Singapore Airlines 2003 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 SIA Annual Report 02/03

Notes to the Financial Statements

31 March 2003

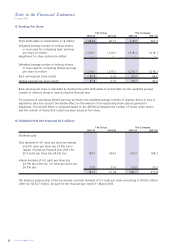

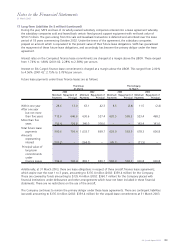

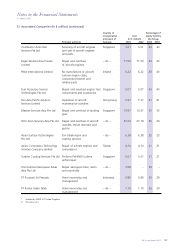

18 Fixed assets (in $ million) (continued)

The Group The Company

31 March 31 March

2003 2002 2003 2002

Net book value of fixed assets acquired under

finance leases:

– aircraft 456.4 485.9 – –

– plant and equipment 159.7 – – –

616.1 485.9 – –

Advance and progress payments comprise mainly purchases of aircraft, related equipment and building projects.

The provision for impairment represents the write-down of certain spares to recoverable amount due to the related

fleet types being phased out. The estimated recoverable amount was determined based on references to average

tender prices for the year and various bids submitted.

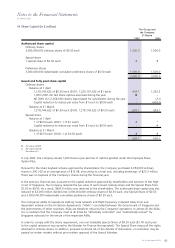

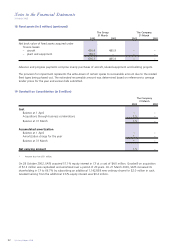

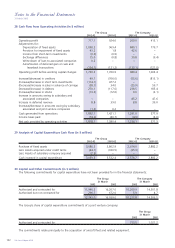

19 Goodwill on Consolidation (in $ million)

The Company

31 March

2003 2002

Cost

Balance at 1 April – –

Acquisitions through business combinations 1.5 –

Balance at 31 March 1.5 –

Accumulated amortization

Balance at 1 April – –

Amortization charge for the year * –

Balance at 31 March * –

Net carrying amount 1.5 –

* Amount less than $0.1 million.

On 28 October 2002, SATS acquired 57.1% equity interest in CF at a cost of $4.0 million. Goodwill on acquisition

of $1.3 million was capitalized and amortized over a period of 20 years. On 21 March 2003, SATS increased its

shareholding in CF to 66.7% by subscribing an additional 1,142,858 new ordinary shares for $2.0 million in cash.

Goodwill arising from the additional 9.6% equity interest was $0.2 million.