Singapore Airlines 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

SIA Annual Report 02/03

Financial Review

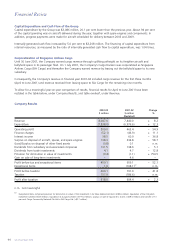

PERFORMANCE OF SUBSIDIARY COMPANIES (continued)

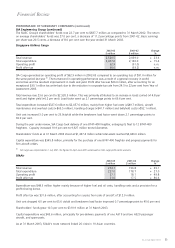

SIA Engineering Group (continued)

The SIAEC Group’s shareholders’ funds rose 22.7 per cent to $837.7 million as compared to 31 March 2002. The return

on average shareholders’ funds was 27.0 per cent, a decrease of 11.2 percentage points from 2001-02. Basic earnings

per share was 20.5 cents, a decrease of 8.0 per cent over the year ended 31 March 2002.

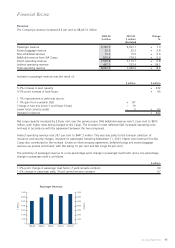

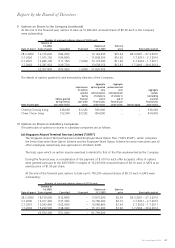

Singapore Airlines Cargo

2002-03 2001-02 Change

$ million $ million %

Total revenue 2,520.5 2,039.0 + 23.6

Total expenditure 2,457.6 2,130.0 + 15.4

Operating profit 62.9 (91.0) n.m.

Profit after tax 66.6 (93.2) n.m.

SIA Cargo generated an operating profit of $62.9 million in 2002-03 compared to an operating loss of $91.0 million for

the same period last year R1. The turnaround in operating performance was a result of a general recovery in world

economies and the resultant improvement in loads and yield. Profit after tax was $66.6 million, after accounting for an

exceptional $30.1 million tax write-back due to the reduction in corporate tax rate from 24.5 to 22 per cent from Year of

Assessment 2003.

Total revenue rose 23.6 per cent to $2,520.5 million. This was primarily attributed to an increase in loads carried (+14.8 per

cent) and higher yield (+6.2 per cent). Load factor went up 2.1 percentage points to 69.6 per cent.

Total expenditure increased $327.6 million to $2,457.6 million, mainly from higher fuel costs (+$49.7 million), aircraft

maintenance and overhaul costs (+$65.5 million), handling charges (+$41.7 million) and bellyhold costs (+$52.1 million).

Unit cost increased 3.0 per cent to 23.9cts/ctk while the breakeven load factor went down 2.1 percentage points to

69.9 per cent.

During the year under review, SIA Cargo took delivery of one B747-400 freighter, enlarging its fleet to 12 B747-400

freighters. Capacity increased 10.9 per cent to 9,927 million tonne-kilometres.

Shareholders’ funds as at 31 March 2003 stood at $1,427.4 million while total assets reached $3,043.6 million.

Capital expenditure was $345.8 million, primarily for the purchase of one B747-400 freighter and progress payments for

firm aircraft orders.

R1 SIA Cargo was corporatized on 1 July 2001, the figures for April–June 2001 were based on SIA’s cargo profit-centre accounts.

