ADT 2001 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

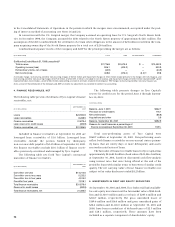

NET INVESTMENTS

Tyco Industrial uses cross currency swaps and designated por-

tions of foreign-currency denominated debt to hedge the for-

eign-currency exposure of certain net investments in foreign

operations. A net unrealized loss of $39.4 million was included

in the cumulative translation adjustment during Fiscal 2001 in

connection with these hedges.

Tyco Capital uses foreign exchange forward contracts and

cross-currency swaps to hedge its net investments in foreign

operations. A net unrealized loss of $13.4 million was included

in the cumulative translation adjustment during the period

from June 2 through September 30, 2001 in connection with

these hedges.

OTHER

Tyco Industrial uses various options, swaps and forwards not

designated as hedging instruments under SFAS No. 133 to hedge

the impact of the variability in the price of raw materials, such

as copper and other commodities, and the impact of the vari-

ability in foreign exchange rates on accounts and notes receiv-

able, intercompany loan balances and subsidiary earnings

denominated in certain foreign currencies.

9. INCOME TAXES

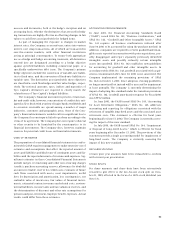

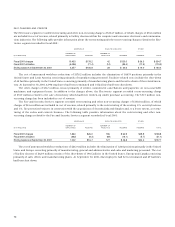

The provision for income taxes and the reconciliation between

the notional United States federal income taxes at the statutory

rate on consolidated income before taxes and the Company’s

income tax provision are as follows:

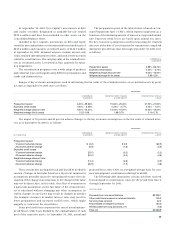

YEAR ENDED SEPTEMBER 30,

($ IN MILLIONS) 2001 2000 1999

Notional U.S. federal income

taxes at the statutory rate $2,170.7 $2,262.7 $ 596.8

Adjustments to reconcile to the

Company’s income tax

provision:

U.S. state income tax

provision, net 88.3 46.7 33.6

SFAS 121 impairment 1.2 6.4 43.5

Non-U.S. net earnings (920.4) (495.6) (216.5)

Nondeductible charges 194.7 140.8 139.2

Other (54.6) (35.0) 40.9

Provision for income taxes 1,479.9 1,926.0 637.5

Deferred provision 725.6 721.3 191.2

Current provision $ 754.3 $1,204.7 $ 446.3

The provisions for Fiscal 2001, Fiscal 2000, and Fiscal 1999

include $629.2 million, $648.6 million and $263.9 million,

respectively, for non-U.S. income taxes. The non-U.S. compo-

nent of income before income taxes was $4,398.8 million,

$3,343.6 million and $1,376.3 million for Fiscal 2001, Fiscal 2000

and Fiscal 1999, respectively.

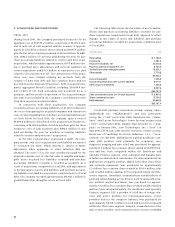

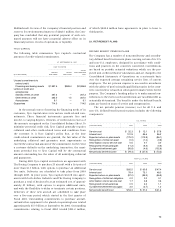

The deferred income tax balance sheet accounts result from

temporary differences between the amount of assets and liabil-

ities recognized for financial reporting and tax purposes. The

components of the net deferred income tax asset are as follows:

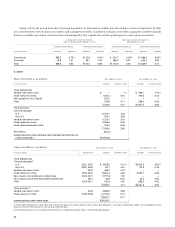

SEPTEMBER 30,

($ IN MILLIONS) 2001 2000

Deferred tax assets:

Accrued liabilities and reserves $ 1,522.6 $ 658.6

Tax loss and credit carryforwards 851.8 474.6

Capitalized research and development

and interest 139.6 148.9

Other 135.8 56.1

2,649.8 1,338.2

Deferred tax liabilities:

Property, plant and equipment (844.8) (281.9)

Intangibles (654.5) (251.6)

Undistributed earnings of subsidiaries (126.1) (155.1)

Other (100.9) (163.6)

(1,726.3) (852.2)

Net deferred income tax asset before

valuation allowance 923.5 486.0

Valuation allowance (127.1) (122.4)

Net deferred income tax asset $ 796.4 $ 363.6

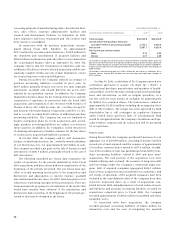

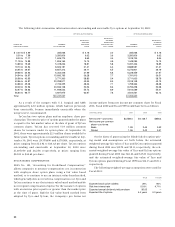

At September 30, 2001, the Company had approximately

$586 million of net operating loss carryforwards in certain non-

U.S. jurisdictions. Of these, $222 million have no expiration, and

the remaining $364 million will expire in future years through

2011. U.S. operating loss carryforwards at September 30, 2001

were approximately $1,605 million and will expire in future

years through 2021. A valuation allowance has been provided for

operating loss carryforwards that are not expected to be utilized.

In the normal course, the Company and its subsidiaries’

income tax returns are examined by various regulatory tax author-

ities. In connection with such examinations, substantial tax defi-

ciencies have been proposed. However, the Company is contesting

such proposed deficiencies, and ultimate resolution of such mat-

ters is not expected to have a material adverse effect on the Com-

pany’s financial position, results of operations or liquidity.

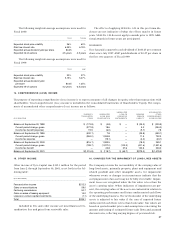

10. KEY EMPLOYEE LOAN PROGRAM

Loans are made to employees under the Company’s Key

Employee Loan Program for the payment of taxes upon the vest-

ing of shares granted under our Restricted Share Ownership

Plans. The loans are unsecured and bear interest, payable annu-

ally, at a rate which approximates the Company’s incremental

short-term borrowing rate. Loans are generally repayable in ten

years, except that earlier payments are required under certain

circumstances. During Fiscal 2001, the maximum amount out-

standing under this program was $29.5 million. Loans receivable

under this program were $11.2 million and $11.4 million at

September 30, 2001 and 2000, respectively.