ADT 2001 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

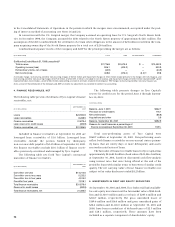

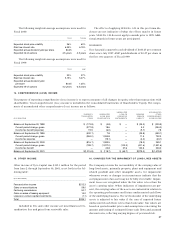

2001 CHARGES

During Fiscal 2001, the Electronics, Healthcare and Specialty

Products and Fire and Security Services segments recorded

charges of $98.6 million, $15.4 million and $6.1 million, respec-

tively, related primarily to the impairment of property, plant and

equipment associated with the closure of facilities.

2000 CHARGES

The Healthcare and Specialty Products segment recorded a

charge of $99.0 million in Fiscal 2000 primarily related to an

impairment in goodwill and other intangible assets associated

with the Company exiting the interventional cardiology busi-

ness of U.S. Surgical.

1999 CHARGES

The Electronics segment recorded a charge of $431.5 million in

Fiscal 1999, which includes $350.1 million related to the write-

down of property, plant and equipment, primarily manufactur-

ing and administrative facilities, associated with facility

closures throughout AMP’s worldwide operations in connection

with its profit improvement plan and the combination of facili-

ties as a result of its merger with the Company, approximately

$143.6 million of which was taken as part of the AMP profit

improvement plan prior to its acquisition by the Company. It

also includes an impairment in the value of goodwill and other

intangible assets of $81.4 million. The Company evaluated the

profitability and products and found that certain product lines

were underperforming relative to expectations. As a result of

this analysis, which was performed in connection with AMP’s

profit improvement plan, the book value of goodwill and other

intangible assets was deemed impaired and written down to

fair value.

The Healthcare and Specialty Products segment recorded a

charge of $76.0 million in Fiscal 1999 relating primarily to the

write-down of property, plant and equipment, principally

administrative facilities, associated with the consolidation of

facilities in U.S. Surgical’s operations in the United States and

Europe as a result of its merger with the Company.

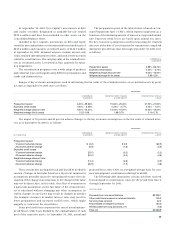

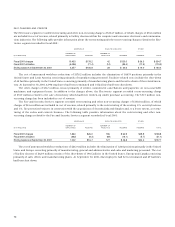

17. EXTRAORDINARY ITEMS

Tyco Industrial recorded an extraordinary item of $17.1 million,

net of tax benefit of $9.2 million, in Fiscal 2001 relating to the

early extinguishment of debt. The extraordinary item in Fiscal

2000 of $0.2 million, net of tax benefit of $0.1 million, and the

extraordinary item in Fiscal 1999 of $45.7 million, net of tax

benefit of $18.0 million, related primarily to the write-off of

unamortized deferred financing costs related to the early

extinguishment of debt.

18. CUMULATIVE EFFECT OF ACCOUNTING CHANGES

In December 1999, the SEC issued SAB 101, in which the SEC

Staff expressed its views regarding the appropriate recognition

of revenue with respect to a variety of circumstances, some of

which are relevant to the Company. As required under SAB 101,

the Company modified its revenue recognition policies with

respect to the installation of electronic security systems (see

“Revenue Recognition” within Note 1). In addition, in response to

SAB 101, the Company undertook a review of its revenue recog-

nition practices and identified certain provisions included in a

limited number of sales arrangements that delayed the recogni-

tion of revenue under SAB 101. During the fourth quarter of Fis-

cal 2001, the Company changed its method of accounting for

these items retroactive to the beginning of the fiscal year to con-

form to the requirements of SAB 101. This was reported as a

$653.7 million after-tax ($1,005.6 million pre-tax) charge for the

cumulative effect of change in accounting principle in the Fiscal

2001 Consolidated Statement of Operations.

The impact of SAB 101 on total revenues in Fiscal 2001 was

a net decrease of $241.1 million, reflecting the deferral of

$520.5 million of Fiscal 2001 revenues, partially offset by the

recognition of $279.4 million of revenue that is included in the

cumulative effect adjustment as of the beginning of the fiscal

year. The Company restated each of the first three quarters of

Fiscal 2001 in the Consolidated Statement of Operations to

reflect the adoption of SAB 101 (see Note 29). Pro forma

amounts for the periods prior to Fiscal 2001 have not been pre-

sented since the effect of the change in accounting principle for

these periods could not be reasonably determined.

The Company recorded a cumulative effect adjustment, a

$29.7 million loss, net of tax, in Fiscal 2001 in accordance with

the transition provisions of SFAS No. 133 (see Note 1).