Singapore Airlines 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

It is, therefore, important for SIA

management, staff and unions to

embrace the realities of the new

world, to change our mindsets,

and to move forward and do the

right things. Together I am

confident we will overcome these

adversities and emerge stronger.

Running an airline has often been likened to

a flight through turbulence, but like passengers

on the flight, we usually expect to pass through

it unscathed. The turbulence facing the

industry in recent years since 9-11, however,

is not so benign. It is clear that not all airlines

will survive. Worse, there is no visibility about

when this period of turbulence will end or

how it will end. We thought nothing could

be worse than the immediate aftermath of

9-11; we were wrong.

At the start of the financial year, the industry

was on a slow and steady climb, following

a dramatic plunge in the weeks after 9-11.

We were encouraged by the faster-than-

expected recovery but were not misled into

unjustified optimism: consumer confidence in

air travel was still fragile, despite enhanced

security at airports and on board airplanes,

and business travel was still tentative because

of slow economic growth around the world.

Although traffic had begun to return, yields

were still depressed and costs remained high,

with oil prices rising on expectations of war

in Iraq. Despite these trying conditions, we

restored nearly all of the services suspended

after the 9-11 attacks and expanded route

capacity. We also pressed ahead with new

products and services and continued building

alliances on the cargo side of the business.

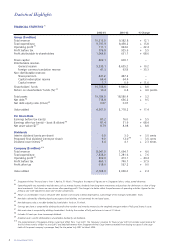

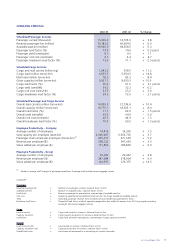

Our results for the half-year reflected how well

we had capitalized on the early recovery from

9-11. Profit attributable to shareholders was

$774 million, an improvement of 474 per cent

over the previous year. A tax writeback of

$278 million due to a cut in the corporate tax

rate contributed significantly to our earnings.

In October, the steady recovery in demand in

the first half of the year was shattered by the

bomb blasts in Bali. SIA immediately set up

extra flights to meet the surge in demand for

seats out of Denpasar. Later, the Airline played

a key role in attracting tourists back to this

perennial hotspot with innovative packages,

including special deals for the Singapore

market that were so enticing that 11,000

packages were sold in just three weeks.

While Bali was beginning its recovery, the

threat of war in Iraq loomed large on the

horizon. After the busy December period,

the market began to soften, with passenger

load factors in February 2003 down to 72 per

cent, compared with 77.6 per cent twelve

months earlier.

SIA Annual Report 02/036

Chairman’s Statement