Xerox 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57Xerox 2009 Annual Report

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

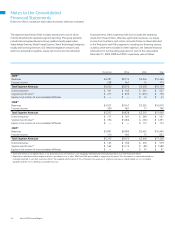

Note 5 – Inventories and Equipment on

Operating Leases, Net

Inventories at December 31, 2009 and 2008 were as follows:

2009 2008

Finished goods $ 772 $ 1,044

Work-in-process 43 80

Raw materials 85 108

Total Inventories $ 900 $ 1,232

Cost of sales in 2008 included a charge of $39 associated with an

Office segment product line equipment and residual value write-off.

The write-off was the result of a 2008 change in strategy reflecting our

decision to discontinue the remanufacture of end-of-lease returned

inventory from a certain Office segment product line following an

assessment of the current and expected market for these products.

The transfer of equipment from our inventories to equipment subject

to an operating lease is presented in our Consolidated Statements of

Cash Flows in the operating activities section as a non-cash adjustment.

Equipment on operating leases and similar arrangements consists of our

equipment rented to customers and depreciated to estimated salvage

value at the end of the lease term. We recorded $52, $115 and $66 in

inventory write-down charges for the years ended December 31, 2009,

2008 and 2007, respectively.

Equipment on operating leases and the related accumulated

depreciation at December 31, 2009 and 2008 were as follows:

2009 2008

Equipment on operating leases $ 1,583 $ 1,507

Accumulated depreciation (1,032) (913)

Equipment on Operating Leases, Net $ 551 $ 594

Depreciable lives generally vary from three to four years, consistent

with our planned and historical usage of the equipment subject to

operating leases. Depreciation and obsolescence expense for equipment

on oper ating leases was $329, $298 and $269 for the years ended

December 31, 2009, 2008 and 2007, respectively. Our equipment

operating lease terms vary, generally from 12 to 36 months. Scheduled

minimum future rental revenues on operating leases with original

terms of one year or longer are:

2010 2011 2012 2013 2014 Thereafter

$385 $281 $181 $94 $46 $45

Total contingent rentals on operating leases, consisting principally of

usage charges in excess of minimum contracted amounts, for the years

ended December 31, 2009, 2008 and 2007 amounted to $125, $117

and $117, respectively.

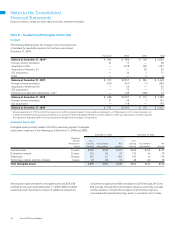

Note 4 – Receivables, Net

Finance Receivables

Finance receivables result from installment arrangements and

sales-type leases arising from the marketing of our equipment. These

receivables are typically collateralized by a security interest in the

underlying assets. Finance receivables, net at December 31, 2009

and 2008 were as follows:

2009 2008

Gross receivables $ 8,427 $ 8,718

Unearned income (1,197) (1,273)

Residual values 19 31

Allowance for doubtful accounts (222) (198)

Finance Receivables, Net $ 7,027 $ 7,278

Less: Billed portion of finance receivables, net (226) (254)

Less: Current portion of finance receivables

not billed, net (2,396) (2,461)

Finance Receivables Due After One Year, Net $ 4,405 $ 4,563

Contractual maturities of our gross finance receivables as of December

31, 2009 were as follows (including those already billed of $226):

2010 2011 2012 2013 2014 Thereafter Total

$3,191 $2,334 $1,622 $910 $327 $43 $8,427

Accounts Receivable Sales Arrangements

We have facilities in the U.S., Canada and several countries in Europe

that enable us to sell, on an ongoing basis, certain accounts receivable

without recourse to third parties. The accounts receivables sold are

generally short-term trade receivables with a payment due date of

less than 60 days. In some of the agreements we continue to service

the sold receivables and hold beneficial interests. When applicable, a

servicing liability is recorded for the estimated fair value of the servicing.

Beneficial interests are included in the caption “Other current assets” in

the accompanying Consolidated Balance Sheets and are recorded at

estimated fair value. The amounts associated with the servicing liability

and beneficial interests were not material at December 31, 2009 and

2008, respectively. Accounts receivables sales for the three years ended

December 31, 2009 were as follows:

2009 2008 2007

Accounts receivables sales $ 1,566 $ 717 $ 326

Fees associated with sales 13 4 2

Estimated impact of sales

on operating cash flows 309 51 147