ADT 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Reserves for restructuring and other non-recurring items

are taken as a charge against current earnings at the time the

reserves are established. Amounts expended for restructuring

and other non-recurring costs are charged against the reserves

as they are paid out. If the amount of the reserves proves to be

greater than the costs actually incurred, any excess is credited

against restructuring and other non-recurring charges in the

Consolidated Statement of Operations in the period in which

that determination is made.

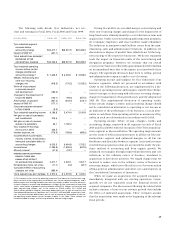

In Fiscal 2001, we recorded net restructuring and other non-

recurring charges of $331.8 million, of which charges of

$98.2 million are included in cost of revenue, consisting of

charges of $498.6 million, related primarily to the closure of

manufacturing plants, sales offices, warehouses and adminis-

trative offices in the Electronics and Fire and Security Services

segments, partially offset by a $166.8 million credit to litigation

reserves established in the prior year. In addition, we incurred a

non-recurring charge of $86.7 million related to the sale of

inventory which had been written-up under purchase account-

ing, which has been included in cost of revenue. At Septem-

ber 30, 2000, there existed merger, restructuring and other

non-recurring reserves of $365.9 million. During Fiscal 2001, we

paid out $215.5 million in cash and incurred $228.7 million in

non-cash charges that were charged against these reserves. At

September 30, 2001, there remained $340.2 million of merger,

restructuring and other non-recurring reserves on Tyco Indus-

trial’s Consolidated Balance Sheet, of which $304.9 million is

included in accrued expenses and other current liabilities and

$35.3 million is included in other long-term liabilities.

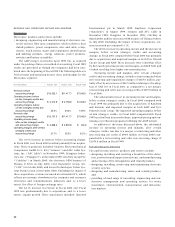

All business combinations completed in Fiscal 2001 were

accounted for under the purchase accounting method. At the

time each purchase acquisition is made, we establish a reserve

for transaction costs and the costs of integrating the purchased

company within the relevant Tyco business segment. The

amounts of such reserves established in Fiscal 2001 are detailed

in Note 2 to the Consolidated Financial Statements. These

amounts are not charged against current earnings but are

treated as additional purchase price consideration and have the

effect of increasing the amount of goodwill recorded in connec-

tion with the respective acquisition. We view these costs as the

equivalent of additional purchase price consideration when we

consider making an acquisition. If the amount of the reserves

proves to be in excess of costs actually incurred, any excess is

used to reduce the goodwill account that was established at the

time the acquisition was made.

In Fiscal 2001, Tyco Industrial made acquisitions that

were accounted for under the purchase accounting method

at an aggregate cost of $14,741.5 million. Of this amount,

$10,956.6 million was paid in cash, net of cash acquired

(excluding $2,156.4 million of cash acquired from Tyco Capital),

and $3,784.9 million was paid in the form of Tyco common

shares. Debt of acquired companies aggregated $1,592.3 mil-

lion. In connection with these acquisitions, we established pur-

chase accounting reserves of $1,021.3 million for transaction and

integration costs. In addition, purchase accounting liabilities

of $103.7 million and a corresponding increase to goodwill

and deferred tax assets were recorded during Fiscal 2001.

Changes in estimates related to acquisitions consummated prior

to Fiscal 2001, primarily related to revisions associated with

finalizing the exit plans of the electronic OEM business of

Thomas & Betts, AFC Cable, Critchley and Siemens, all acquired

during Fiscal 2000. At the beginning of Fiscal 2001, purchase

accounting reserves were $372.6 million as a result of purchase

accounting transactions made in prior years. During Fiscal 2001,

we paid out $894.4 million in cash (including approximately

$105.7 million relating to purchase price adjustments and

earn-out liabilities on certain acquisitions and $51.5 mil-

lion relating to the acquisition of Tyco Capital) and incurred

$7.2 million in non-cash charges against the reserves estab-

lished during and prior to Fiscal 2001. Also, in Fiscal 2001, we

determined that $68.9 million of purchase accounting reserves

related primarily to acquisitions prior to Fiscal 2001 were not

needed and reversed that amount against goodwill. At Septem-

ber 30, 2001, there remained $702.1 million in purchase account-

ing reserves on Tyco Industrial’s Consolidated Balance Sheet, of

which $583.1 million is included in accrued expenses and other

current liabilities and $119.0 million is included in other long-

term liabilities.

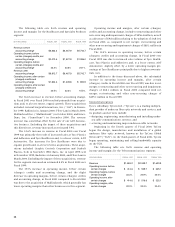

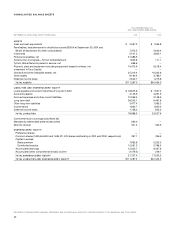

The following details the Fiscal 2001 capital expenditures

and depreciation by segment for Tyco Industrial:

CAPITAL

($ IN MILLIONS) EXPENDITURES DEPRECIATION

Electronics $ 587.8 $ 429.0

Fire and Security Services 897.1 456.9

Healthcare and Specialty Products 159.6 257.0

Telecommunications 113.0(1) 89.1

Corporate 40.0 11.1

$1,797.5(2) $1,243.1

(1) Excludes $2,247.7 million in spending for construction of the TGN.

(2) Includes $427.7 million received in sale-leaseback transactions.

We continue to fund capital expenditures to improve the

cost structure of our businesses, to invest in new processes and

technology, and to maintain high quality production standards.

The level of capital expenditures for the Fire and Security Ser-

vices segment significantly exceeded, and is expected to con-

tinue to significantly exceed, depreciation due to the substantial

growth in the number of new security system installations. The

level of capital expenditures in the other segments is expected

to increase moderately in Fiscal 2002. During Fiscal 2001, TyCom

spent $2,247.7 million on construction of the TGN. We expect our

expenditures on construction of the TGN to be approximately

$1,500.0 million in Fiscal 2002. The source of funds for capital

expenditures and construction of the TGN is expected to be cash

from operating activities.