Singapore Airlines 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

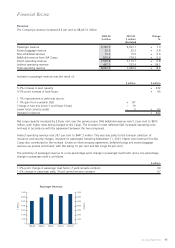

Financial Position of the Group

Net asset value per share for the Group was $8.79 at 31 March 2003, an improvement of 8.8 per cent compared to

31 March 2002.

The Group’s total assets increased 3.2 per cent to $19,184 million as at 31 March 2003.

Shareholders’ funds of the Group stood at $10,709 million on 31 March 2003, up 8.8 per cent from a year ago.

The net debt of the Group as at 31 March 2003 grew 9.5 per cent from a year ago, to $719 million. his was largely

the result of aircraft purchases. The net debt equity ratio remain unchanged at 0.07 time.

The Group’s profitability ratios are as follows:

2002-03 2001-02 Change

% % % points

Return on turnover 10.6 7.4 + 3.2

Return on total assets 5.9 3.8 + 2.1

Return on average shareholders’ funds 10.4 6.4 + 4.0

43

SIA Annual Report 02/03

Financial Review

2,500

2,000

1,500

1,000

500

0

-500

-1,000

Group Net Liquid Assets and Net Debt

$ Million

$ Million

1999 2000 2001 2002 2003

31 March

Net Liquid Assets

Net Debt

2,500

2,000

1,500

1,000

500

0

-500

-1,000

Group Capital Expenditure and

Internally Generated Cash Flow

1.8

1.5

1.2

0.9

0.6

0.3

0

Ratio

$ Million

1998-99 1999-00 2000-01 2001-02 2002-03

5,000

4,000

3,000

2,000

1,000

0

Cash Flow: Capital Expenditure Ratio

Other Capital Expenditure ($ million)

Capital Expenditure on Aircraft,

Engines and Spares ($ million)

Internally Generated Cash Flow ($ million)

140

105

70

35

0

Group Profitability Ratios

Cents

Percent

1998-99 1999-00 2000-01 2001-02 2002-03

Earnings per share (¢)

Return on Turnover (%)

Return on Shareholders' Funds (%)

Return on Total Assets (%)

25

20

15

10

5

0

10

8

6

4

2

0

Group Shareholders’ Funds, Total Assets

and Net Asset Value Per Share

Dollars

$ Million

1999 2000 2001 2002 2003

31 March

Shareholders’ Funds ($ million)

Total Assets ($ million)

NAV per share ($)

25,000

20,000

15,000

10,000

5,000

0