Singapore Airlines 2003 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

SIA Annual Report 02/03

Notes to the Financial Statements

31 March 2003

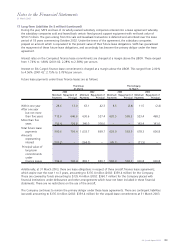

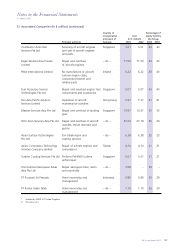

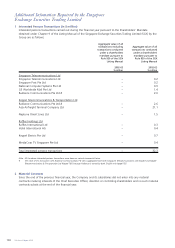

23 Long-Term Investments (in $ million)

The Group The Company

31 March 31 March

2003 2002 2003 2002

Quoted investments at cost

Equity investments 51.4 51.4 432.0 432.0

Provision for diminution – – (380.6) (380.6)

51.4 51.4 51.4 51.4

Non-equity investments 372.7 375.6 372.7 375.6

424.1 427.0 424.1 427.0

Unquoted investments at cost

Trade investments 76.1 76.0 48.8 48.2

Non-equity investments 42.4 44.2 42.4 44.2

118.5 120.2 91.2 92.4

Provision for diminution (25.9) (16.5) (25.9) (16.5)

92.6 103.7 65.3 75.9

Long-term loans 52.9 59.7 – –

569.6 590.4 489.4 502.9

Market value of quoted investments

Equity investments 118.1 95.0 118.1 95.0

Non-equity investments 374.2 372.7 374.2 372.7

492.3 467.7 492.3 467.7

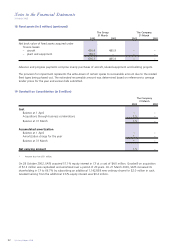

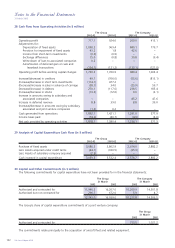

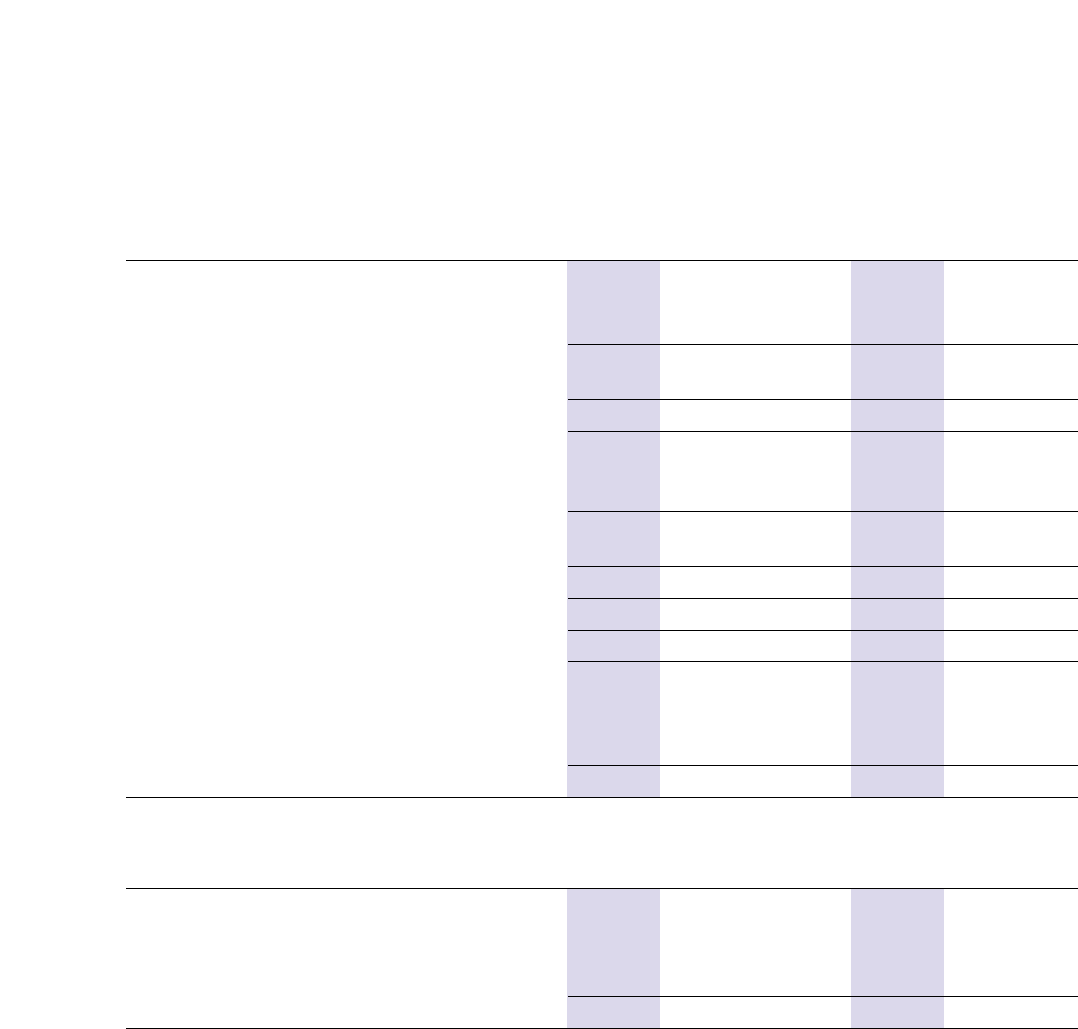

The Group The Company

31 March 31 March

2003 2002 2003 2002

Analysis of provision for diminution in value

of quoted and unquoted investments

Balance at 1 April 16.5 15.4 397.1 15.4

Provided during the year 9.4 1.1 9.4 381.7

Balance at 31 March 25.9 16.5 406.5 397.1

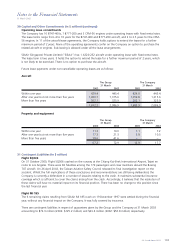

In financial year 2001-02, Air New Zealand Limited ("Air NZ") announced the completion of its recapitalization

