ADT 2001 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

Not so. TyCom, which is supported by Tyco’s very strong

balance sheet, will remain standing after many competi-

tors have buckled. Over time, TyCom should achieve an

outstanding return on its investment in the TGN.

Demand for sub-sea communications continues to grow

and we are the low-cost supplier with a unique global

product offering.

>TYCO FIRE AND SECURITY SERVICES

In Tyco’s Fire and Security Services segment, operating

income increased an impressive 38 percent to $2 billion,

from $1.5 billion last year. Revenues jumped to $10.5 bil-

lion, compared to last year’s $8.5 billion.

The unit enjoyed dramatic organic growth of 17 percent,

led by worldwide electronic security sales. In August 2001

alone, we opened 100,000 new accounts in North

America, compared to 75,000 in August 2000. Including

the acquisitions of the security businesses of SecurityLink

and Southern California Edison, we increased our North

American customer base to five million in fiscal 2001.

Sales of residential systems were especially strong in

Germany, Latin America and Asia.

Our airport security monitoring business saw major

sales gains. You will find our fire and/or security prod-

ucts—fire alarms, closed circuit TV, access systems and

security monitoring—in virtually every airport in the

world, and we expect strong growth in this business.

The recent acquisition of Sensormatic, the world’s lead-

ing retail security firm, allows us to offer a complete

security package to retailers around the globe. The acqui-

sition of Simplex Time Recorder makes us the largest fire

alarm company in the world.

We continue to benefit globally from tougher fire protec-

tion regulations and the growth of our fire inspection

business.

Tyco Valves & Controls had a fine year, seeing increased

demand for products in the oil and gas, petrochemical

and power generation industries. Excellent results were

also turned in by Tyco Thermal Controls, which is sup-

plying heat-tracing equipment for two large oil sand

projects in western Canada operated by Shell Oil and

Suncor Energy. Tyco Infrastructure Services won con-

tracts to design, build, own, operate and finance large

water and wastewater facilities in several countries.

>TYCO HEALTHCARE AND SPECIALTY PRODUCTS

Tyco Healthcare and Specialty Products had an outstand-

ing year, with operating income increasing to $2.1 billion,

up 36 percent from $1.5 billion in the prior year.

Revenues grew 37 percent to $8.8 billion, as compared

with $6.5 billion last year.

Revenues increased throughout the world, including

stellar international sales with double-digit organic

growth in Japan and Latin America. Tyco Healthcare

continued to increase direct sales operations abroad,

replacing distributors with direct salespeople in China,

Brazil and Singapore.

New products included a highly competitive line of

sutures and an improved trocar that allows doctors to

enter a body cavity in a much less invasive manner. Tyco

Healthcare increased its lead in laparoscopic surgical

instruments, partly by enhancing its number one posi-

tion in hernia repair, one of the fastest growing markets

for minimally invasive procedures.

Tyco Healthcare continues to invest in research and

development to drive new product innovation, increase

market share and improve profitability. The company’s

focus on “mid-technology” medical products, where

Tyco’s manufacturing and distribution expertise give

it a competitive advantage, offers a stable platform

for growth.

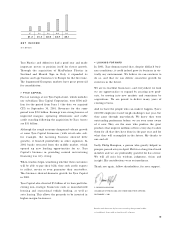

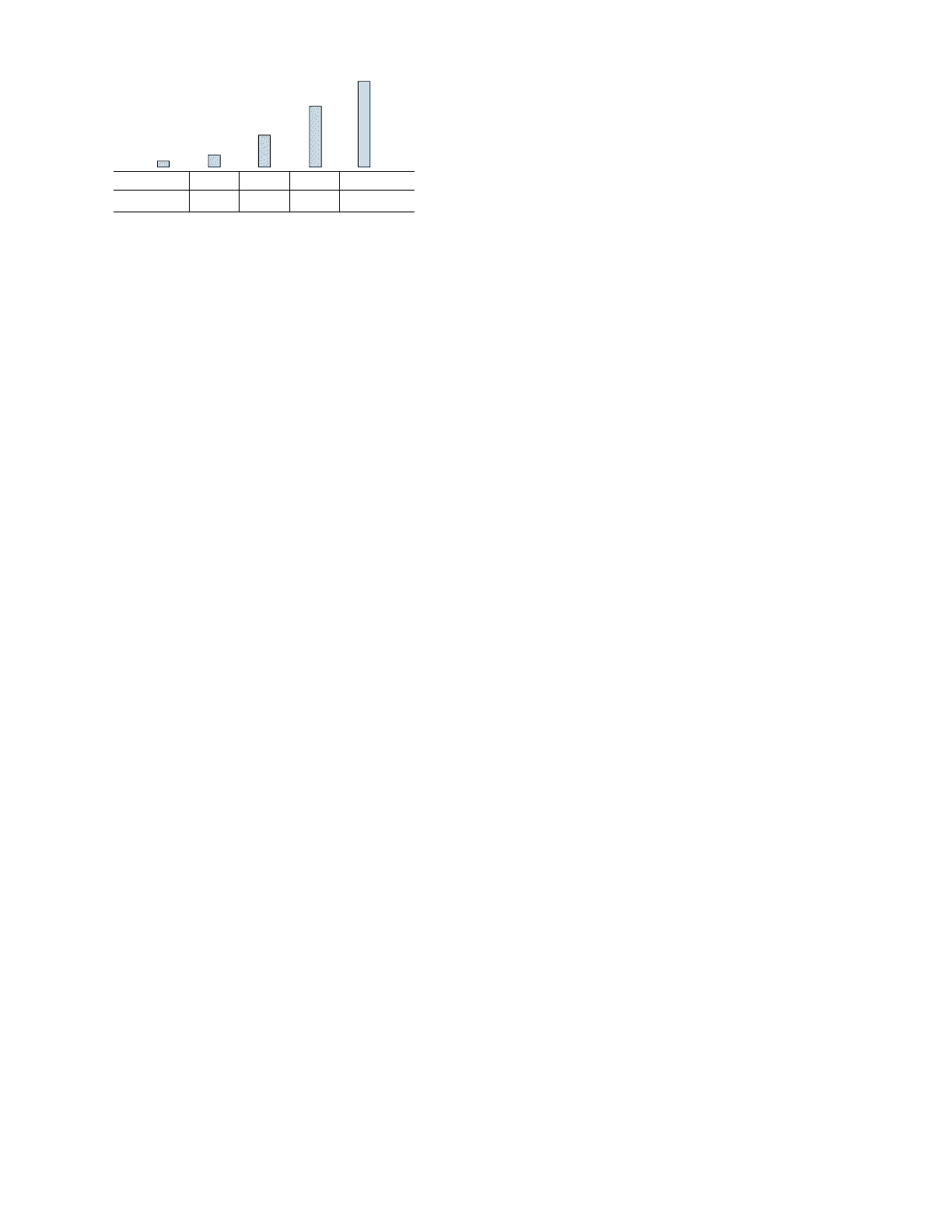

FREE CASH FLOW

$ in millions

97 98 99 00 01

$309 $661 $1,729 $3,312 $4,740