Singapore Airlines 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

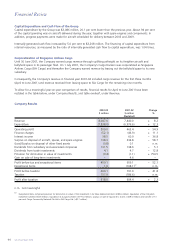

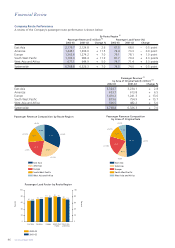

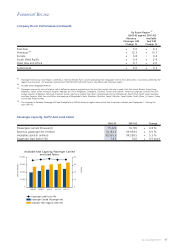

Capital Expenditure and Cash Flow of the Group

Capital expenditure by the Group was $3,086 million, 20.1 per cent lower than the previous year. About 94 per cent

of the capital spending was on aircraft delivered during the year, together with spare engines and components. In

addition, progress payments were made for aircraft scheduled for delivery between 2003 and 2009.

Internally generated cash flow increased by 5.0 per cent to $3,208 million. The financing of capital expenditure from

internal resources, as measured by the ratio of internally generated cash flow to capital expenditure, was 1.04 times.

Corporatization of Singapore Airlines Cargo

Until 30 June 2001, the Company earned cargo revenue through uplifting airfreight on its freighter aircraft and

bellyhold space in its passenger fleet. On 1 July 2001, the Company’s Cargo Division was corporatized as Singapore

Airlines Cargo (SIA Cargo) and thereafter the Company earned revenue by leasing out the bellyhold space to its new

subsidiary.

Consequently, the Company’s revenue in financial year 2001-02 included cargo revenue for the first three months

(April to June 2001) and revenue received from leasing space to SIA Cargo for the remaining nine months.

To allow for a meaningful year-on-year comparison of results, financial results for April to June 2001 have been

restated in the table below, under Company Results, and table overleaf, under Revenue.

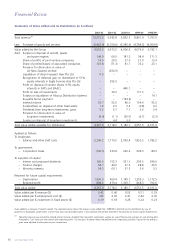

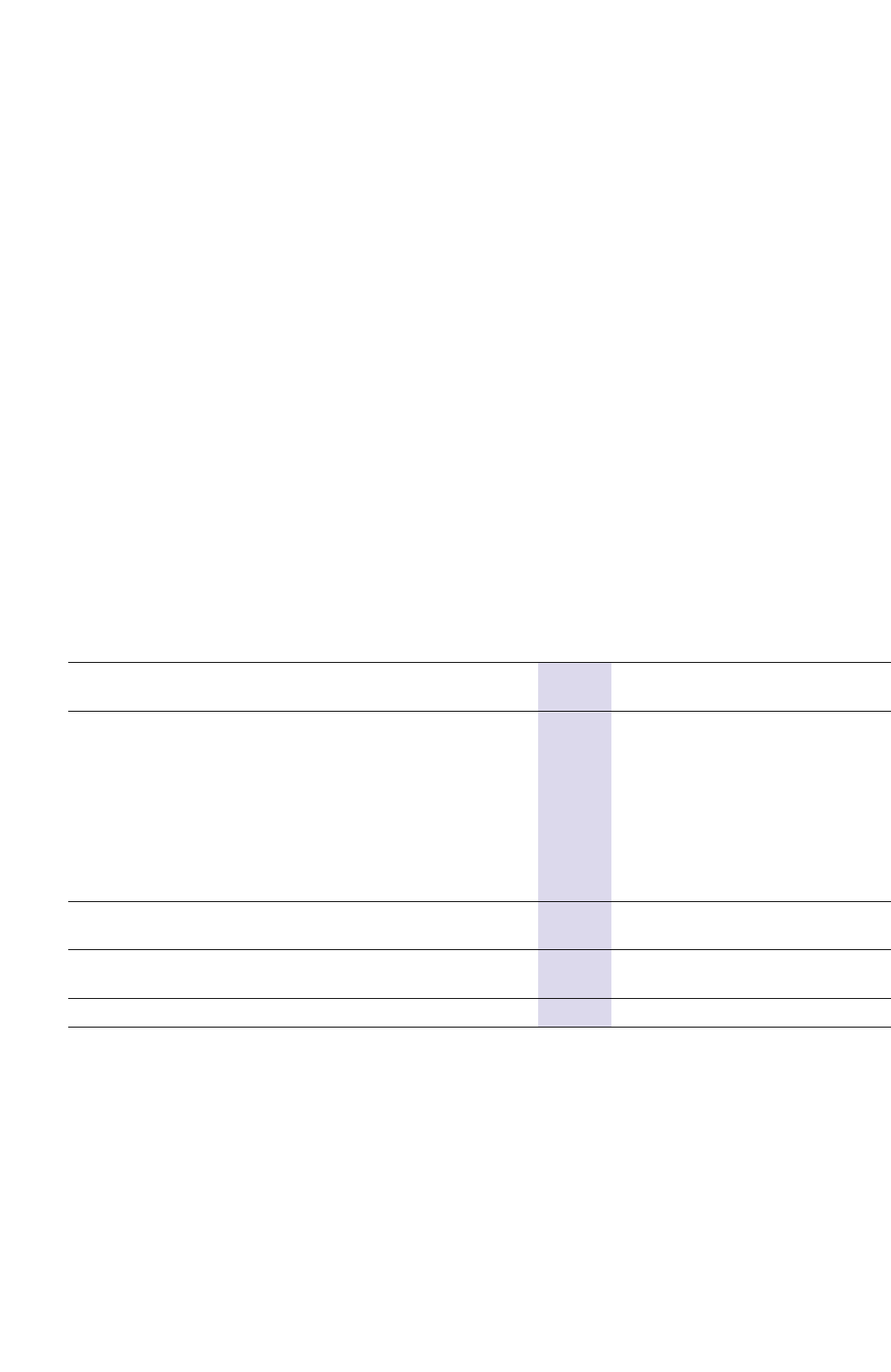

Company Results

2002-03 2001-02 Change

$ million $ million %

(Restated)

Revenue 8,047.0 7,440.0 + 8.2

Expenditure (7,838.0) (6,976.6) + 12.3

Operating profit 209.0 463.4 – 54.9

Finance charges (52.1) (46.9) + 11.1

Interest income 38.5 60.9 – 36.8

Surplus on disposal of aircraft, spares, and spare engines 138.3 334.8 – 58.7

(Loss)/Surplus on disposal of other fixed assets (0.8) 0.1 n.m.

Dividends from subsidiary and associated companies 131.5 138.6 – 5.1

Dividends from trade investments 4.1 4.7 – 12.8

Provision for diminution in value of investments (9.4) (1.1) + 754.5

Gain on sale of long-term investments – 4.6 –

Profit before tax and exceptional items 459.1 959.1 – 52.1

Exceptional items 1.0 (168.1)R1 n.m.

Profit before taxation 460.1 791.0 – 41.8

Taxation 157.9 (186.6) n.m.

Profit after taxation 618.0 604.4 + 2.3

n.m. not meaningful

R1 Exceptional items comprised provision for diminution in value of the investment in Air New Zealand Limited (-$380.6 million), liquidation of Star Kingdom

Investment Limited (-$8.6 million), liquidation of Auspice Limited (+$191.4 million), surplus on sale of Equant N.V. shares (+$29.0 million) and transfer of 51

per cent Cargo Community Network Pte Ltd to SIA Cargo Ltd (+$0.7 million).

44 SIA Annual Report 02/03

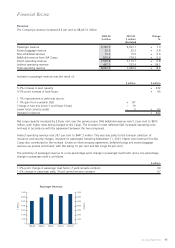

Financial Review