Singapore Airlines 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 SIA Annual Report 02/03

Financial Review

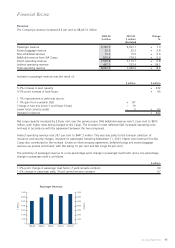

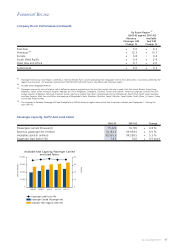

Passenger Yield

Cents / Passenger-km

Cents / Passenger-km

1998-99 1999-00 2000-01 2001-02 2002-03

10.0

9.5

9.0

8.5

8.0

10.0

9.5

9.0

8.5

8.0

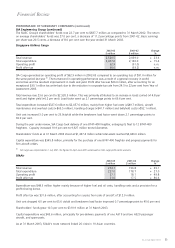

Passenger Yield, Unit Cost and Breakeven Load Factor

2002-03 2001-02 Change

(Restated)

Yield (¢/pkm) 9.1 9.0 + 1.1 %

Unit cost (¢/ask) 6.7 6.4R1 +4.7%

Breakeven load factor (%) 73.6 71.1R1 + 2.5 points

R1 Restated to exclude cargo operating costs to allow meaningful year-on-year comparison.

A weaker SGD contributed to the improvement in passenger yield.

Unit cost rose as the increase in operating expenditure exceeded the increase in capacity.

The spread between passenger load factor and breakeven load factor narrowed to 0.9 percentage point in 2002-03

from 2.9 percentage points the year before.

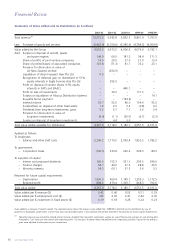

Expenditure

The Company’s expenditure during 2002-03 increased 12.3 per cent, to $7,838 million.

Higher staff costs contributed significantly to the increase. The rise in staff costs was due mainly to (i) a provision to

pay a profit-sharing bonus, equivalent to 3.23 months’ salary, whereas no provision was made the previous year; (ii) an

increased provision for a gratuity fund for staff in Japan, which was found to be underfunded by an annual actuarial

valuation; (iii) staff strength increase from 14,205 to 14,418; (iv) the payment of service increments to all levels of staff;

(v) the restoration of cuts in salary that were imposed after September 11, 2001; and (vi) higher meal and nightstop

allowances for crew, arising from an increase in capacity of 5.3 per cent, in terms of available seat kilometres.

Aircraft maintenance and overhaul (AMO) expenses rose $177 million. The increase was mainly attributable to more

engine and component overhaul/rectification work done during the year. From 2002-03, the Company started making

provisions for AMO costs ($29 million) to meet return conditions of 16 aircraft under sale and leaseback agreements.

This provision also added to the AMO costs.

Depreciation charges were $129 million higher as a result of (i) the commissioning of one B777-200A, two B777-200s,

eight B777-200ERs and one B777-300 during the year; (ii) the full year’s effect of three B747-400s, one B777-200, five

B777-200As, six B777-200ERs and two B777-300s, delivered in the previous year; (iii) a provision for impairment in the

value of spares for fleet types being phased out, i.e. A310-300 and A340-300; and (iv) a write-down of the remaining

carrying value of business class seats replaced by the lie-flat spacebed seats.

Rentals on the lease of aircraft rose $49 million from (i) the full year’s impact of the sale and leaseback of one

B777-200 and two B747-400s last year; and (ii) higher lease rentals for three B747-400s as structured under the lease

agreement. A weaker US Dollar against Singapore Dollar cushioned the increase.