Singapore Airlines 2003 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

SIA Annual Report 02/03

Notes to the Financial Statements

31 March 2003

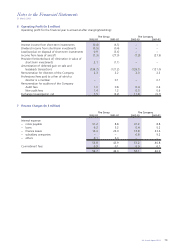

2 Accounting Policies (continued)

(d) Goodwill (continued)

Goodwill arising from business combinations prior to that date has been written-off against Group reserves in the

financial year in which it arose. When determining goodwill, assets and liabilities of the acquired interest are translated

using the exchange rate at the date of acquisition if the financial statements of the acquired interest are not

denominated in Singapore dollars.

(e) Foreign currencies

Foreign currency transactions are converted into Singapore dollars at exchange rates which approximate bank rates

prevailing at dates of transactions, after taking into account the effect of forward currency contracts which expired

during the financial year.

All foreign currency monetary assets and liabilities are translated into Singapore dollars using year-end exchange rates.

Non-monetary assets and liabilities are translated using exchange rates that existed when the values were determined.

Gains and losses arising from conversion of current assets and liabilities are dealt with in the profit and loss account.

For the purposes of the Group financial statements, the net assets of the foreign subsidiary, associated and joint

venture companies are translated into Singapore dollars at the exchange rates ruling at the balance sheet date. The

financial results of foreign subsidiary, associated and joint venture companies are translated into Singapore dollars at

the annual average exchange rates. The resulting gains or losses on exchange are taken to foreign currency translation

reserve.

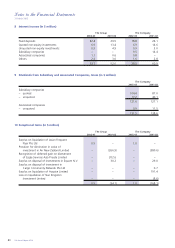

(f) Fixed assets

Fixed assets are stated at cost less accumulated depreciation and any impairment in value. The cost of an asset

comprises its purchase price and any directly attributable costs of bringing the asset to working condition for its

intended use. The cost of all aircraft is stated net of manufacturers’ credit, with subsequent expenditure stated at cost.

Aircraft and related equipment acquired on an exchange basis are stated at amounts paid plus the fair value of the

fixed asset traded-in. Expenditure for additions, improvements and renewal is capitalized and expenditure for

maintenance and repairs is charged to the profit and loss account. When assets are sold or retired, their costs and

accumulated depreciation are removed from the financial statements and any gain or loss resulting from their disposal

is included in the profit and loss account.

The carrying amounts are reviewed at each balance sheet date to assess whether they are recorded in excess of

their recoverable amount, and if the carrying values exceed their recoverable amounts, assets are written-down.

In determining the recoverable amount for fixed asset, the higher of the net selling price and the value in use

of the fixed asset is considered.

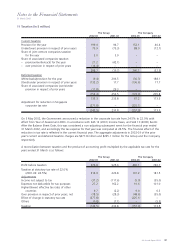

(g) Depreciation of fixed assets

Fixed assets are depreciated on a straight-line basis at rates which are calculated to write-down their cost to their

estimated residual values at the end of their operational lives. Operational lives and residual values are reviewed

annually in the light of experience and changing circumstances.

Aircraft fleet

The Group depreciates its new passenger aircraft, spares and spare engines over 15 years to 10% residual values.

For used passenger aircraft, the Group depreciates them over the remaining life (15 years less age of aircraft) to 10%

residual values.

The Group depreciates its new freighter aircraft over 15 years to 20% residual values. For used freighter aircraft, the

Group depreciates them over the remaining life (15 years less age of aircraft) to 20% residual value.

Land and buildings

Buildings on freehold land and leasehold land and buildings are amortized to nil residual values as follows:

Company owned office premises – according to lease period or 30 years whichever is the shorter.

Company owned household premises – according to lease period or 10 years whichever is the shorter.

Leased premises – according to lease period or 5 years whichever is the shorter.

Flight training equipment

Flight simulators and training aircraft are depreciated over 10 years to nil residual values, and 5 years to 20% residual

values respectively.

Other fixed assets

These are depreciated over 1 to 12 years to nil residual values.

Fully depreciated assets are retained in the financial statements until they are no longer in use. No depreciation is

charged after assets are depreciated to their residual values.