Singapore Airlines 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

SIA Annual Report 02/03

Notes to the Financial Statements

31 March 2003

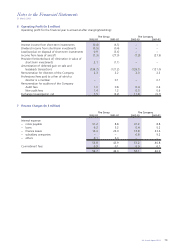

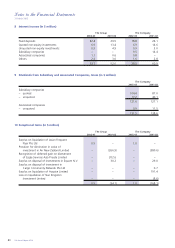

2 Accounting Policies (continued)

(n) Loans and borrowings

Loans, notes payable and other borrowings are recognized at cost.

(o) Aircraft maintenance and overhaul costs

The Company recognizes aircraft maintenance and overhaul expenses on an incurred basis.

Aircraft maintenance and overhaul expenses incurred to meet contractual return conditions for sale and leaseback

aircraft are accrued equally over the remaining lease terms.

(p) Employee Benefits

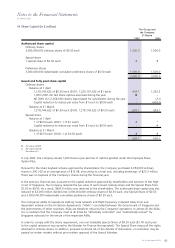

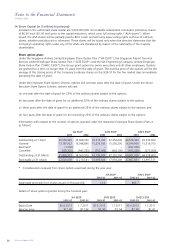

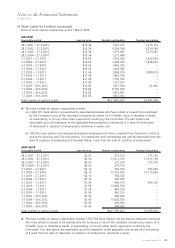

Equity compensation plan

The Group has in place the Singapore Airlines Limited Employee Share Option Plan, the Singapore Airport Terminal

Services Limited Employee Share Option Plan and the SIA Engineering Company Limited Employee Share Option

Plan for granting of share options to senior executives and all other employees. There are no charges to the profit

and loss account upon the grant or exercise of the options. The exercise price approximates the market value of

the shares at the date of grant. Details of the plans are disclosed in Note 14 to the financial statements.

Defined contribution plan

As required by law, the companies in Singapore make contributions to the state pension scheme, the Central

Provident Fund ("CPF"). Certain of the Group’s companies and overseas stations outside Singapore make

contributions to their respective countries’ pension schemes. Such contributions are recognized as compensation

expenses in the same period as the employment that gave rise to the contributions.

Defined benefit plan

The Company contributes to several defined benefit pension and other post employment benefit plans for

employees stationed in certain overseas countries. The cost of providing benefits includes the company

contribution for the year plus any unfunded liabilities under the plans, which is determined separately for each

plan. Contributions to the plans over the expected average remaining working lives of the employees participating

in the plans are expensed as incurred.

(q) Trade creditors

Trade creditors and amounts owing to subsidiary and associated companies are carried at cost.

(r) Forward contracts

Gains and losses arising from forward contracts on foreign currencies and jet fuel are recognized at dates of

maturity.

(s) Revenue

Passenger and cargo sales are recognized as operating revenue when the transportation is provided. The value of

unused tickets and air waybills is included in current liabilities as sales in advance of carriage and recognized as

revenue if unused after two years.

Revenue from the provision of airport terminal services is recognized upon services rendered.

Revenue from engine overhaul, repair and maintenance of aircraft is recognized based on the percentage of

completion of the projects.

(t) Income from investments

Dividend income from investments is recognized when the shareholders’ right to receive the payment is

established.

Interest income from investments and fixed deposits is recognized on an accrual basis.

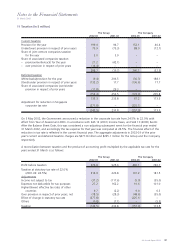

(u) Frequent flyer programme

The Company operates a frequent flyer programme called "KrisFlyer" that provides travel awards to programme

members based on accumulated mileage. A portion of passenger revenue attributable to the award of frequent

flyer benefits is estimated and deferred until they are utilized. These are included under "Deferred revenue" on the

balance sheet. Such unutilized benefits are recognized as revenue upon expiry.

(v) Training and development costs

Training and development costs, including start-up programme costs, are charged to the profit and loss account in

the financial year in which they are incurred.

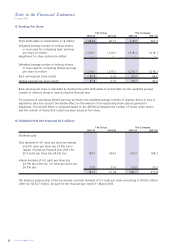

(w) Capitalized loan interest

Borrowing costs incurred to finance progress payments for aircraft and building projects are capitalized until the

aircraft are commissioned for operation or the projects are completed. All other borrowing costs are recognized as

expenses in the period in which they are incurred. $2.9 million (2001-02: $1.3 million) of the Company’s borrowing

costs were capitalized during the year.