Xerox 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13Xerox 2009 Annual Report

Cash Generation

Our consistent strong cash flow from operations is driven by recurring

revenues; this, along with modest capital investments, will enable us to

pay down the debt associated with the ACS acquisition and continue

to provide a return to shareholders through:

• Expanding through acquisitions our distribution and business

process outsourcing capabilities;

• Buying back shares under our share repurchase program once

debt leverage targets are met; and

• Maintaining our quarterly dividend.

Expanded Earnings

We anticipate expanding our future earnings through:

• Modest revenue growth;

• Driving cost efficiencies to balance gross profit and expense;

• Leveraging share repurchase; and

• Making accretive acquisitions.

Segment Information

Our reportable segments are Production, Office and Other.

We present operating segment financial information in Note 2 –

Segment Reporting in the Consolidated Financial Statements, which

we incorporate by reference here. We have a very broad and diverse

base of customers by both geography and industry, ranging from

SMB to graphic communications companies, governmental entities,

educational institutions and large Fortune 1000 corporate accounts.

None of our business segments depends upon a single customer, or

a few customers, the loss of which would have a material adverse

effect on our business.

We are still evaluating and assessing the impact of the ACS

acquisition on our internal organizational and reporting structure,

as well as its related impact on our reportable segment disclosures.

Accordingly, in the first quarter 2010, we currently expect to report

ACS as a separate reportable segment pending completion of that

evaluation and assessment.

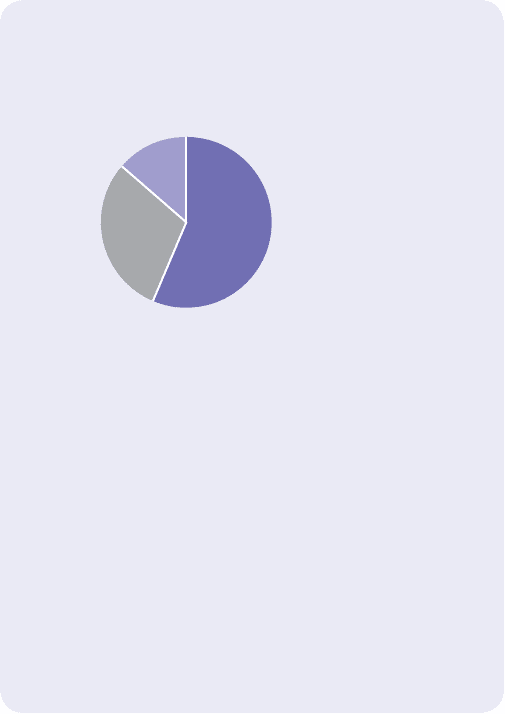

Revenues by Business Segment

(in millions)

n$8,576 Office

Our Office segment serves global, national and small to

mid-size commercial customers, as well as government,

education and other public sector customers.

n

$4,545 Production

Our Production segment provides high-end digital

monochrome and color systems designed for customers

in the graphic communications industry and for large

enterprises.

n$2,058 Other

Our Other segment primarily includes revenue from paper

sales, wide-format systems, value-added services, and

Global Imaging Systems network integration solutions

and electronic presentation systems.

$4,545

$2,058

$8,576