ADT 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

scores, including those based upon both its proprietary internal

credit scoring model and external credit bureau scoring, com-

bined with judgment.

MARKET RISK MANAGEMENT

Market risk is the risk of loss arising from changes in values of

financial instruments, including interest rate risk, foreign

exchange risk, derivative credit risk and liquidity risk. Tyco Cap-

ital engages in transactions in the normal course of business

that expose it to market risks, and maintains what it believes are

conservative management practices and policies designed to

effectively mitigate such risks. The objectives of Tyco Capital’s

market risk management efforts are to preserve company value

by hedging changes in future expected net cash flows and to

decrease the cost of capital. Strategies for managing market

risks associated with changes in interest rates and foreign

exchange rates are an integral part of the process, because those

strategies affect Tyco Capital’s future expected cash flows, as

well as its cost of capital.

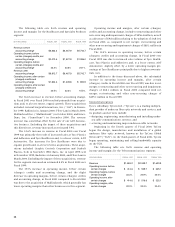

INTEREST RATE AND FOREIGN EXCHANGE

RISK MANAGEMENT

Tyco Capital offers a variety of financing products to its cus-

tomers including fixed and floating-rate loans of various matu-

rities and currency denominations, and a variety of leases,

including operating leases. Changes in market interest rates, or

in the relationships between short-term and long-term market

interest rates, or in the relationships between different interest

rate indices (i.e., basis risk) can affect the interest rates charged

on interest-earning assets differently than the interest rates

paid on interest-bearing liabilities, which can result in an

increase in interest expense relative to finance income. Tyco

Capital measures its asset/liability position in economic terms

through duration measures and value at risk analysis, and mea-

sures its periodic effect on earnings using maturity gap analysis.

A substantially matched asset/liability position is generally

achieved through a combination of financial instruments,

including issuing commercial paper, medium-term notes, long-

term debt, interest rate and currency swaps, foreign exchange

contracts, and through asset syndication and securitization.

Tyco Capital does not speculate on interest rates or foreign

exchange rates, but rather seeks to mitigate the possible impact

of such rate fluctuations encountered in the normal course of

business. This process is ongoing due to prepayments, refinanc-

ings and actual payments varying from contractual terms, as

well as other portfolio dynamics.

Tyco Capital periodically enters into structured financings

(involving both the issuance of debt and an interest rate swap

with corresponding notional principal amount and maturity) to

manage liquidity and reduce interest rate risk at a lower overall

funding cost than could be achieved by solely issuing debt.

Interest rate swaps with notional principal amounts of

$6.9 billion at September 30, 2001 were designated as hedges

against outstanding debt and were principally used to convert

the interest rate on variable-rate debt to a fixed-rate, establish-

ing a fixed-rate term debt borrowing cost for the life of the swap.

These hedges reduce Tyco Capital’s exposure to rising interest

rates, but also reduce the benefits from lower interest rates.

Tyco Capital’s foreign operations include Canada, Latin

America, Europe, Asia and Australia and are funded through

both local currency borrowings and U.S. dollar borrowings

which are converted to local currency through the use of foreign

exchange forward contracts or cross-currency swaps. At Sep-

tember 30, 2001, $2.5 billion in notional principal amount of for-

eign exchange forwards and $1.7 billion in notional principal

amount of cross-currency swaps were designated as

currency-related debt hedges.

Tyco Capital also utilizes foreign exchange forward con-

tracts to hedge its net investments in foreign operations. Trans-

lation gains and losses of the underlying foreign net investment,

as well as offsetting derivative gains or losses on designated

hedges, are reflected in other comprehensive income. At Sep-

tember 30, 2001, $0.8 billion in notional principal of foreign

exchange forwards were designated as hedges of net invest-

ments in foreign operations.

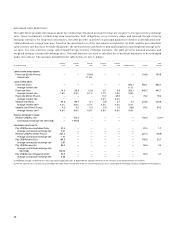

DERIVATIVE RISK MANAGEMENT

Tyco Capital enters into interest rate and currency swaps and

foreign exchange forward contracts as part of its overall market

risk management practices.

The primary external risk of derivative instruments is coun-

terparty credit exposure, which is defined as the ability of a

counterparty to perform its financial obligations under a deriv-

ative contract. Tyco Capital controls the credit risk of its deriva-

tive agreements through counterparty credit approvals,

pre-established exposure limits and monitoring procedures.

LIQUIDITY RISK MANAGEMENT

Liquidity risk refers to the risk of Tyco Capital being unable to

meet potential cash outflows promptly and cost effectively. Fac-

tors that could cause such a risk to arise might be a disruption

of a securities market or the unavailability of funds. Tyco Capi-

tal actively manages and mitigates liquidity risk by maintaining

diversified sources of funding. The primary funding sources are

commercial paper (U.S., Canada and Australia), medium-term

notes (U.S., Canada and Europe) and asset-backed securities

(U.S. and Canada). Included as part of Tyco Capital’s securitiza-

tion programs are committed asset-backed commercial paper

programs in the U.S. and Canada. Tyco Capital also maintains

committed bank lines of credit to provide back-stop support of

commercial paper borrowings and local bank lines to support

our international operations. Additional sources of liquidity are

loan and lease payments from customers, whole loan asset sales

and loan syndications.