Singapore Airlines 2003 Annual Report Download - page 76

Download and view the complete annual report

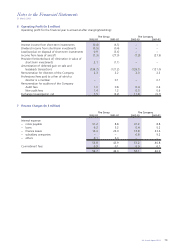

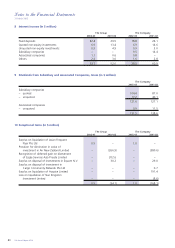

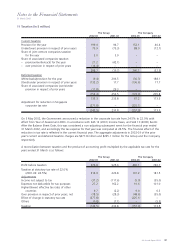

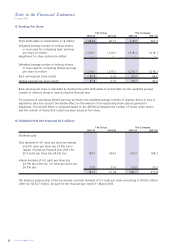

Please find page 76 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

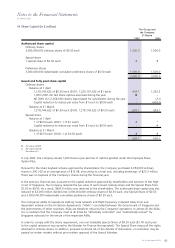

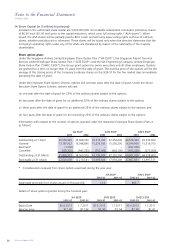

74 SIA Annual Report 02/03

Notes to the Financial Statements

31 March 2003

2 Accounting Policies (continued)

(h) Leased assets

As lessee

Finance leases, which effectively transfer to the Group substantially all the risks and benefits incidental to ownership

of the leased asset, are capitalized at the present value of the minimum lease payments at the inception of the

lease term and disclosed as leased fixed assets and the corresponding lease commitments are included under

liabilities. Lease payments are apportioned between finance charges and reduction of the lease liability so as to

achieve a constant rate of interest on the remaining balance of the liability. Finance charges are charged directly

against the profit and loss accounts. Depreciation on the relevant assets is charged to the profit and loss accounts.

Leases where the lessor effectively retains substantially all the risks and benefits of ownership of the leased assets

are classified as operating leases. Operating lease payments are recognized as an expense in the profit and loss

accounts on a straight-line basis over the lease term.

Gains arising from sale and operating leaseback of aircraft are determined based on fair values. Sale proceeds in

excess of fair values are deferred and amortized over the minimum lease terms.

Major improvements and modifications to leased aircraft due to operational requirements are capitalized and

depreciated over the lease-term period.

(i) Investments

Investments held on a long-term basis are stated at cost and provisions are made for diminution in value which is

considered to be permanent. Short-term investments are stated at the lower of cost and net realizable value on a

portfolio basis.

(j) Stocks

Stocks are stated at the lower of cost and net realizable value. Cost is determined on either a first-in-first-out or

weighted average basis depending on the nature of the stocks. Net realizable value is the estimated selling price in

the ordinary course of business less estimated costs necessary to make the sale.

Work-in-progress is stated at cost plus estimated attributable profit.

(k) Trade debtors

Trade debtors are recognized and carried at original invoiced amount less an allowance for any uncollectible

amounts. An estimate for doubtful debts is made when collection of the full amount is no longer probable. Bad

debts are written-off as incurred.

Amounts owing by subsidiary, associated and joint venture companies are recognized and carried at cost less

provisions for any uncollectible amounts.

(l) Cash and bank balances

Cash and bank balances are defined as cash on hand, demand deposits and short-term, highly liquid investments

readily convertible to known amounts of cash and subject to insignificant risk of changes in value.

Cash on hand and in banks, demand deposits and short-term deposits which are held to maturity are carried at cost.

For the purposes of the Cash Flow Statements, cash and cash equivalents consist of cash on hand and deposits in

banks, net of outstanding bank overdrafts.

(

m

) Deferred taxation

Deferred tax is provided, using the liability method, on all temporary differences at the balance sheet date between

the tax bases of assets and liabilities and their carrying amounts for financial reporting purposes.

Additionally the Group’s deferred tax liabilities include all taxable temporary differences associated with investments

in subsidiary, associated and joint venture companies, except where the timing of the reversal of the temporary

differences can be controlled and it is probable that the temporary differences will not reverse in the foreseeable

future.

Deferred tax assets are recognized for all deductible temporary differences and, carry forward of unused tax assets

and losses, to the extent that it is probable that taxable profit will be available against which the deductible

temporary differences and, carry forward of unused tax assets and losses, can be utilized.

The carrying amount of deferred tax assets is reviewed at each balance sheet date and reduced to the extent that it

is no longer probable that sufficient taxable profits will be available to allow all or part of the deferred tax assets to

be utilized.

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the period when the

asset is realized or the liability is settled, based on tax rates (and tax laws) that have been enacted at the balance

sheet date.