Singapore Airlines 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

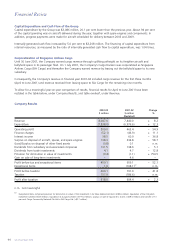

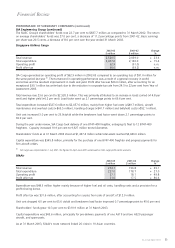

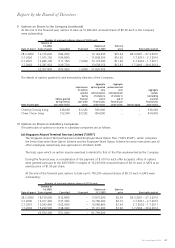

Finance Charges

The Company’s finance charges increased 11.1 per cent mainly because of the full year impact of the interest charge on

the $900 million Bond issue in December 2001. Interest income was 36.8 per cent less after SIA Cargo and SilkAir

made partial repayment of loans, and lower interest was earned from deposits.

Surplus/Loss On Disposal Of Aircraft, Spares And Spare Engines

The Company’s surplus on the disposal of aircraft, spares and spare engines was $197 million lower than the year

before, mainly due to the transfer of nine B744 freighters and six spare engines to SIA Cargo in 2001-02. In 2002-03,

a sale and leaseback agreement was completed for one B747-400 aircraft. Two A310-300 and four learjet aircraft were

sold, and two A310-300 and five A340-300 aircraft were traded-in.

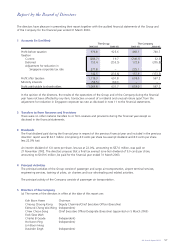

Gross Dividends From Subsidiaries And Associated Companies

Gross dividends from subsidiaries and associated companies fell by $7 million as Sing-Bi Funds became dormant after

paying dividends ($27 million) and returning most of the funds to SIA in 2001-02. Higher dividends were received from

SATS (+$9 million), SIAEC (+$9 million), and SilkAir (+$3 million).

Provision for Diminution in Value of Long-Term Investment

The $9 million provision for a diminution in value of long-term investments pertains to investments in the Star Alliance

led purchasing portal, AeroXchange Ltd (-$6 million), and convertible preference shares in Air Canada (-$3 million).

There was no diminution in the value of other investments as their market values were higher than their carrying values.

Exceptional Item

Net proceeds of $1 million were received on the liquidation of Asian Frequent Flyer Pte Ltd during the year.

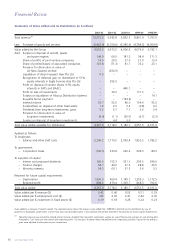

Taxation

The provision for current tax was $240 million and writeback of deferred tax $173 million. As at 31 March 2003, the

Company had a Section 44 charge balance of $288 million available for set-off against tax liabilities. To make use of this

tax prepayment before it expires on 31 December 2007, capital allowance claims have been deferred from Year of

Assessment 2003. As at 31 March 2003, the Company’s deferred taxation account stood at $1,808 million.

There was a tax writeback of $225 million from the cut in corporate tax rate from 24.5 to 22.0 per cent.

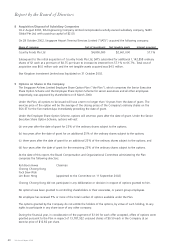

Issued Share Capital and Share Options

There was no buyback of the Company’s shares during the period under review.

On 1 July 2002, the Company made a fourth grant of share options to employees. Staff accepted 13,658,152 share

options (99.1 per cent of total options offered) to be exercised between 1 July 2003 and 30 June 2012.

In July 2002, the Company issued 1,000 shares upon the exercise of options granted under the Employee Share Option

Plan. As at 31 March 2003, there were 51,826,922 unexercised options under the Plan.

51

SIA Annual Report 02/03

Financial Review