Singapore Airlines 2003 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 SIA Annual Report 02/03

Notes to the Financial Statements

31 March 2003

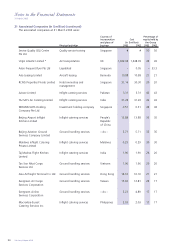

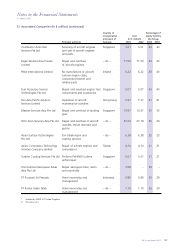

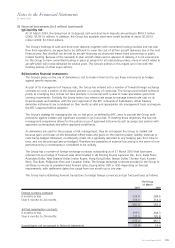

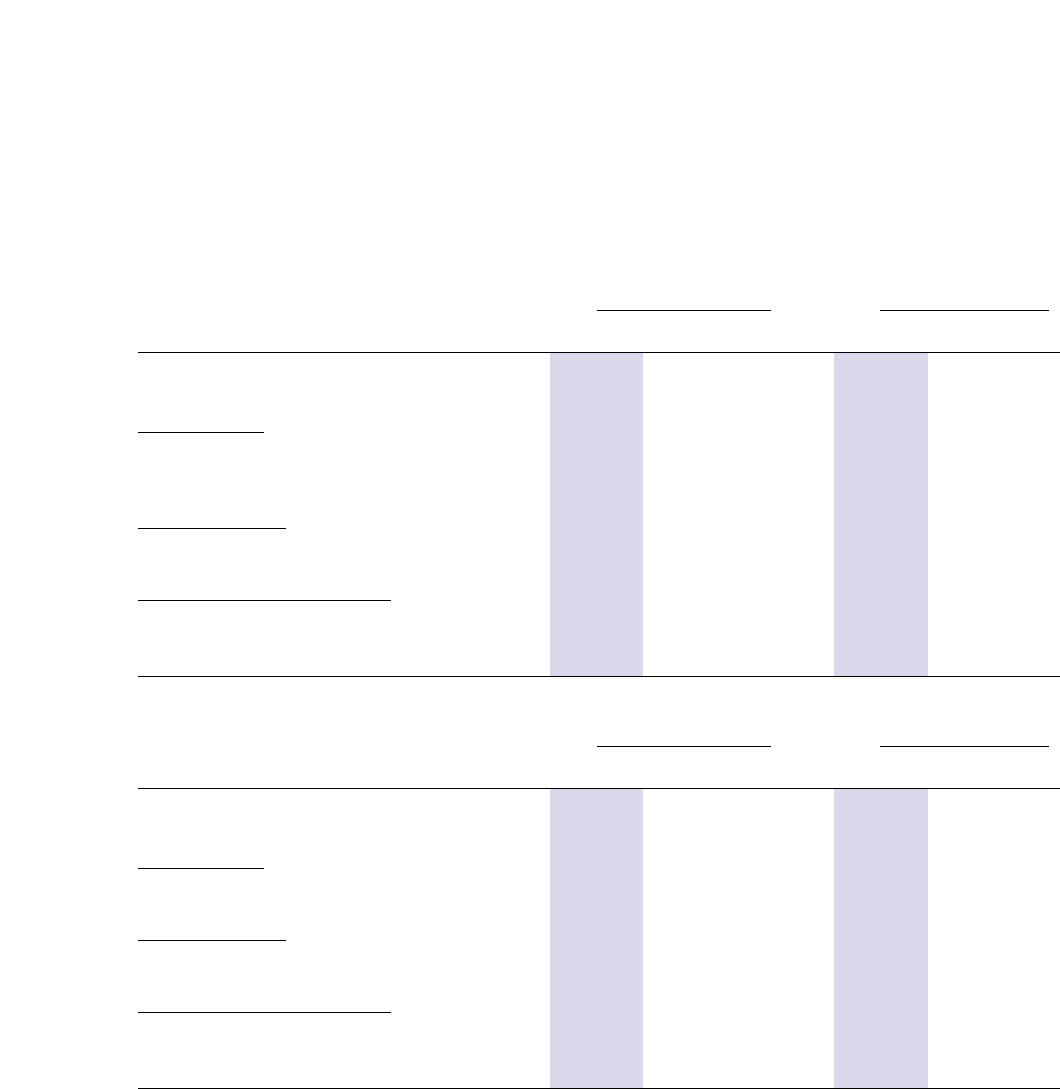

32 Financial Instruments (in $ million) (continued)

(i) Net fair values

The aggregate net fair values of financial assets and financial liabilities which are not carried at fair value on the

Group and Company balance sheets are presented as follows:

Total carrying amount Aggregate net

on Balance Sheet fair value

31 March 31 March

2003 2002 2003 2002

Group

Financial Assets

Long-term investments 569.6 590.4 637.8 631.1

Short-term investments 148.3 34.2 148.4 37.4

Financial Liabilities

Notes payable 1,100.0 1,100.0 1,197.8 1,086.2

Derivative financial instruments

Foreign currency contracts * * (31.1) (3.4)

Jet fuel swap contracts * * 9.2 17.6

Jet fuel options contracts * * (11.5) 0.2

Total carrying amount Aggregate net

on Balance Sheet fair value

31 March 31 March

2003 2002 2003 2002

Company

Financial Assets

Long-term investments 489.4 502.9 557.6 543.6

Financial Liabilities

Notes payable 900.0 900.0 994.5 884.9

Derivative financial instruments

Foreign currency contracts * * (31.1) (3.4)

Jet fuel swap contracts * * 7.6 14.4

Jet fuel options contracts * * (9.4) 0.2

* No balance sheet carrying amounts are shown as these are commitments as at year end.

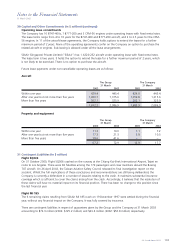

The fair value of quoted investments is generally determined by reference to stock exchange quoted market bid

prices at the close of the business on the balance sheet date. For investments where there is no quoted market

price, fair value is based on either acquisition cost or the attributable net assets of those corporations.

The fair value of loans and borrowings is estimated using discounted cash flow analysis, based on current

incremental lending rates for similar types of lending and borrowing arrangements.

The fair value of forward currency contracts is determined by reference to current forward exchange rates for

contracts with similar maturity profiles. The fair value of jet fuel swap and option contracts is determined by

reference to current forward prices for contracts with similar maturity profiles.

The carrying amounts of the following financial assets and liabilities approximate their fair values due to their

short-term nature: cash and bank balances, bank overdrafts – unsecured, amounts owing by/to subsidiary,

associated and joint venture companies, loans, finance lease commitments, trade debtors and creditors.