Singapore Airlines 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128

|

|

71

SIA Annual Report 02/03

Cash Flow Statements

For the financial year ended 31 March 2003 (in $ million) (continued)

The notes on pages 72 to 107 form an integral part of these financial statements.

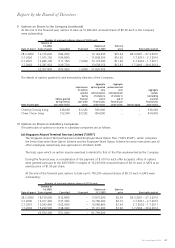

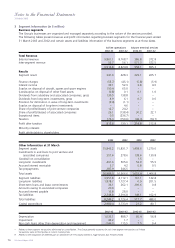

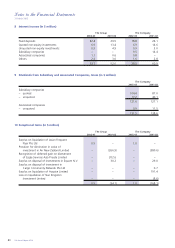

The acquisition of 57.1% equity interest in Country Foods Pte Ltd ("CF") by Singapore Airport Terminal Services Limited

("SATS") has been shown in the statement as a single item. The effects on the individual assets and liabilities are set

out below.

2002-03

Fixed assets 2.9

Stocks 0.5

Trade debtors 2.0

Cash and bank balances 1.9

Creditors (2.6)

Net identifiable assets and liabilities acquired 4.7

Goodwill on acquisition 1.3

Minority interest (2.0)

Cash consideration paid 4.0

Less:

Cash acquired (1.9)

Net cash outflow 2.1

Subsequent acquisition of an additional 9.6% equity interest was by subscription of new shares in CF. The additional

investment of $2.0 million into the subsidiary has no impact on the Group’s cash flow statement.