity investments.

CHARGE-OFFS FOR THE PERIOD PAST DUE 60 DAYS OR MORE AT

JUNE 2 THROUGH SEPTEMBER 30, 2001 SEPTEMBER 30, 2001

FINANCE RECEIVABLES MANAGED RECEIVABLES FINANCE RECEIVABLES MANAGED RECEIVABLES

($ IN MILLIONS) AMOUNT PERCENT AMOUNT PERCENT AMOUNT PERCENT AMOUNT PERCENT

Commercial $68.0 0.73% $115.9 0.81% $ 915.7 3.18% $1,386.6 3.62%

Consumer 18.8 1.61 29.1 1.35 188.2 6.01 253.1 4.35

Total $86.8 0.83 $145.0 0.88 $1,103.9 3.46 $1,639.7 3.72

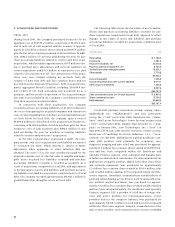

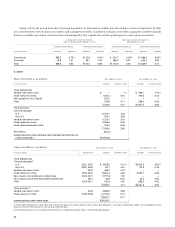

6. DEBT

Short-term debt is as follows: SEPTEMBER 30, 2001 SEPTEMBER 30, 2000

($ IN MILLIONS) AMOUNT INTEREST RATE AMOUNT INTEREST RATE

TYCO INDUSTRIAL

Variable-rate senior notes $

——

% $ 499.7 7.47%

Fixed-rate senior notes 1,347.2 6.81 749.2 6.13

Note payable to Tyco Capital 200.0

———

Other 475.8 3.11 288.3 6.65

2,023.0 5.27 $1,537.2 6.66

TYCO CAPITAL(1)

Commercial paper

U.S. 8,515.1 3.32

Non-U.S. 354.1 4.64

Variable-rate senior notes 5,725.0 3.47

Fixed-rate senior notes 2,356.4 6.38

Fixed-rate subordinated notes 100.0 8.38

17,050.6 3.85

Eliminations (200.0)

CONSOLIDATED LOANS PAYABLE AND CURRENT MATURITIES OF

LONG-TERM DEBT $18,873.6

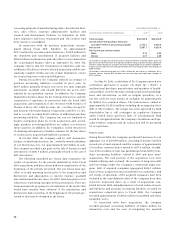

Long-term debt is as follows: SEPTEMBER 30, 2001 SEPTEMBER 30, 2000

($ IN MILLIONS) MATURITIES AMOUNT INTEREST RATE AMOUNT INTEREST RATE

TYCO INDUSTRIAL

Commercial paper(2)

U.S. 2002, 2006 $ 3,909.5 3.31% $2,420.6 6.81%

Non-U.S. 2002, 2006 80.7 4.61 172.9 4.79

Variable-rate senior notes 2003 498.4 4.16

——

Fixed-rate senior notes 2003-2030 8,902.4 6.26 6,395.1 6.56

Zero coupon convertible senior debentures 2020-2021 5,771.8 1.50

——

Zero coupon convertible subordinated debentures 2010 30.8 6.50 35.0 6.50

Other 2003-2017 402.4 4.50 438.2 4.50

19,596.0 4.17 $9,461.8 6.50

TYCO CAPITAL(1)

Variable-rate senior notes 2003 3,889.6 3.89

Fixed-rate senior notes 2003-2028 14,757.5 6.77

18,647.1 6.17

CONSOLIDATED LONG-TERM DEBT $38,243.1

(1) Tyco Capital Corporation’s senior notes and commercial paper have a priority position over its other debt obligations. Tyco Capital Corporation’s debt is not an obligation of Tyco

Industrial, and Tyco International Ltd. has not guaranteed this debt.

(2) Tyco Industrial plans to use its long-term credit facilities to support borrowings under its commercial paper program.