ADT 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

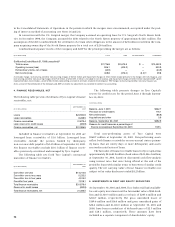

56

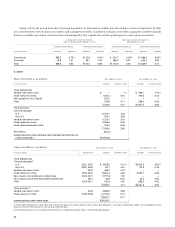

consisting primarily of manufacturing plants, distribution facil-

ities, sales offices, corporate administrative facilities and

research and development facilities. At September 30, 2001,

8,201 employees had been terminated and 172 facilities had

been closed or consolidated.

In connection with the purchase acquisitions consum-

mated during Fiscal 2001, liabilities for approximately

$151.5 million for severance and related costs, $330.9 million for

the shutdown and consolidation of acquired facilities and

$108.9 million in transaction and other direct costs remained on

the Consolidated Balance Sheet at September 30, 2001. The

Company expects that the termination of employees and con-

solidation of facilities related to all such acquisitions will be sub-

stantially complete within one year of plan finalization, except

for certain long-term contractual obligations.

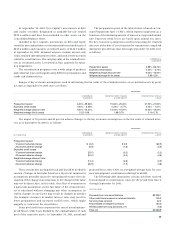

During Fiscal 2001, the Company reduced its estimate of

purchase accounting liabilities recorded in prior years by

$68.9 million primarily because costs were less than originally

anticipated. Goodwill and related deferred tax assets were

reduced by an equivalent amount. In addition, the Company

finalized its business plans for the exiting of businesses and the

termination of employees in connection with the Fiscal 2000

acquisitions and integration of the electronic OEM business of

Thomas & Betts, AFC Cable Systems, Inc., Critchley Group PLC

and Siemens Electromechanical Components GmbH & Co. KG,

and as a result recorded $103.7 million of additional purchase

accounting liabilities. The Company has not yet finalized its

business integration plans for recent acquisitions and, accord-

ingly, purchase accounting liabilities are subject to revision in

future quarters. In addition, the Company is still in the process

of obtaining information to finalize estimates for the fair values

of certain assets acquired and liabilities assumed.

In October 2000, the Company sold its ADT Automotive

business to Manheim Auctions, Inc., a wholly-owned subsidiary

of Cox Enterprises, Inc., for approximately $1.0 billion in cash.

The Company recorded a net gain on the sale of businesses and

investments of $406.5 million, principally related to the sale of

ADT Automotive.

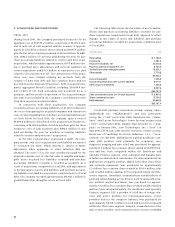

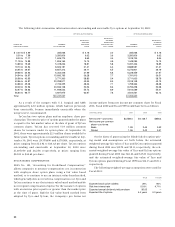

The following unaudited pro forma data summarize the

results of operations for the periods indicated as if the Fiscal

2001 acquisitions and divestitures had been completed as of the

beginning of the periods presented. The pro forma data give

effect to actual operating results prior to the acquisitions and

divestitures and adjustments to interest expense, goodwill

amortization and income taxes. No effect has been given to cost

reductions or operating synergies in this presentation. These pro

forma amounts do not purport to be indicative of the results that

would have actually been obtained if the acquisitions and

divestitures had occurred as of the beginning of the periods pre-

sented or that may be obtained in the future.

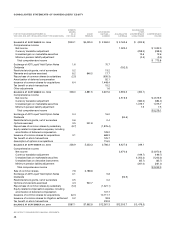

YEAR ENDED SEPTEMBER 30,

($ IN MILLIONS, EXCEPT PER SHARE DATA) 2001(1) 2000(2)

Total revenues $42,203.8 $43,003.9

Income before extraordinary items and

cumulative effect of accounting changes 4,740.1 4,640.8

Net income 3,987.7 4,600.4

Net income per common share:

Basic 2.10 2.42

Diluted 2.07 2.39

(1) Includes a net gain on sale of businesses and investments of $276.6 million and a net

gain on sale of common shares of a subsidiary of $64.1 million, partially offset by a decrease

of $241.1 million related to a change in revenue recognition policies to conform to SAB 101.

Income also includes net restructuring and other non-recurring and impairment charges of

$538.6 million.

(2) Includes a non-recurring gain of $1,760.0 million on the sale by a subsidiary of its

common shares. Income also includes net non-recurring and impairment charges of

$275.3 million.

On May 30, 2001, a subsidiary of the Company entered into

a definitive agreement to acquire C.R. Bard, Inc. (“Bard”), a

multinational developer, manufacturer and marketer of health-

care products used for vascular, urological and oncological diag-

nosis and intervention, as well as surgical specialties, in a

tax-free stock-for-stock merger, in exchange for approximately

58 million Tyco common shares. The transaction is valued at

approximately $3,200.0 million, including the assumption of net

debt of $72.9 million. The merger has been approved by Bard

shareholders but is still contingent on regulatory clearance

under United States anti-trust laws. If consummated, Bard

would be integrated within the Company’s Healthcare and Spe-

cialty Products segment and the transaction will be accounted

for as a purchase.

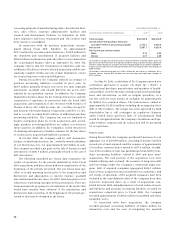

FISCAL 2000

During Fiscal 2000, the Company purchased businesses for an

aggregate cost of $4,917.9 million, consisting of $4,246.5 million

in cash, net of cash acquired, and the issuance of approximately

15.6 million common shares valued at $671.4 million. In addi-

tion, $544.2 million of cash was paid during Fiscal 2000 for pur-

chase accounting liabilities related to 2000 and prior years’

acquisitions. The cash portions of the acquisition costs were

funded utilizing cash on hand, the issuance of long-term debt

and borrowings under the Company’s commercial paper pro-

gram. Debt of acquired companies aggregated $244.1 million.

Each of these acquisitions was accounted for as a purchase, and

the results of operations of the acquired companies have been

included in the consolidated results of the Company from their

respective acquisition dates. As a result of acquisitions com-

pleted in Fiscal 2000, and adjustments to the fair values of assets

and liabilities and purchase accounting liabilities recorded for

acquisitions completed prior to Fiscal 2000, the Company

recorded approximately $5,206.8 million in goodwill and other

intangible assets.

In connection with these acquisitions, the Company

recorded purchase accounting liabilities of $426.2 million for

transaction costs and the costs of integrating the acquired