ADT 2001 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

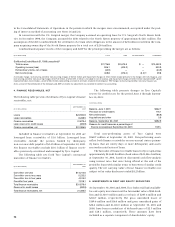

control panels, detection devices and system software, was pur-

chased for approximately $1,094.7 million in cash and has been

integrated within the Fire and Security Services segment. Scott,

a designer and manufacturer of respiratory systems and other

life-saving devices for the firefighting and aviation markets, was

purchased for approximately 7.5 million Tyco common shares

valued at $391.1 million and has been integrated within the Fire

and Security Services segment. CIT was purchased for

$9,455.5 million, consisting of: the issuance of approximately

133.0 million Tyco common shares, valued at $6,650.5 million, for

approximately 73% of the outstanding shares of CIT; a cash pay-

ment of $2,486.4 million to Dai-Ichi Kangyo Bank, Limited for

the purchase of approximately 27% of the outstanding shares of

CIT; and options assumed valued at $318.6 million. The

$9,455.5 million purchase price plus $29.2 million in acquisition

related costs incurred by Tyco Industrial have been reflected on

Tyco Capital’s Consolidated Balance Sheet as a contribution by

Tyco, in accordance with “push-down” accounting for business

combinations. In addition, $22.3 million was paid by Tyco Indus-

trial for acquisition related costs and have been reflected on Tyco

Capital’s Consolidated Balance Sheet as an additional capital

contribution. SecurityLink, a provider of electronic security sys-

tems to residential, commercial and government customers, was

purchased for cash of approximately $1,000.0 million and has

been integrated within the Fire and Security Services segment.

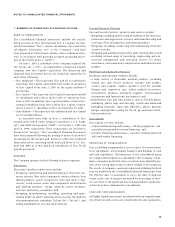

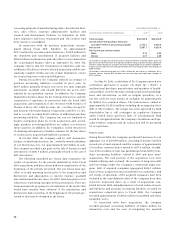

In connection with the acquisition of Mallinckrodt, the

Company obtained an appraisal from an independent appraiser

of the fair value of its intangible assets. This appraisal valued

purchased in-process research and development (“IPR&D”) of

various projects for the development of new products and tech-

nologies at $184.3 million. The purchased IPR&D was written off

during the quarter ended December 31, 2000. The value of the

purchased IPR&D was based on the value of the various projects

utilizing the discounted cash flow method. This valuation

included consideration of (i) the stage of completion of each of

the projects, (ii) the technological feasibility of each of the proj-

ects, (iii) whether the projects had an alternative future use, and

(iv) the estimated future residual cash flows that could be gen-

erated from the various projects and technologies over their

respective projected economic lives.

As of the Mallinckrodt acquisition date, there were several

projects under development at different stages of completion.

The primary basis for determining the technological feasibility

of these projects was obtaining Food and Drug Administration

(“FDA”) approval. As of the acquisition date, none of the IPR&D

projects had received FDA approval. In assessing the technolog-

ical feasibility of a project, consideration was also given to the

level of complexity and future technological hurdles that each

project had to overcome prior to being submitted to the FDA for

approval. As of the acquisition date, none of the IPR&D projects

was considered to be technologically feasible or to have any

alternative future use.

Future residual cash flows that could be generated from

each of the projects were determined based upon management’s

estimate of future revenue and expected profitability of the var-

ious products and technologies involved. These projected cash

flows were then discounted to their present values taking into

account management’s estimate of future expenses that would

be necessary to bring the projects to completion. The discount

rates include a rate of return, which accounts for the time value

of money, as well as risk factors that reflect the economic risk

that the cash flows projected may not be realized. The cash flows

were discounted at discount rates ranging from 14% to 25% per

annum, depending on the project’s stage of completion and the

type of FDA approval needed. This discounted cash flow

methodology for the various projects included in the purchased

IPR&D resulted in a total valuation of $184.3 million.

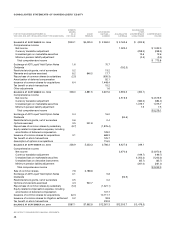

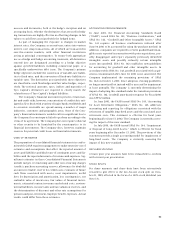

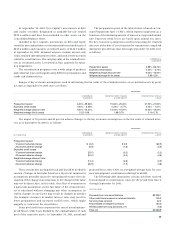

The following table summarizes the purchase accounting

liabilities recorded in connection with the Fiscal 2001 purchase

acquisitions:

SEVERANCE FACILITIES OTHER

NUMBER OF NUMBER OF

($ IN MILLIONS) EMPLOYEES RESERVE FACILITIES RESERVE RESERVE TOTAL

Original reserve established(1) 10,270 $ 367.9 349 $393.6 $ 358.5 $1,120.0

Fiscal 2001 utilization (8,201) (216.4) (172) (62.7) (249.6) (528.7)

Ending balance at September 30, 2001 2,069 $ 151.5 177 $330.9 $ 108.9 $ 591.3

(1) Included within the $1,120.0 million reserve established is $98.7 million in purchase accounting liabilities recorded by Tyco Industrial related to the acquisition of CIT and reported as

a liability of Tyco Capital.

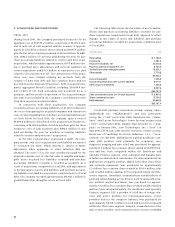

sition for workforce reductions and the closure and consolida-

tion of an aggregate of 349 facilities. The costs of employee ter-

mination benefits relate to the elimination of 6,651 positions in

the United States, 1,559 positions in Europe, 1,354 positions in

the Asia-Pacific region and 706 positions in Canada and Latin

America, consisting primarily of manufacturing and distribu-

tion, administrative, technical, and sales and marketing person-

nel. Facilities designated for closure include 226 facilities in the

United States, 54 facilities in Europe, 48 facilities in the Asia-

Pacific region and 21 facilities in Canada and Latin America,

Purchase accounting liabilities recorded during Fiscal 2001

consist of $367.9 million for severance and related costs;

$393.6 million for costs associated with the shut down and con-

solidation of certain acquired facilities, including unfavorable

leases, lease terminations and other related fees and other costs;

and $358.5 million for transaction and other costs. These pur-

chase accounting liabilities relate primarily to the acquisitions

of Mallinckrodt, LPS, CIT, Simplex and SecurityLink.

In connection with the Fiscal 2001 purchase acquisitions,

the Company began to formulate plans at the date of each acqui-