ADT 2001 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

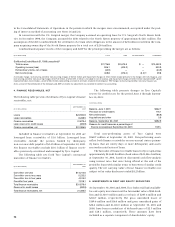

INVENTORIES

Inventories are recorded at the lower of cost (primarily first-in,

first-out) or market value.

FINANCING AND LEASING ASSETS

Tyco Capital provides funding for a variety of financing arrange-

ments, including term loans, lease financing and operating

leases. The amounts outstanding on loans and leases are referred

to as finance receivables. Financing and leasing assets consist of

finance receivables, finance receivables held for sale, net book

value of operating lease equipment and certain investments.

At the time of designation for sale, securitization or syndi-

cation, assets are classified as finance receivables held for sale,

which are included in other assets on the Consolidated Balance

Sheet. These assets are carried at the lower of aggregate cost or

market value.

CHARGE-OFF OF FINANCE RECEIVABLES

Finance receivables are reviewed periodically to determine the

probability of loss. Charge-offs are taken after considering such

factors as the borrower’s financial condition and the value of

underlying collateral and guarantees (including recourse to

dealers and manufacturers). Such charge-offs are deducted

from the carrying value of the related finance receivables. To the

extent that an unrecovered balance remains due, a final charge-

off is taken at the time collection efforts are no longer deemed

useful. Charge-offs are recorded on consumer and certain small

ticket commercial finance receivables beginning at 180 days of

contractual delinquency based upon historical loss severity.

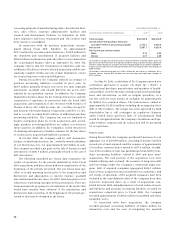

PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment is recorded principally at cost less

accumulated depreciation. Maintenance and repair expendi-

tures are charged to expense when incurred. For the years ended

September 30, 2001, 2000 and 1999, the Company capitalized

interest of $76.3 million, $10.8 million and $8.7 million, respec-

tively. The increase in capitalized interest is primarily due to

construction of the TyCom Global Network (“TGN”), which

began during the last quarter of Fiscal 2000. The straight-line

method of depreciation is used over the estimated useful lives of

the related assets as follows:

Buildings and related improvements 5 to 50 years

Leasehold improvements and

equipment leased to others Remaining term of the lease

Subscriber systems 10 to 14 years

Other plant, machinery, equipment and

furniture and fixtures 2to 25 years

TyCom Global Network 15 years

Equipment leased to others by Tyco Capital is also included

in property, plant and equipment. Gains and losses arising on

the disposal of property, plant and equipment are included in the

Consolidated Statements of Operations and were not material.

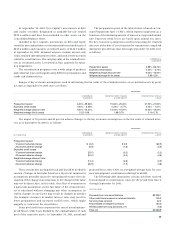

GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill, net was $29,790.8 million and $13,723.0 million at Sep-

tember 30, 2001 and 2000, respectively. Accumulated amortiza-

tion amounted to $1,556.5 million and $959.3 million at

September 30, 2001 and 2000, respectively. In accordance with

Statement of Financial Accounting Standards (“SFAS”) No. 142,

“Goodwill and Other Intangible Assets,” goodwill associated

with acquisitions consummated after June 30, 2001 is not being

amortized. All other goodwill is being amortized on a straight-

line basis over periods ranging from 10 to 40 years through Sep-

tember 30, 2001. See “Accounting Pronouncements” within Note 1

for more information on SFAS No. 142.

Other intangible assets, net were $5,519.6 million and

$2,609.6 million at September 30, 2001 and 2000, respectively.

These amounts include patents, trademarks, customer contracts

and other items, which are being amortized on a straight-line

basis over lives ranging from 2 to 40 years. At September 30, 2001

and 2000, accumulated amortization amounted to $885.3 mil-

lion and $525.2 million, respectively.

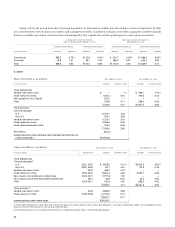

INVESTMENTS

The Company accounts for its long-term investments that rep-

resent less than twenty percent ownership by adjusting the

securities to market value at the end of each accounting period.

Unrealized market gains and losses are charged to earnings if

the securities are traded for short-term profit. Otherwise, such

unrealized gains and losses are charged or credited to share-

holders’ equity unless an unrealized loss is deemed to be other

than temporary, in which case such loss is charged to earnings.

Management determines the proper classification of invest-

ments in debt obligations with fixed maturities and securities

for which there is a readily determinable market value at the

time of purchase and reevaluates such classifications as of each

balance sheet date. Realized gains and losses on sales of invest-

ments, as determined on a specific identification basis, are

included in the Consolidated Statements of Operations.

Other investments for which the Company does not have

the ability to exercise significant influence and for which there

is not a readily determinable market value are accounted for

under the cost method of accounting. The Company periodically

evaluates the carrying value of its investments accounted for

under the cost method of accounting. At September 30, 2001 and

2000, such investments were recorded at the lower of cost or

estimated net realizable value.

For investments in which the Company owns or controls

twenty percent or more of the voting shares, or over which it

exerts significant influence over operating and financial poli-

cies, the equity method of accounting is used. The Company’s

share of net income or losses of equity investments is included

in the Consolidated Statements of Operations and was not

material in any period presented.

Investments are included in other assets on the Consoli-

dated Balance Sheets.