Singapore Airlines 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

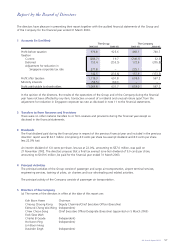

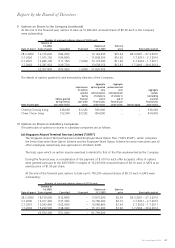

10 Options on Shares in Subsidiary Companies (continued)

(b) SIA Engineering Company Limited ("SIAEC")

The SIA Engineering Company Limited Employee Share Option Plan ("SIAEC ESOP"), which comprises the Senior

Executive Share Option Scheme and the Employee Share Option Scheme for senior executives and all other

employees respectively, was approved on 9 February 2000.

The basis upon which an option may be exercised is identical to that of the Plan implemented by the Company.

During the financial year, in consideration of the payment of $1.00 for each offer accepted, offers of options

were granted pursuant to the SIAEC ESOP in respect of 16,594,800 unissued shares of $0.10 each in SIAEC at

an exercise price of $2.38 per share.

At the end of the financial year, options to take up 60,301,000 unissued shares of $0.10 each in SIAEC were

outstanding:

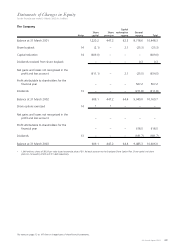

Number of unissued ordinary shares of $0.10 each

Balance at

1.4.2002/ Balance at Exercise

Date of grant Date of grant Cancelled Exercised 31.3.2003 price Exercisable period

28.3.2000 15,079,650 (158,200) (216,700) 14,704,750 $2.05 28.3.2001 – 27.3.2010

3.7.2000 14,067,750 (133,000) (207,100) 13,727,650 $1.95 3.7.2001 – 2.7.2010

2.7.2001 15,431,000 (80,800) (13,200) 15,337,000 $1.41 2.7.2002 – 1.7.2011

1.7.2002 16,594,800 (63,200) – 16,531,600 $2.38 1.7.2003 – 30.6.2012

61,173,200 (435,200) (437,000) 60,301,000

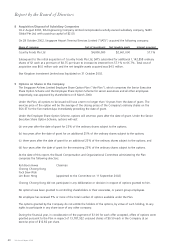

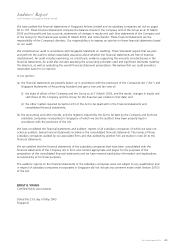

11 Other Statutory Information

(a) Before the financial statements of the Group and of the Company were made out, the directors took

reasonable steps:

(i) to ascertain that proper action had been taken in relation to the writing-off of bad debts and the making of

provision for doubtful debts and had satisfied themselves that all known bad debts had been written-off and

that adequate provision had been made for doubtful debts; and

(ii) to ensure that any current assets which were unlikely to realize their book values in the ordinary course of

business were written-down to an amount which they might be expected so to realize.

(b) At the date of this report, the directors are not aware of any circumstances which would render:

(i) the amount written-off for bad debts or provision for doubtful debts in the Group inadequate to any

substantial extent; and

(ii) the values attributed to current assets in the consolidated financial statements misleading.

(c) At the date of this report, the directors are not aware of any circumstances not otherwise dealt with in the

report or financial statements which would render any amount stated in the financial statements of the Group

and of the Company misleading.

(d) At the date of this report:

(i) there are no charges on the assets of the Group and of the Company which have arisen since the end of the

financial year to secure the liabilities of any other person; and

(ii) there are no material contingent liabilities which have arisen since the end of the financial year.

62 SIA Annual Report 02/03

Report by the Board of Directors