ADT 2001 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

Since 1990, it has grown pre-tax earnings at about a 15

percent annual rate without a single down year. That’s

Tyco’s kind of company.

Tyco Capital is the leader in U.S. factoring, construction

equipment financing, Small Business Administration

loans and vendor financing (when a company leases

computers from Dell, Tyco Capital handles the financing

package). All are compelling growth markets.

But there’s more to the story. Owning a large finance

company bolsters Tyco’s other businesses in several

ways. From an internal perspective, the presence of Tyco

Capital allows us to become more capital efficient. From

an external perspective, owning a finance unit gives us a

competitive advantage when selling ADT products and

Tyco Infrastructure Services offerings to our customers

who meet the credit quality requirements of Tyco

Capital. In addition, we have already made Tyco Capital

a much more efficient operator by cutting its annual

costs by $150 million—triple our initial expectations—

and by exiting in excess of $5 billion worth of non-

strategic businesses. Finally, because Tyco Capital gained

a strong parent when we acquired it, its borrowing costs

have declined and its profit margins improved.

>TYCO ELECTRONICS

Tyco’s Electronics segment performed well in a tough

environment, as operating income grew 20 percent to

$3.3 billion, up from $2.8 billion last year. Sales for the

group totaled $13.1 billion, compared to $11.4 billion in

the prior year.

Tyco Electronics’ products gained share across the board,

with especially large increases in the automotive and

wireless markets. New products accounted for a large

portion of revenues and should play an even more

important role in fiscal 2002. Recent introductions

included a new automotive radar sensor to further

improve driver and passenger safety; an electrical distri-

bution box system for the automotive market; chip carri-

er sockets for Intel’s Pentium 4 processor; and intercon-

nect products for Sony’s Memory Stick and PlayStation 2.

We remain confident about the long-term growth of the

electronic components business. Cellular phone demand

should rise with the rollout of 3G technology and the

quantity of electronics in the typical automobile will

continue to increase relentlessly.

At TyCom, our telecommunications unit, operating

income was $415 million, compared to $530 million

last year. Revenues were $1.9 billion, compared to $2.5

billion in the prior year. (In October, we announced that

we had reached an agreement with the TyCom board of

directors to acquire all outstanding shares of TyCom that

we did not already own. We did this because we believe

that TyCom represents a compelling value.)

In June, TyCom successfully completed Phase 1 of

the TyCom Global Network (TGN), from the United

States to Europe, ahead of schedule and $1 billion under

budget. It began recognizing revenue that month.

The Phase 2 link to the Pacific is on schedule

and also under budget. When completed in 2002, the

TGN will be the most technologically advanced network

in the world.

Trans-Atlantic pricing has fallen more rapidly than

we anticipated, although it has stabilized recently.

Prices in the Pacific have not declined nearly as much.

These lower prices have meant disaster for some

competitors, especially those with highly leveraged

balance sheets. Some have already gone bankrupt, while

others are close to the brink. This shakeout—which

TyCom managers long expected—has convinced some

casual observers that no one will ever make money in

this market.

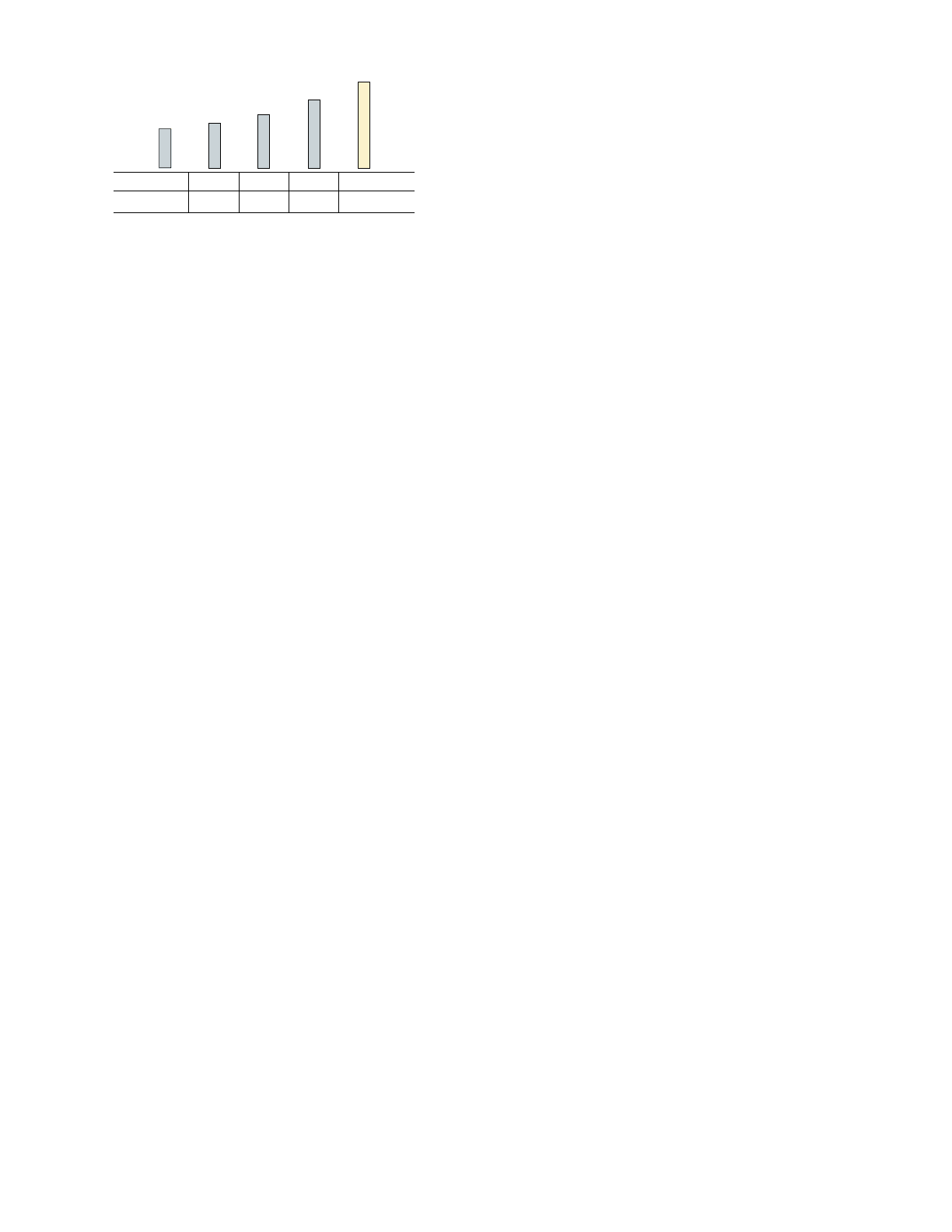

REVENUES

$ in billions

97 98 99 00 01

$16.7 $19.1 $22.5 $28.9 $36.3