ADT 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

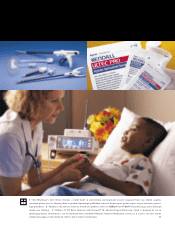

> Tyco’s subsidiary, Tyco Capital Corporation (formerly The CIT Group, Inc.), is the cornerstone of Tyco’s newest

business unit and the result of the Company’s largest acquisition during fiscal 2001. A leading provider of capital

to middle market companies, Tyco Capital has several very strong franchises; it ranks first in the United States

in factoring, vendor financing, construction equipment financing and Small Business Administration loans.

The acquisition of Tyco Capital improves Tyco’s capital efficiency and provides financing to a variety of commercial and

consumer customers of other Tyco units, such as ADT Security and Tyco Infrastructure Services (formerly Earth Tech).

But Tyco Capital is also a strong growth business in its own right, and the expanding need for asset-based financing

coupled with Tyco Capital’s responsive approach to the market should lead to many years of consistent growth. Within

months after the acquisition’s closing, Tyco Capital disposed of and exited in excess of $5 billion worth of non-strategic

businesses and reduced annual operating costs by $150 million.

TYCO CAPITAL

WORLDWIDE LOCATIONS: NORTH AMERICA & THE CARIBBEAN: CANADA, MEXICO, UNITED STATES CENTRAL & SOUTH AMERICA: ARGENTINA,

COLOMBIA EUROPE, AFRICA & MIDDLE EAST: BELGIUM, GERMANY, REPUBLIC OF IRELAND, SPAIN, UNITED KINGDOM FAR EAST & AUSTRALIA:

AUSTRALIA, HONG KONG, NEW ZEALAND

GROWTH DRIVERS

Asset-based financing displacing traditional sources in the middle market

Improves Tyco asset utilization and capital efficiency

Exit underperforming portfolios: accretive to earnings and delevers balance sheet

Enhances growth through cross-selling financing with Tyco’s other units

Opportunities for greater cost efficiency:

—overhead

—underutilized international structure