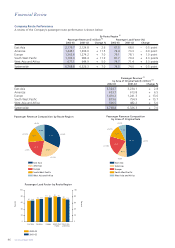

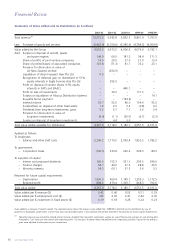

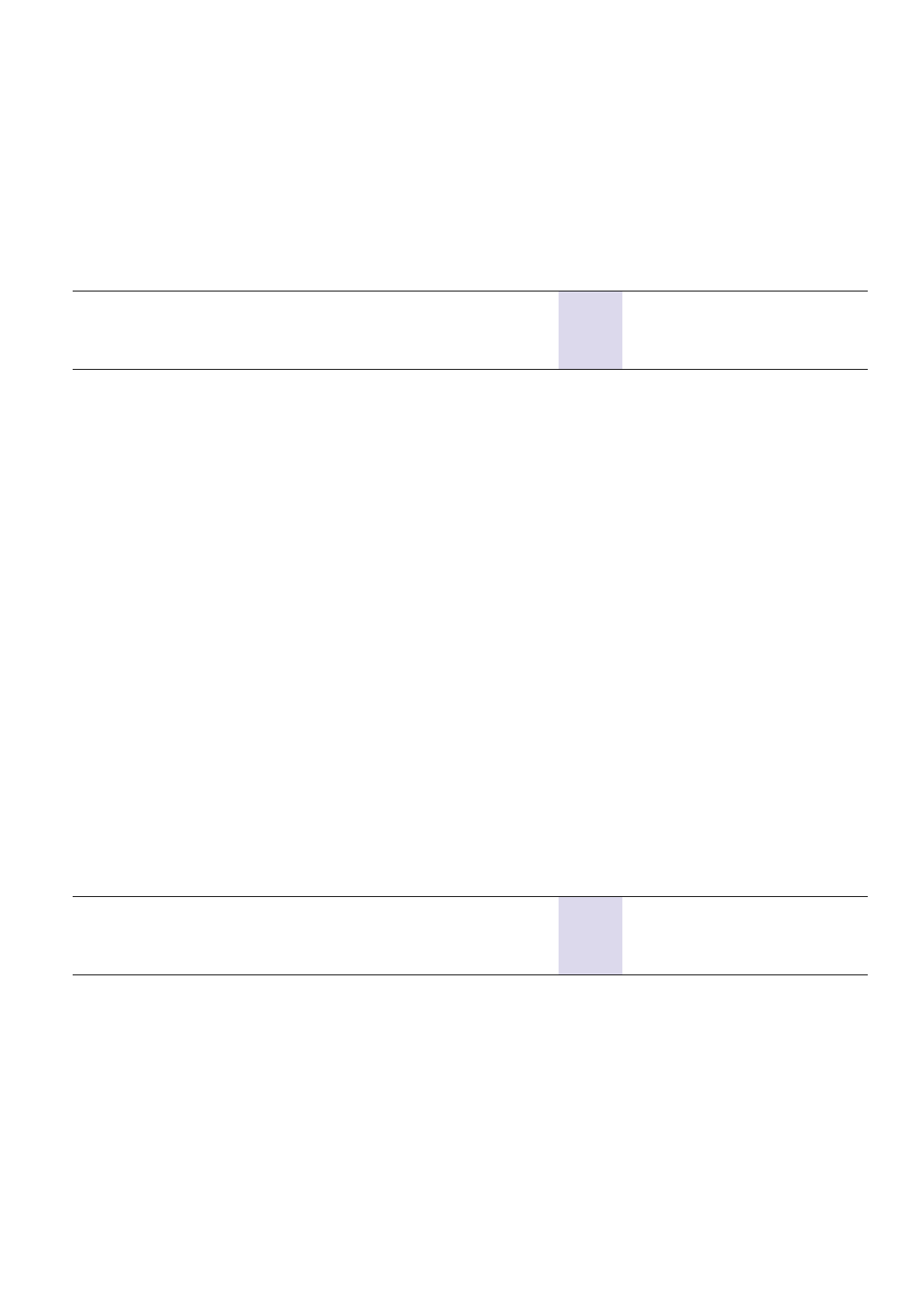

SilkAir

2002-03 2001-02 Change

$ million $ million %

Total revenue 254.1 196.8 + 29.1

Total expenditure 227.0 178.7 + 27.0

Operating profit 27.1 18.1 + 49.8

Profit after tax 31.6 17.5 + 80.6

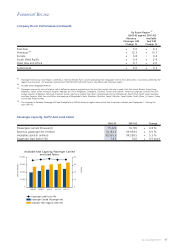

Expenditure was $48.3 million higher mainly because of higher fuel and oil costs, handling costs and a provision for a

profit-sharing bonus.

Profit after tax was $31.6 million, after accounting for surplus from sale of aircraft of $12.0 million.

Unit cost dropped 4.0 per cent to 65.6 cts/ctk and breakeven load factor improved 0.7 percentage point to 45.6 per cent.

Shareholders’ funds grew 10.3 per cent to $310.9 million at 31 March 2003.

Capital expenditure was $43.6 million, principally for pre-delivery payments of one A319 and two A320 passenger

aircraft, and spare parts.

As at 31 March 2003, SilkAir’s route network linked 26 cities in 10 Asian countries.