ADT 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

TYCO CAPITAL

On June 1, 2001, a subsidiary of Tyco acquired The CIT Group,

Inc., an independent commercial finance company, now Tyco

Capital Corporation. The discussion herein is only for the period

June 2 through September 30, 2001 (the “Four Month Period”).

The results for the Four Month Period are not indicative of

results which would have been achieved for an entire year. Tyco

Capital’s services include:

• commercial financing and leasing

—

offering equipment, com-

mercial factoring and structured financing; and

• specialty financing and leasing

—

consumer lending and retail

sales and vendor financing.

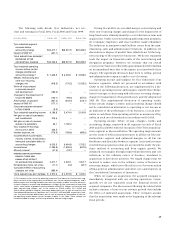

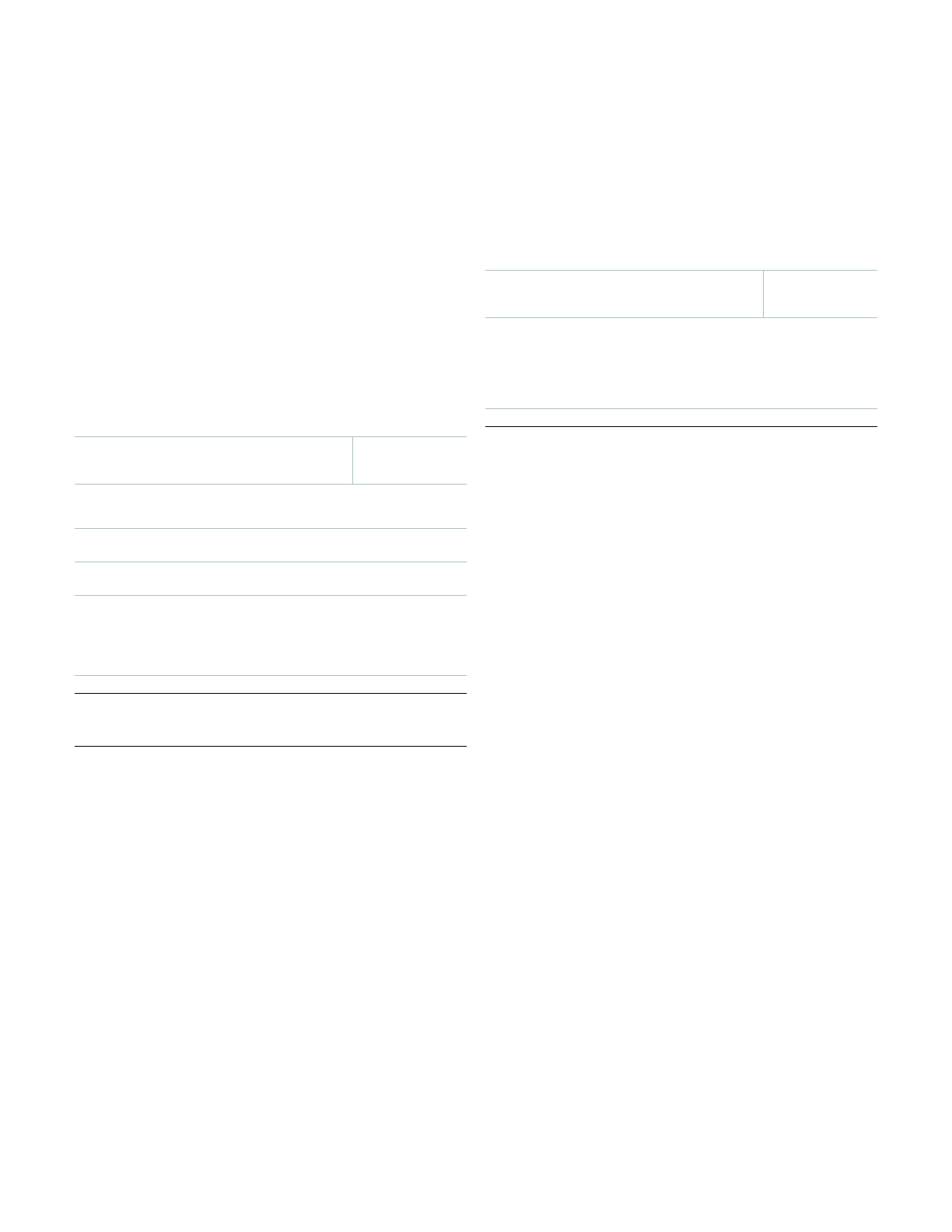

The following table sets forth operating results of Tyco

Capital:

