ADT 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

EXTRAORDINARY ITEMS

Extraordinary items in Fiscal 2001, Fiscal 2000 and Fiscal 1999

included after-tax losses amounting to $17.1 million, $0.2 mil-

lion and $45.7 million, respectively, relating primarily to the

early extinguishment of debt (see Note 17 to our Consolidated

Financial Statements).

CUMULATIVE EFFECT OF ACCOUNTING CHANGES

In December 1999, the Securities and Exchange Commission

(“SEC”) issued SAB 101, in which the SEC Staff expressed its

views regarding the appropriate recognition of revenue in a

variety of circumstances, some of which are relevant to us. As

required under SAB 101, we modified our revenue recognition

policies with respect to the installation of electronic security

systems (see “Revenue Recognition” within Note 1 to our Consoli-

dated Financial Statements). In addition, in response to SAB

101, we undertook a review of our revenue recognition practices

and identified certain provisions included in a limited number

of sales arrangements that delayed the recognition of revenue

under SAB 101. During the fourth quarter of Fiscal 2001, we

changed our method of accounting for these items retroactive to

the beginning of the fiscal year to conform to the requirements

of SAB 101. This was reported as a $653.7 million after-tax

($1,005.6 million pre-tax) charge for the cumulative effect of

change in accounting principle in the Fiscal 2001 Consolidated

Statement of Operations.

The impact of SAB 101 on total revenues in Fiscal 2001 was

a net decrease of $241.1 million, reflecting the deferral of

$520.5 million of Fiscal 2001 revenues, partially offset by the

recognition of $279.4 million of revenue that is included in the

cumulative effect adjustment as of the beginning of the fiscal

year. We restated each of the first three quarters of Fiscal 2001

in the Consolidated Statement of Operations to reflect the adop-

tion of SAB 101 (see Note 29 to our Consolidated Financial State-

ments). Pro forma amounts for the periods prior to Fiscal 2001

have not been presented since the effect of the change in

accounting principle for these periods could not be reasonably

determined.

We recorded a cumulative effect adjustment, a $29.7 million

loss, net of tax, in Fiscal 2001 in accordance with the transition

provisions of SFAS No. 133 (see Note 1 to our Consolidated

Financial Statements).

LIQUIDITY AND CAPITAL RESOURCES

TYCO INDUSTRIAL

The following table shows the sources of our cash flow from

operating activities and the use of a portion of that cash in our

operations in Fiscal 2001, Fiscal 2000 and Fiscal 1999. We refer

to the net amount of cash generated from operating activities

less capital expenditures and dividends as “free cash flow.”

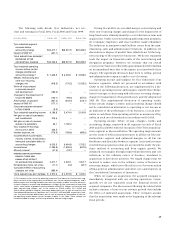

($ IN MILLIONS) FISCAL 2001 FISCAL 2000 FISCAL 1999

Tyco Industrial operating

income, before certain

charges (credits) and

accounting change(1) $ 7,623.5 $ 6,094.1 $ 3,949.6

Depreciation and amortization

of intangible assets (2) 1,603.2 1,300.0 1,095.1

Net increase in

deferred income taxes 219.0 507.8 351.6

Less:

Net increase in working capital (3) (466.0) (64.9) (122.6)

Interest expense, net (776.5) (769.6) (485.6)

Income tax expense (1,284.9) (1,926.0) (637.5)

Restructuring expenditures (4) (215.5) (155.2) (633.6)

Other, net 222.7 288.8 32.8

Cash flow from operating

activities 6,925.5 5,275.0 3,549.8

Less:

Capital expenditures (5) (1,797.5) (1,703.8) (1,632.5)

Tyco Capital factoring

receivables (297.8)

——

Dividends paid (90.0) (86.2) (187.9)

Free cash flow $ 4,740.2 $ 3,485.0 $ 1,729.4

(1) This amount is the sum of the operating income of the four Tyco Industrial business seg-

ments as set forth above, less certain corporate expenses, and is before merger, restruc-

turing and other non-recurring charges (credits), a charge for the write-off of purchased

in-process research and development, charges for the impairment of long-lived assets,

goodwill amortization and the adoption of SAB 101.

(2) This amount is the sum of depreciation of tangible property ($1,243.1 million,

$1,095.0 million and $979.6 million in Fiscal 2001, Fiscal 2000 and Fiscal 1999, respectively)

and amortization of intangible assets other than goodwill ($360.1 million, $205.0 million and

$115.5 million in Fiscal 2001, Fiscal 2000 and Fiscal 1999, respectively).

(3) This amount includes $490.6 million (of which $297.8 million relates to sales to Tyco

Capital), $100.0 million and $50.0 million received on the sale of accounts receivable in

Fiscal 2001, Fiscal 2000 and Fiscal 1999, respectively.

(4) This amount is cash paid for merger, restructuring and other non-recurring charges.

(5) This amount excludes expenditures related to construction of the TGN of $2,247.7 mil-

lion and $111.1 million for the years ended September 30, 2001 and 2000, respectively. This

amount includes $427.7 million and $172.0 million received in sale-leaseback transactions

for the years ended September 30, 2001 and 2000, respectively.

In addition, in Fiscal 2001, Fiscal 2000 and Fiscal 1999 we

paid out $737.2 million, $544.2 million and $354.4 million,

respectively, in cash that was charged against reserves estab-

lished in connection with acquisitions accounted for under the

purchase accounting method. This amount is included in

“Acquisition of businesses, net of cash acquired” in the Consol-

idated Statements of Cash Flows.