ADT 2001 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

for the new TV and radio antenna on the Chrysler

Building to replace the one destroyed at the World

Trade Center. As part of their Environmental Protection

Agency Region 2 Emergency Response contract, Tyco

Infrastructure Services provided decontamination units

at points on the perimeter of the work zone that each

worker passed through before exiting the site.

In many ways, fiscal 2001 truly tested the determination

of Tyco and its employees. We can’t yet say that the test

is over, but thus far we are pleased with our perform-

ance. It is one thing to have a plan for tough times; it is

quite another to be able to execute under pressure.

This strength was reflected in our earnings. For the

ninth consecutive year, we increased revenues and

earnings substantially. Revenues rose 25 percent to $36.3

billion and earnings grew $1.4 billion to $5.1 billion, a

38 percent increase over the prior year. Our diluted earn-

ings per share increased 29 percent to $2.81. Free cash

flow exceeded $4.7 billion in fiscal 2001 and should

surpass $5 billion next year.

Much of the increase came from organic growth. If Tyco

never made another acquisition, we should be able to

increase our earnings at a solid double-digit rate. We are

fortunate to be in the types of businesses that grow even

during economic slowdowns. For fiscal 2002, we are look-

ing forward to earnings growth of 20 percent or better.

I remain optimistic about Tyco’s future. It’s a cliché

today for a CEO to proclaim that his company is “well-

positioned” but, in truth, we are. We are a global leader

in some of the best growth businesses in the world.

Demographics and technological innovation assure that

healthcare spending will increase. As the world’s sec-

ond-largest medical device company, we will benefit. The

growing concern about security (which has, of course,

intensified since September 11) will lead to more sales of

our security and fire protection products, categories in

which we lead the world. Technological innovation and

the proliferation of electronic devices will drive cus-

tomers to Tyco Electronics, the world’s leading passive

electronic component supplier. Tyco Capital’s diversified

revenue base, broad access to funding markets and cred-

it risk management skills will provide consistent growth.

Fiscal 2001 was a year of many achievements. Among

the highlights:

* Through strong internal growth and acquisitions, we grew our

global electronic security customer base from 4.4 million to 6.7

million. Electronic security has now become a mainstream prod-

uct for people all around the world. Because penetration rates

are even lower outside the United States, the opportunity for

international expansion remains extraordinary.

* We successfully integrated the Mallinckrodt acquisition more

rapidly than expected, more than doubling its profits. We still

see opportunity to increase Mallinckrodt’s profits m uch faster

than its healthy, high single-digit revenue growth rate.

* In virtually all of our businesses, new product introductions

spurred organic growth. It was a great year for innovation at

Tyco. New product launches included Nellcor’s fetal oximeter,

which revolutionizes the way doctors can m onitor a fetus’s

heartbeat; ADT’s Safewatch™ iCenter, an Internet-enabled home

security system; and new autom otive radar sensors that improve

driver safety.

* We acquired The CIT Group, Inc., a leading commercial and

consumer finance com pany with over $50 billion in assets. In

the four months we have owned CIT (now known as Tyco

Capital Corporation), it has performed exceptionally well.

Tyco Capital is a broadly diversified lender—both geo-

graphically and by industry—with powerful franchises

and the ability to grow its earnings in all types of envi-

ronments. It has a large base of recurring revenue.

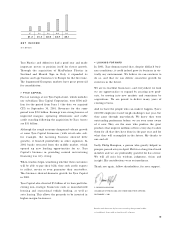

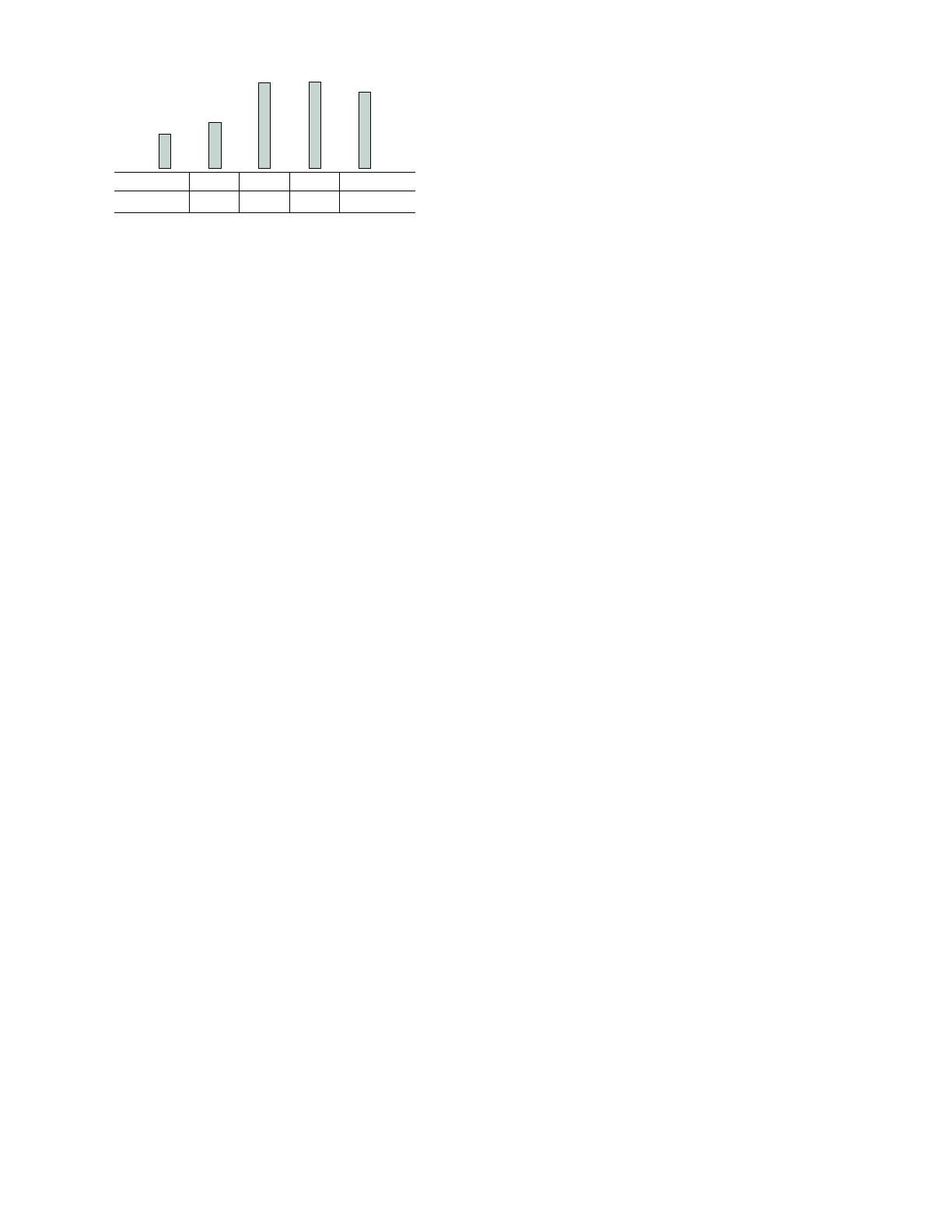

STOCK PRICE

[September 30] in dollars per share

97 98 99 00 01

$20.52 $27.63 $51.63 $51.88 $45.50