Singapore Airlines 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

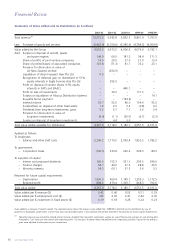

Value Added

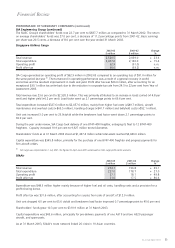

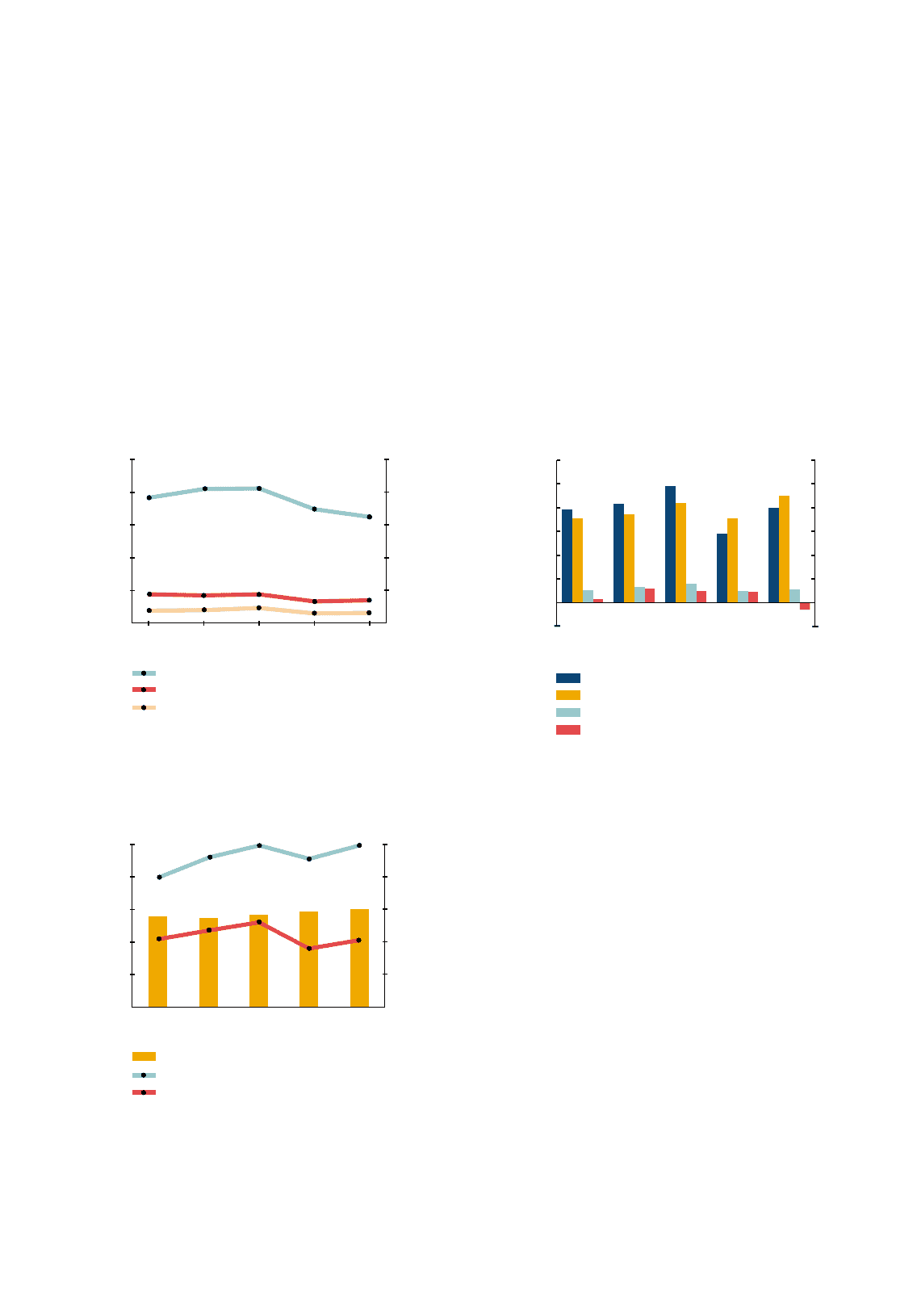

Compared to 2001-02, the total value added of the Group increased by $649 million to $4,367 million in 2002-03.

This was mainly attributable to increase in revenue (+$1,132 million), provision for diminution in value of the

investment in Air New Zealand Limited in the previous year (+$267 million) and higher share of profits of associated

companies (+$195 million), partially offset by higher costs of goods and services purchased (-$753 million) and gain

on divestment of 51 per cent equity interests in Eagle Services Asia Pte Ltd in the previous year (-$203 million).

Salaries and other staff costs accounted for $2,245 million (51.4 per cent) of the value added. $167 million (3.8 per

cent) was applied on dividends for shareholders, and $55 million paid for finance charges (1.3 per cent). Minority

interests’ share was $55 million (1.2 per cent). The remaining $1,988 million (45.6 per cent) was retained for future

capital requirement. The above was partially offset by the write-back of corporate taxes, at $143 million (3.3 per cent).

55

SIA Annual Report 02/03

Financial Review

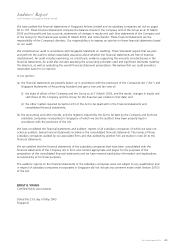

Group Value Added Productivity Ratios

Dollar

Dollar

1998-99 1999-00 2000-01 2001-02 2002-03

Value Added per $ Employment Costs

Value Added per $ Revenue

Value Added per $ Investment in Fixed Assets

3.0

2.4

1.8

1.2

0.6

0

3.0

2.4

1.8

1.2

0.6

0

350

280

210

140

70

0

Group Staff Strength and Productivity

$ ‘000

Staff Number

Staff Strength

Revenue per Employee ($)

Value Added per Employee ($)

50,000

40,000

30,000

20,000

10,000

0

1998-99 1999-00 2000-01 2001-02 2002-03

Group Value Added

$ Million

$ Million

1998-99 1999-00 2000-01 2001-02 2002-03

-500

0

500

1000

1500

2000

2500

3000

-500

0

500

1000

1500

2000

2500

3000

Retained in the Business

Employees

Suppliers of Capital

Government