Singapore Airlines 2003 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

SIA Annual Report 02/03

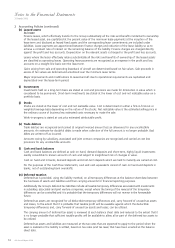

Notes to the Financial Statements

31 March 2003

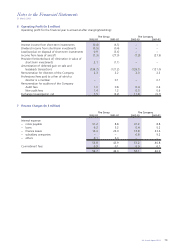

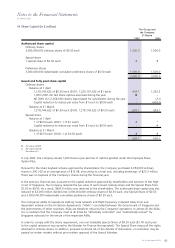

11 Taxation (in $ million)

The Group The Company

2002-03 2001-02 2002-03 2001-02

Current taxation

Provision for the year 199.0 94.7 152.1 40.4

Under/(over) provision in respect of prior years 79.9 (75.3) 88.0 (72.7)

Share of joint venture companies taxation

for the year 3.0 3.0 – –

Share of associated companies taxation:

– provision/(write-back) for the year 21.2 (42.1) – –

– over provision in respect of prior years (14.4) – – –

288.7 (19.7) 240.1 (32.3)

Deferred taxation

(Write-back)/provision for the year (9.4) 206.5 (36.3) 188.1

(Over)/under provision in respect of prior years (132.2) 17.7 (136.6) 17.7

Share of associated companies (over)/under

provision in respect of prior years (11.8) 29.3 – –

(153.4) 253.5 (172.9) 205.8

135.3 233.8 67.2 173.5

Adjustment for reduction in Singapore

corporate tax rate (277.8) – (225.1) –

(142.5) 233.8 (157.9) 173.5

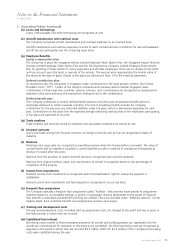

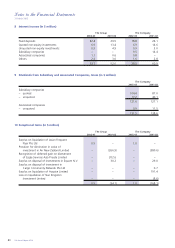

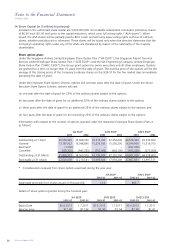

On 3 May 2002, the Government announced a reduction in the corporate tax rate from 24.5% to 22.0% with

effect from Year of Assessment 2003. In accordance with SAS 12 (2001) Income Taxes, and SAS 10 (2000) Events

After the Balance Sheet Date, this was considered a non-adjusting subsequent event for the financial year ended

31 March 2002, and accordingly the tax expense for that year was computed at 24.5%. The financial effect of the

reduction in tax rate is reflected in the current financial year. The aggregate adjustments in 2002-03 of the prior

year’s current and deferred taxation charges are $277.8 million and $225.1 million for the Group and the Company

respectively.

A reconciliation between taxation and the product of accounting profit multiplied by the applicable tax rate for the

years ended 31 March is as follows:

The Group The Company

2002-03 2001-02 2002-03 2001-02

Profit before taxation 976.8 925.6 460.1 740.7

Taxation at statutory tax rate of 22.0%

(2001-02: 24.5%) 214.9 226.8 101.2 181.5

Adjustments

Income not subject to tax (37.2) (117.6) (5.0) (55.0)

Expenses not deductible for tax purposes 27.2 162.2 10.6 101.0

Higher/(lower) effective tax rates of other

countries 9.7 (2.2) 9.0 6.3

Over provision in respect of prior years, net (78.5) (28.3) (48.6) (55.0)

Effect of change in statutory tax rate (277.8) – (225.1) –

Others (0.8) (7.1) – (5.3)

Taxation (142.5) 233.8 (157.9) 173.5