ADT 2001 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

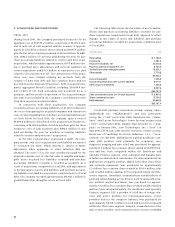

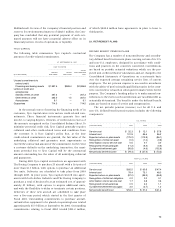

11. MANDATORILY REDEEMABLE PREFERRED SECURITIES

In connection with the acquisition of CIT, the Company assumed

$260.0 million of 7.70% Preferred Capital Securities (the “Capi-

tal Securities”), which were originally issued in February 1997.

A subsidiary of Tyco Capital, Capital Trust I (“The Trust”),

invested the offering proceeds in Junior Subordinated Deben-

tures (the “Debentures”) of Tyco Capital, having identical rates

of return and payment dates. The Debentures of Tyco Capital

represent the sole assets of the Trust. Holders of the Capital

Securities are entitled to receive cumulative distributions at an

annual rate of 7.70% through either the redemption date or

maturity of the Debentures (February 15, 2027). Both the Capi-

tal Securities issued by the Trust and the Debentures of Tyco

Capital owned by the Trust are redeemable in whole or in part

on or after February 15, 2007 or at any time in whole upon

changes in specific tax legislation, bank regulatory guidelines or

securities law. Distributions by the Trust are guaranteed by Tyco

Capital to the extent that the Trust has funds available for dis-

tribution. Distributions payable on the Capital Securities are

recorded as minority interest expense in the Consolidated State-

ments of Operations.

12. PREFERENCE SHARES

Tyco has authorized 125,000,000 preference shares, par value of

$1 per share, none of which was issued or outstanding at Sep-

tember 30, 2001 or 2000. Rights as to dividends, return of capi-

tal, redemption, conversion, voting and otherwise may be

determined by Tyco’s Board of Directors on or before the time of

issuance. In the event of the liquidation of the Company, the

holders of any preference shares then outstanding would be

entitled to payment to them of the amount for which the pref-

erence shares were subscribed and any unpaid dividends prior

to any payment to the common shareholders.

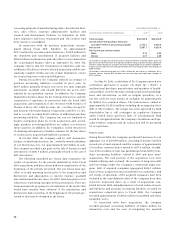

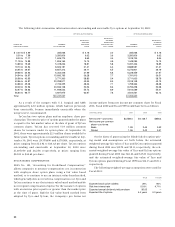

13. SHAREHOLDERS’ EQUITY

Tyco has authorized 2,500,000,000 common shares, par value of

$.20 per share, 1,935,464,840 and 1,684,511,070 of which were

outstanding, net of 17,026,256 and 31,551,310 shares owned by

subsidiaries, at September 30, 2001 and 2000, respectively. Shares

owned by subsidiaries are treated as treasury shares and are

recorded at cost. Included within Tyco’s outstanding common

shares at September 30, 2001 are 4,243,108 common shares

representing the assumed exchange of 6,143,199 exchangeable

shares (at 0.6907 of a Tyco common share per exchange-

able share). Exchangeable shares of CIT Exchangeco Inc., a

wholly-owned subsidiary of Tyco Capital Corporation were

issued by CIT prior to CIT’s acquisition by Tyco. In connection

with the acquisition of CIT, each outstanding exchangeable

share, which was exchangeable prior to the merger for one share

of CIT common stock, became exchangeable for 0.6907 of a Tyco

common share. The holders of these exchangeable shares have

dividend, liquidation and voting rights equivalent to those of

Tyco common shareholders, except that each exchangeable share

is equivalent to 0.6907 of a Tyco common share. These shares may

be exchanged for Tyco common shares at any time at the option

of the holder. The Company may redeem these shares for Tyco

common shares at any time on or after November 1, 2004.

Contributed Surplus includes $85.3 million and $59.4 mil-

lion in deferred compensation at September 30, 2001 and 2000,

respectively.

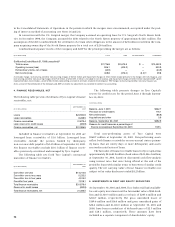

During the last quarter of Fiscal 1999, Tyco’s Board of Direc-

tors declared a two-for-one stock split in the form of a 100% stock

dividend on its common shares. The split was payable on Octo-

ber 21, 1999 to shareholders of record on October 1, 1999. Per

share amounts and share data have been retroactively adjusted

to reflect the stock split. There was no change in the par value or

the number of authorized shares as a result of the stock split.

On June 6, 2001, Tyco sold 39 million common shares for

approximately $2,198.0 million in an underwritten public offer-

ing. Net proceeds from the offering were $2,196.6 million and

were used to repay debt incurred to finance a portion of the

acquisition of CIT.

Information with respect to U.S. Surgical and AMP com-

mon shares and options has been retroactively restated in con-

nection with their mergers with the Company to reflect their

applicable merger per share exchange ratios of 0.7606 and 0.7507,

respectively (1.5212 and 1.5014, respectively, after giving effect

to the subsequent split).

The total compensation cost expensed for all stock-based

compensation awards discussed below was $116.8 million,

$137.4 million and $96.9 million for Fiscal 2001, Fiscal 2000 and

Fiscal 1999, respectively.

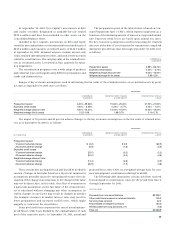

RESTRICTED SHARES

The Company maintains a restricted share ownership plan,

which provides for the award of an initial amount of common

shares plus an amount equal to one-half of one percent of the

total shares outstanding at the beginning of each fiscal year. At

September 30, 2001, there were 39,978,168 shares authorized

under the plan, of which 13,796,851 shares had been granted.

Common shares are awarded subject to certain restrictions with

vesting varying over periods of up to ten years.

For grants which vest based on certain specified perfor-

mance criteria, the fair market value of the shares at the date of

vesting is expensed over the period of performance, once

achievement of criteria is deemed probable. For grants that

vest through passage of time, the fair market value of the shares

at the time of the grant is amortized (net of tax benefit) to

expense over the period of vesting. The unamortized portion of

deferred compensation expense is recorded as a reduction of

shareholders’ equity. Recipients of all restricted shares have the

right to vote such shares and receive dividends. Income tax ben-

efits resulting from the vesting of restricted shares, including a