Xerox 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89Xerox 2009 Annual Report

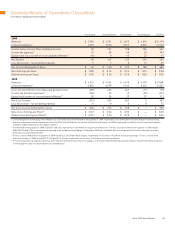

Quarterly Results of Operations (Unaudited)

(in millions, except per-share data)

First Quarter Second Quarter Third Quarter Fourth Quarter Full Year

2009

Revenues $ 3,554 $ 3,731 $ 3,675 $ 4,219 $ 15,179

Costs and expenses(1) 3,476 3,534 3,517 4,025 14,552

Income before Income Taxes and Equity Income 78 197 158 194 627

Income tax expenses(2) 19 59 44 30 152

Equity in net (loss) income of unconsolidated affiliates(3) (10) 9 15 27 41

Net Income 49 147 129 191 516

Less: Net income – noncontrolling interests 7 7 6 11 31

Net Income Attributable to Xerox $ 42 $ 140 $ 123 $ 180 $ 485

Basic Earnings per Share $ 0.05 $ 0.16 $ 0.14 $ 0.21 $ 0.56

Diluted Earnings per Share $ 0.05 $ 0.16 $ 0.14 $ 0.20 $ 0.55

2008

Revenues $ 4,335 $ 4,533 $ 4,370 $ 4,370 $ 17,608

Costs and expenses(1) 4,844 4,279 4,123 4,441 17,687

(Loss) Income before Income Taxes and Equity Income (509) 254 247 (71) (79)

Income tax (benefits) expenses(2) (246) 59 15 (59) (231)

Equity in net income of unconsolidated affiliates(3) 28 29 35 21 113

Net (Loss) Income (235) 224 267 9 265

Less: Net income – noncontrolling interests 9 9 9 8 35

Net (Loss) Income Attributable to Xerox $ (244) $ 215 $ 258 $ 1 $ 230

Basic (Loss) Earnings per Share(4) $ (0.27) $ 0.24 $ 0.30 $ — $ 0.26

Diluted (Loss) Earnings per Share(4) $ (0.27) $ 0.24 $ 0.29 $ — $ 0.26

(1) Costs and expenses include acquisition-related costs of $9 and $63 for the third and fourth quarters of 2009, respectively. Costs and expenses include charges for restructuring

and asset impairments and an equipment write-off of $63, $14 and $388 for the second, third and fourth quarters of 2008, respectively. In addition, the first and fourth quarters

of 2008 include $795 and $(21) for litigation matters.

(2) The third and fourth quarters of 2009 include $1 and $22, respectively, of tax benefits for acquisition-related costs. The first, second, third and fourth quarters of 2008 include

$304, $20, $5 and $124 of tax benefits, respectively, from the above-noted charges. Third quarter 2008 also included a $41 income tax benefit from the settlement of certain

previously unrecognized tax benefits.

(3) The first, second, third and fourth quarters of 2009 include $22, $9, $9 and $6 of charges, respectively, for our share of Fuji Xerox restructuring charges. The first, second, third

and fourth quarters of 2008 include $10, $3, $2 and $1 of charges, respectively, for our share of Fuji Xerox restructuring charges.

(4) The sum of quarterly earnings per share may differ from the full-year amounts due to rounding or, in the case of diluted earnings per share, because securities that are anti-dilutive

in certain quarters may not be anti-dilutive on a full-year basis.