package, where 2,166,666,667 new ordinary shares and 1,279,866,438 new convertible preference shares were

issued to the Government of New Zealand at NZ$0.27 per share and NZ$0.24 per share respectively. With the

issuance of the new ordinary and preference shares to the Government of New Zealand, the Company’s equity

interest in Air NZ was diluted from 25.0% to 6.47%. Accordingly, the Group reclassified the net carrying amount of

the Air NZ investment from associated company to long-term investments.

Non-equity investments of $415.1 million (2002: $419.8 million) for the Group and the Company relate to interest-

bearing investments with an effective annual interest rate of 1.93% (2001-02: 4.21%).

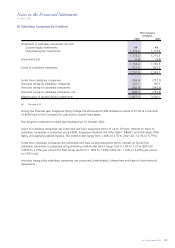

The Group’s long-term loans comprise:

(a) Loan to August Skyfreighter 1994 Trust of $46.0 million (2002: $48.0 million) is unsecured and bears interest

between 1.74% and 2.30% (2001-02: 2.28% to 4.23%) per annum. The loan is repayable on 28 March 2007;

(b) Loan to Taikoo (Xiamen) Aircraft Engineering Company Limited of US$0.5 million (2002: US$0.5 million) is

unsecured, interest free and is expected to be repayable in 2003-04, subject to further review with the investee

company; and

(c) Shareholders’ loan to Hong Kong Aero Engine Services Limited of US$3.6 million (2002: US$6.0 million of which

US$1.3 million is interest free and US$4.7 million is interest bearing). The loan is unsecured and bears interest

between 1.88% and 2.75% (2001-02: 2.38% and 6.20%) per annum. There is no fixed repayment term, and it

is not expected to be repayable within the next 12 months.