Singapore Airlines 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

SIA Annual Report 02/03

Report by the Board of Directors

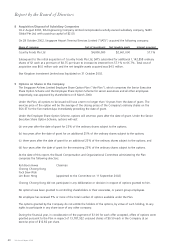

5 Directors of the Company (continued)

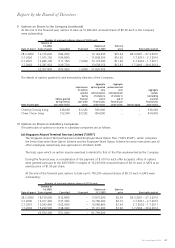

Direct Interest Deemed interest

1.4.2002/ 1.4.2002/

date of date of

Name of Director appointment 31.3.2003 21.4.2003 appointment 31.3.2003 21.4.2003

Interest in Raffles Holdings Limited

Ordinary shares of $0.50 each

Chew Choon Seng 12,000 12,000 12,000 – – –

Interest in SMRT Corporation Limited

Ordinary shares of $0.10 each

Chew Choon Seng 50,000 50,000 50,000 – – –

Neither at the end of the financial year, nor at any time during that financial year, did there subsist any

arrangements to which the Company is a party, whereby directors might acquire benefits by means of the

acquisition of shares and share options in, or debentures of, the Company or any other body corporate, other

than pursuant to the Singapore Airlines Limited Employee Share Option Plan.

(c) Since the end of the previous financial year no director has received or has become entitled to receive benefits

under contracts required to be disclosed by Section 201(8) of the Companies Act, Chapter. 50, except for

$0.6 million (2002: $0.9 million) of loans to directors of the Company and its subsidiary companies in

accordance with schemes approved by shareholders of the Company and $0.015 million (2001-02: $0.057

million) of professional fees paid by the Group and the Company to a firm of which one director is a member.

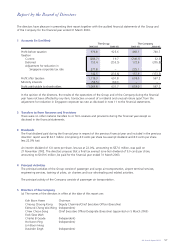

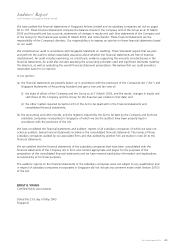

6 Audit And Risk Committee

At the date of this report, the Audit and Risk Committee comprises three members, two of whom are independent

non-executive directors. The members of the Audit and Risk Committee at the date of this report are:

Edmund Cheng Wai Wing Chairman (Independent)

Ho Kwon Ping (Independent)

Koh Boon Hwee

The Committee holds quarterly meetings with the internal auditors and the external auditors of the Company. Its

functions include the following:

(a) review of the audit plans of the internal auditors and external auditors of the Company, the results of their

examination of the Company’s system of internal accounting controls and the co-operation given by the

Company’s officers to the internal and external auditors;

(b) review of the financial statements of the Group and the Company and the auditors’ report thereon before their

submission to the Board of Directors;

(c) nomination of the external auditors for re-appointment; and

(d) review of interested persons transactions and the opinion of the Independent Financial Advisor on the adequacy

of the Company’s methods/procedures for future interested persons transactions.

7 Share Capital and Debentures

In July 2002, the Company issued 1,000 ordinary shares of $0.50 par value at an exercise price of $11.96 each

pursuant to the Employee Share Option Plan.

During the financial year, Singapore Flying College Pte Ltd issued 62,949 preference shares of $1.00 at a premium

of $999 each to the Company for cash and to acquire fixed assets.