FOR THE PERIOD

JUNE 2 THROUGH

($ IN MILLIONS) SEPTEMBER 30, 2001

Finance income $ 1,676.5

Interest expense 597.1

Net finance income 1,079.4

Depreciation on operating lease equipment (1) 448.6

Net finance margin 630.8

Other income 335.1

Operating revenue 965.9

Selling, general, administrative and other

costs and expenses less depreciation on

operating lease equipment (398.7)

Provision for credit losses (116.1)

Income before income taxes and minority interest $ 451.1

Average earning assets (“AEA”) (2) $39,159.2

Net finance margin as a percent of AEA (annualized) 4.83%

Operating revenue as a percent of AEA (annualized) 7.40%

(1) Depreciation on operating lease equipment has been included within selling, gen-

eral, administrative and other costs and expenses in the Consolidated Statements of

Operations.

(2) Average earning assets is the average of finance receivables, operating lease equip-

ment, finance receivables held for sale and certain investments, less credit balances of

factoring clients.

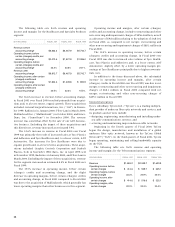

Tyco Capital’s revenues were $2,011.6 million for the Four

Month Period. Finance income totaled $1,676.5 million for the

Four Month Period. As a percentage of AEA, finance income

(excluding interest income related to short-term interest-

bearing deposits) was 12.70%.

Interest expense totaled $597.1 million for the Four Month

Period. As a percentage of AEA, interest expense (excluding

interest related to short-term interest-bearing deposits and div-

idends related to preferred capital securities) was 4.43%.

Other income for Tyco Capital was $335.1 million for the

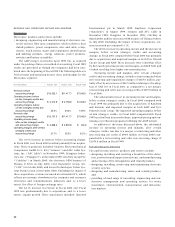

Four Month Period as set forth in the following table:

FOR THE PERIOD

JUNE 2 THROUGH

($ IN MILLIONS) SEPTEMBER 30, 2001

Fees and other income $212.3

Gains on securitizations 59.0

Factoring commissions 50.7

Gains on sales of leasing equipment 14.2

Losses on venture capital investments (1.1)

TOTAL $335.1

Included in fees and other income are miscellaneous fees,

syndication fees and gains from receivable sales.

The provision for credit losses was $116.1 million for the

Four Month Period, while charge-offs were $86.8 million. Man-

aged assets were $50.9 billion at September 30, 2001, while

financing and leasing portfolio assets totaled $40.7 billion. Man-

aged assets include finance receivables, operating lease equip-

ment, finance receivables held for sale, certain investments, and

finance receivables previously securitized and still managed by

Tyco Capital.

CONSOLIDATED ITEMS

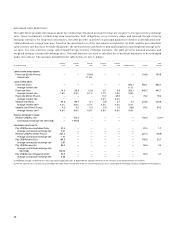

CONSOLIDATED INCOME TAX EXPENSE

The effective income tax rate, excluding the impact of purchased

in-process research and development, merger, restructuring and

other non-recurring (charges) credits, charges for the impair-

ment of long-lived assets, net gain on the sale of businesses and

investments, net gain on the sale of common shares of a sub-

sidiary and accounting change, was 23.0% during Fiscal 2001, as

compared to 24.8% in Fiscal 2000 and 27.0% in Fiscal 1999. The

decrease in the effective income tax rate was primarily due to

higher earnings in tax jurisdictions with lower income tax rates.

We believe that we will generate sufficient future income to

realize the tax benefits related to our deferred tax assets. A

valuation allowance has been maintained due to continued

uncertainties of realization of certain tax benefits, primarily

tax loss carryforwards (see Note 9 to our Consolidated Finan-

cial Statements).