ADT 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

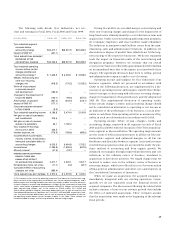

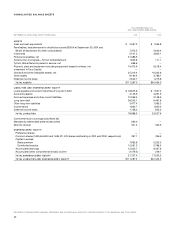

The provision for income taxes in the Consolidated State-

ment of Operations for Fiscal 2001 was $1,284.9 million, but the

amount of income taxes paid (net of refunds) during the year

was $722.9 million. The difference is due to timing differences,

as well as the tax benefits related to the exercise of share

options. The current income tax liability at September 30, 2001

was $1,845.0 million, as compared to $1,650.3 million at Sep-

tember 30, 2000.

The net change in working capital, net of the effects of

acquisitions and divestitures, was an increase of $466.0 million

in Fiscal 2001. The components of this change are set forth in

detail in Tyco Industrial’s Consolidated Statement of Cash

Flows. The increase in working capital accounts is attributable

to the higher level of business activity in Fiscal 2001 as reflected

in the increased revenue over the prior year. We focus on maxi-

mizing the cash flow from our operating businesses and attempt

to keep the working capital employed in the businesses to the

minimum level required for efficient operations.

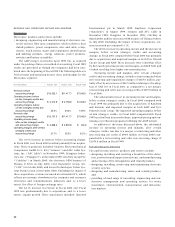

During Fiscal 2001, we used $1,326.1 million to repurchase

our own common shares under our ongoing share buyback pro-

gram. We repurchase our own shares from time to time in the

open market to satisfy certain stock-based compensation

arrangements, such as the exercise of share options, or to use for

acquisitions.

During Fiscal 2001, Tyco sold 39 million common shares for

approximately $2,198.0 million in an underwritten public offer-

ing. Net proceeds from the offering were $2,196.6 million and

were used to repay debt incurred to finance a portion of the

acquisition of CIT.

During Fiscal 2001, we received proceeds of $545.0 million

from the exercise of common share options. In addition, during

Fiscal 2001, we received proceeds of $904.4 million, net of cash

sold, primarily from the sale of our ADT Automotive business.

The source of the cash used for acquisitions in Fiscal 2001

was primarily through the issuance of debt, free cash flow, the

sale of common shares and proceeds on the sale of businesses.

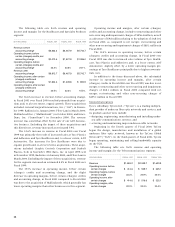

Goodwill and other intangible assets were $28,740.9 million at

September 30, 2001, compared to $16,332.6 million at Septem-

ber 30, 2000. At September 30, 2001, Tyco Industrial’s total debt

was $21,619.0 million, as compared to $10,999.0 million at Sep-

tember 30, 2000. This increase resulted principally from net pro-

ceeds of approximately $3,374.0 million and $2,203.4 million

from the sale of zero coupon convertible debentures due 2020

and 2021, respectively; $1,982.1 million from the sale of notes due

2006 and 2011; $1,787.9 million from the sale of notes due 2003

and 2006; and borrowings under Tyco International Group S.A.’s

(“TIG”) commercial paper program. For a full discussion of debt

activity, see Note 6 to the Consolidated Financial Statements.

Shareholders’ equity was $31,737.4 million, or $16.40 per

share, at September 30, 2001, compared to $17,033.2 million,

or $10.11 per share, at September 30, 2000. The increase in

shareholders’ equity was due primarily to the issuance of

approximately 211.2 million common shares valued at

$10,435.3 million for the acquisitions of Mallinckrodt and CIGI

in October 2000, InnerDyne in December 2000, Scott in

May 2001 and CIT in June 2001; net income of $3,970.6 million;

and the sale of 39 million common shares for net proceeds of

$2,196.6 million as discussed above. This increase was partially

offset by the repurchase of our common shares for approxi-

mately $1,326.1 million and an unrealized loss on available for

sale securities of $1,267.9 million. Total debt as a percent of total

capitalization (total debt and shareholders’ equity) was 41% at

September 30, 2001 and 39% at September 30, 2000. Net debt

(total debt less cash and cash equivalents) as a percent of total

capitalization was 37% at September 30, 2001 and 35% at Sep-

tember 30, 2000.

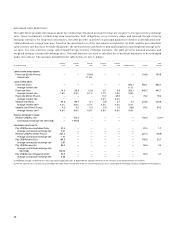

On October 26, 2001, TIG sold $1,500.0 million 6.375% notes

due 2011 under its $6.0 billion shelf registration statement

in a public offering. The notes are fully and unconditionally

guaranteed by Tyco. The net proceeds of approximately

$1,487.8 million were used to repay borrowings under TIG’s com-

mercial paper program.

On November 13, 2001, Tyco completed the acquisition of

Sensormatic Electronics Corporation (“Sensormatic”), a leading

supplier of electronic security solutions to the retail, commercial

and industrial market-places. The acquisition is valued at

approximately $2.3 billion, including the assumption of $116

million of net debt. An aggregate of approximately 48 million

common shares of Tyco were issued in exchange for all the out-

standing capital stock of Sensormatic.

On November 19, 2001, TIG issued €500 million 4.375%

notes due 2005, €685 million 5.5% notes due 2009, £200 million

6.5% notes due 2012 and £285 million 6.5% notes due 2032, uti-

lizing the capacity available under TIG’s European Medium

Term Note Programme established in September 2001. The notes

are fully and unconditionally guaranteed by Tyco. The net pro-

ceeds of $1,726.6 million were used to repay borrowings under

TIG’s commercial paper program.

On December 18, 2001, we completed our amalgamation

with TyCom and each of the approximately 56 million TyCom

common shares not owned by Tyco were converted into the

right to receive 0.3133 of a Tyco common share. Upon completion

of the amalgamation, TyCom became a wholly-owned subsidiary

of Tyco.

We believe that our cash flow from Tyco Industrial’s opera-

tions, together with our existing credit facilities and other credit

arrangements, is adequate to fund Tyco Industrial’s operations.