ADT 2001 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

companies within our various business segments. Details regarding these purchase accounting liabilities are set forth below. During

Fiscal 2000, the Company spent a total of $4,790.7 million in cash related to the acquisition of businesses, consisting of $4,246.5 mil-

lion of purchase price (net of cash acquired) plus $544.2 million of cash paid out during Fiscal 2000 for purchase accounting liabili-

ties related to 2000 and prior years’ acquisitions.

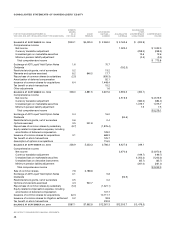

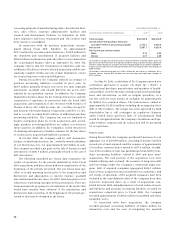

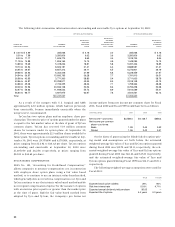

The following table summarizes the purchase accounting liabilities recorded in connection with the Fiscal 2000 purchase

acquisitions:

SEVERANCE FACILITIES OTHER

NUMBER OF NUMBER OF

($ IN MILLIONS) EMPLOYEES RESERVE FACILITIES RESERVE RESERVE TOTAL

Original reserve established 7,215 $ 243.0 102 $ 87.6 $ 95.6 $ 426.2

Fiscal 2000 utilization (4,023) (146.2) (53) (34.3) (47.3) (227.8)

Fiscal 2001 utilization (4,962) (89.3) (65) (40.0) (36.9) (166.2)

Changes in estimates 3,537 35.6 64 36.4 31.7 103.7

Reversal to goodwill in Fiscal 2001 (515) (8.3) (9) (17.2) (7.8) (33.3)

Ending balance at September 30, 2001 1,252 $ 34.8 39 $ 32.5 $ 35.3 $ 102.6

Products segment, for net proceeds of approximately $74.4 mil-

lion in cash.

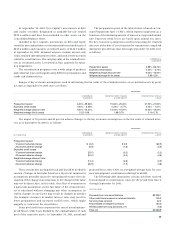

FISCAL 1999

During Fiscal 1999, the Company acquired companies for an

aggregate cost of $5,996.4 million, consisting of $4,546.8 million

in cash and the issuance of 32.4 million common shares valued

at $1,449.6 million. The cash portions of the acquisition costs

were funded utilizing cash on hand, the issuance of long-term

debt and borrowings under the Company’s commercial paper

program. Debt of acquired companies aggregated $926.9 million.

Each of these acquisitions was accounted for as a purchase, and

the results of operations of the acquired companies were

included in the consolidated results of the Company from their

respective acquisition dates. As a result of the acquisitions, the

Company recorded approximately $5,807.9 million in goodwill

and other intangible assets. At September 30, 2001, there

remained on the Consolidated Balance Sheet purchase account-

ing liabilities of $34.5 million for employee severance (princi-

pally for payments to employees already terminated), facility

related costs (principally for rents under non-cancelable leases

for vacated premises) and other costs.

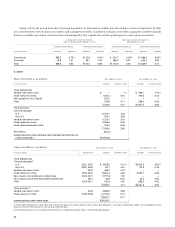

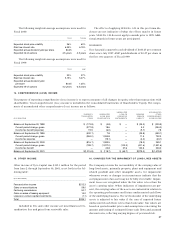

3. POOLING OF INTERESTS TRANSACTIONS

During Fiscal 1999, subsidiaries of Tyco merged with U.S. Surgi-

cal and AMP. A total of approximately 118.4 million and

329.2 million Tyco common shares, respectively, were issued to

the former shareholders of these companies. Both these merger

transactions were accounted for under the pooling of interests

accounting method, which presents as a single interest common

shareholder interests that were previously independent. The

historical consolidated financial statements for periods prior to

the consummation of the mergers are restated as though the

companies had been combined during such periods.

Aggregate fees and expenses related to the mergers and to

the integration of the combined companies have been expensed

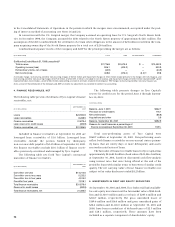

Purchase accounting liabilities recorded during Fiscal 2000

consist of $243.0 million for severance and related costs,

$87.6 million for costs associated with the shut down and consol-

idation of certain acquired facilities and $95.6 million for trans-

action and other direct costs. The $243.0 million of severance and

related costs covers employee termination benefits for approxi-

mately 7,215 employees located throughout the world, consisting

primarily of manufacturing and distribution employees to be ter-

minated as a result of the shut down and consolidation of pro-

duction facilities and, to a lesser extent, administrative, technical

and sales and marketing personnel. At September 30, 2001, 8,985

employees had been terminated and $34.8 million in severance

and related costs remained on the Consolidated Balance Sheet.

The Company expects that the remaining employee terminations

will be completed in Fiscal 2002.

The $87.6 million of exit costs are associated with the closure

and consolidation of 102 facilities located primarily in the Asia-

Pacific region and the United States. These facilities include

manufacturing plants, sales offices, corporate administrative

facilities and research and development facilities. Included

within these costs are accruals for non-cancelable leases associ-

ated with certain of these facilities. Approximately 118 facilities

had been closed or consolidated at September 30, 2001. The

remaining facilities are primarily small manufacturing plants,

which are expected to be shut down in Fiscal 2002. Expenses in

connection with the closure of these remaining facilities, as well

as the rental payments under non-cancelable leases (less any

expected sublease income for facilities already closed), comprise

the approximately $32.5 million for facility related costs remain-

ing on the Consolidated Balance Sheet at September 30, 2001.

During Fiscal 2001, the Company reduced its estimate of

purchase accounting liabilities relating primarily to Fiscal 2000

acquisitions by $33.3 million and, accordingly, goodwill and

related deferred tax assets were reduced by an equivalent

amount. These reductions resulted primarily from costs being

less than originally anticipated.

During Fiscal 2000, the Company sold certain of its

businesses, primarily within the Healthcare and Specialty