Singapore Airlines 2003 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

SIA Annual Report 02/03

Notes to the Financial Statements

31 March 2003

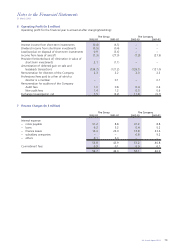

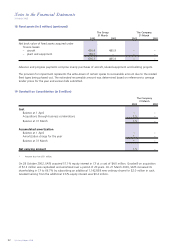

17 Long-Term Liabilities (in $ million) (continued)

During the year, SATS and two of its wholly-owned subsidiary companies entered into a lease agreement whereby

the subsidiary companies sold and leased back certain fixed ground support equipment with net book value of

$159.7 million. The gain arising from this sale and leaseback transaction is deferred and amortized over the lease

period of 18 years commencing October 2002. Under the terms of the agreement, the subsidiary companies

prepaid an amount which is equivalent to the present value of their future lease obligations. SATS has guaranteed

the repayment of these future lease obligations, and accordingly has become the primary obligor under the lease

agreement.

Interest rates on the Company’s finance lease commitments are charged at a margin above the LIBOR. These ranged

from 1.74% to 1.84% (2001-02: 2.28% to 2.38%) per annum.

Interest on SIA Cargo’s finance lease commitment is charged at a margin above the LIBOR. This ranged from 2.00%

to 4.56% (2001-02: 2.75% to 5.78%) per annum.

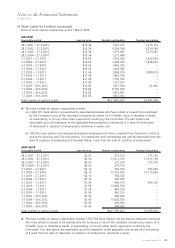

Future lease payments under these finance leases are as follows:

The Group The Company

31 March 31 March

2003 2002 2003 2002

Minimum Repayment of Minimum Repayment of Minimum Repayment of Minimum Repayment of

Payments Principal Payments Principal Payments Principal Payments Principal

Within one year 28.6 13.0 63.1 42.3 8.5 (2.4) 11.5 (2.4)

After one year

but not more

than five years 715.6 646.6 630.6 527.4 620.5 586.3 523.4 468.2

More than five

years 156.4 134.8 340.0 300.0 – – 143.4 141.0

Total future lease

payments 900.6 794.4 1,033.7 869.7 629.0 583.9 678.3 606.8

Amounts

representing

interest (106.2) – (164.0) – (45.1) – (71.5) –

Principal value of

long-term

commitments

under

finance leases 794.4 794.4 869.7 869.7 583.9 583.9 606.8 606.8

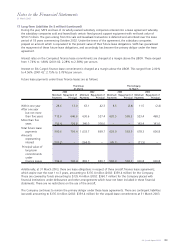

Additionally, at 31 March 2003, there are lease obligations in respect of three aircraft finance lease agreements,

which expire over the next 1 to 3 years, amounting to $135.4 million (2002: $359.4 million) for the Company.

These are covered by funds amounting to $135.4 million (2002: $360.7 million) for the Company placed with

financial institutions under defeasance and other arrangements which have not been included in these financial

statements. There are no restrictions on the use of the aircraft.

The Company continues to remain the primary obligor under these lease agreements. There are contingent liabilities

(secured) amounting to $135.4 million (2002: $359.4 million) for the unpaid lease commitments at 31 March 2003.