Singapore Airlines 2003 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

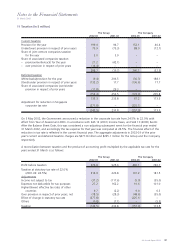

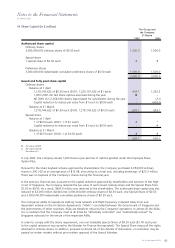

14 Share Capital (in $ million) (continued)

Included in the authorized share capital are 3,000,000,000 non-tradable redeemable cumulative preference shares

of $0.50 each ($1.00 each prior to the capital reduction), which carry full voting rights ("ASA shares"). When

issued, the ASA shares will be partially paid to $0.01 each and will carry equal voting rights as those of ordinary

shares, whether partially paid or otherwise. These shares will be issued only when the directors determine that the

Company’s operating rights under any of the ASAs are threatened by reason of the nationality of the majority

shareholders.

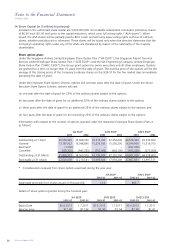

Share option plans

Under the Singapore Airlines Limited Employee Share Option Plan ("SIA ESOP"), the Singapore Airport Terminal

Services Limited Employee Share Option Plan ("SATS ESOP") and the SIA Engineering Company Limited Employee

Share Option Plan ("SIAEC ESOP"), the Group grant options to senior executives and all other employees. Options

are granted for a term no longer than 10 years from the date of grant. The exercise price of the options will be the

average of the closing prices of the Company’s ordinary shares on the SGX-ST for the five market days immediately

preceding the date of grant.

Under the Employee Share Option Scheme, options will vest two years after the date of grant. Under the Senior

Executive Share Option Scheme, options will vest:

(a) one year after the date of grant for 25% of the ordinary shares subject to the options;

(b) two years after the date of grant for an additional 25% of the ordinary shares subject to the options;

(c) three years after the date of grant for an additional 25% of the ordinary shares subject to the options; and

(d) four years after the date of grant for the remaining 25% of the ordinary shares subject to the options.

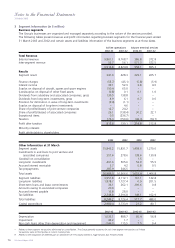

Information with respect to the number of options granted under the respective Employee Share Option Plans is

as follows:

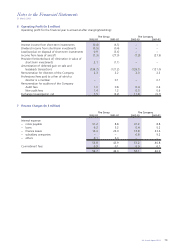

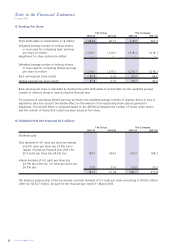

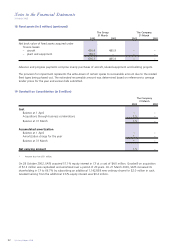

SIA ESOP SATS ESOP SIAEC ESOP

2003 2002 2003 2002 2003 2002

Outstanding at 1 April

38,569,920 25,668,300 47,310,700 32,452,600 44,578,400 29,339,600

Granted

13,787,922 13,348,840 15,239,500 15,350,200 16,594,800 15,516,700

Exercised*

(1,000) – – – (437,000) –

Cancelled

(529,920) (447,220) (751,000) (492,100) (435,200) (277,900)

Outstanding at 31 March

51,826,922 38,569,920 61,799,200 47,310,700 60,301,000 44,578,400

Exercisable at 31 March

22,641,036 12,210,541 31,095,500 17,959,200 27,867,861 14,997,511

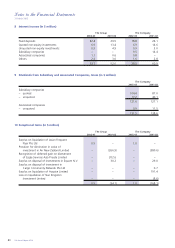

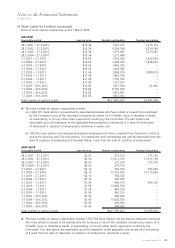

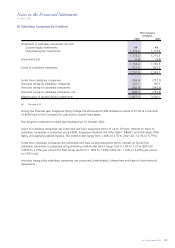

* Considerations received from share options exercised during the year was:

SIA ESOP SIAEC ESOP

2002-03 2001-02 2002-03 2001-02

Aggregate proceeds from shares issued (in thousand $) 12.0 – 866.7 –

Details of share options granted during the financial year:

SIA ESOP SATS ESOP SIAEC ESOP

2002-03 2001-02 2002-03 2001-02 2002-03 2001-02

Expiry Date 30.6.2012 1.7.2011 30.6.2012 1.7.2011 30.6.2012 1.7.2011

Exercise price $12.82 $11.96 $1.90 $1.54 $2.38 $1.41

84 SIA Annual Report 02/03

Notes to the Financial Statements

31 March 2003