ADT 2001 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

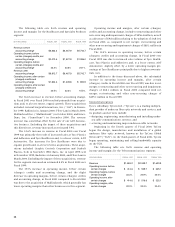

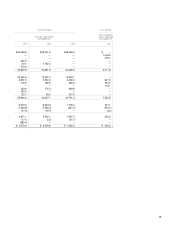

COMMODITY PRICE SENSITIVITY

The table below provides information about Tyco Industrial’s financial instruments that are sensitive to changes in commodity

prices. Total contract dollar amounts and notional quantity amounts are presented for forward commodity contracts.

Contract amounts are used to calculate the contractual payments quantity of the commodity to be exchanged under the

contracts.

FISCAL FISCAL FISCAL FISCAL FISCAL FAIR

($ IN MILLIONS) 2002 2003 2004 2005 2006 THEREAFTER TOTAL VALUE

FORWARD CONTRACTS:

Copper

Contract amount (US$) 28.3 4.3

————

32.6 (5.9)

Contract quantity (in 000 metric tons) 15.9 2.4

————

18.3

Gold

Contract amount (US$) 4.8

—————

4.8 0.2

Contract quantity (in 000 ounces) 17.0

—————

17.0

Silver

Contract amount (US$) 5.1 0.3

————

5.4

—

Contract quantity (in 000 ounces) 1,100.0 80.0

————

1,180.0

Zinc

Contract amount (US$) 3.9 1.4

————

5.3 (1.1)

Contract quantity (in 000 metric tons) 3.7 1.4

————

5.1

EQUIPMENT/RESIDUAL RISK MANAGEMENT

Tyco Capital has developed systems, processes and expertise to

manage the equipment and residual risk in its commercial busi-

nesses. The Tyco Capital process consists of the following:

(i) residual setting and valuation at deal inception, (ii) system-

atic residual reviews, and (iii) monitoring of residual realiza-

tions. Reviews for impairment are performed at least annually.

Residual realizations, by business unit and product, are

reviewed as part of Tyco Capital’s ongoing financial and asset

quality review, both within the business units and by corporate

management.

COMMERCIAL

Tyco Capital has developed systems specifically designed to

effectively manage credit risk in its commercial businesses. The

process starts with the initial evaluation of credit risk and

underlying collateral at the time of origination and continues

over the life of the finance receivable or operating lease,

including collecting past due balances and liquidating underly-

ing collateral.

CONSUMER AND SMALL-TICKET LEASING

Tyco Capital has developed proprietary automated credit scoring

models by loan type that include both customer demographics

and credit bureau characteristics. The profiles emphasize,

among other things, occupancy status, length of residence,

length of employment, debt to income ratio (ratio of total

installment debt and housing expenses to gross monthly

income), bank account references, credit bureau information

and combined loan to value ratio. The models are used to assess

a potential borrower’s credit standing and repayment ability

considering the value or adequacy of property offered as collat-

eral. Tyco Capital’s credit criteria include reliance on credit

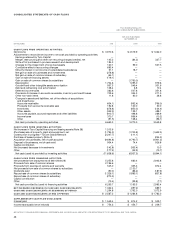

TYCO CAPITAL RISK MANAGEMENT

Tyco Capital’s business activities contain various elements of

risk. Tyco Capital considers the principal types of risk to be

credit risk (including credit, collateral and equipment risk) and

market risk (including interest rate, foreign currency and liq-

uidity risk).

CREDIT RISK MANAGEMENT

Tyco Capital has developed and maintains systems specifically

designed to manage credit risk in each of its business segments.

Tyco Capital evaluates financing and leasing assets for credit

and collateral risk during the credit granting process and peri-

odically after the advancement of funds.

Each of Tyco Capital’s strategic business units has devel-

oped and maintains a formal credit management process in

accordance with formal uniform guidelines established by Tyco

Capital’s corporate credit risk management group. These guide-

lines set forth risk acceptance criteria for:

• acceptable maximum credit line;

• selected target markets and products;

• creditworthiness of borrowers, including credit history, finan-

cial condition, adequacy of cash flow and quality of manage-

ment; and

• the type and value of underlying collateral and guarantees

(including recourse from dealers and manufacturers).

Tyco Capital also employs a risk adjusted pricing process

where the perceived credit risk is a factor in determining the

interest rate and/or fees charged for its financing and leasing

products. As economic and market conditions change, credit

risk management practices are reviewed and modified, if neces-

sary, to seek to minimize the risk of credit loss.