Xerox 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

Our Business

In the U.S., we own approximately 502 trademarks, either registered

or applied for. These trademarks have a perpetual life, subject to renewal

every 10 years. We vigorously enforce and protect our trademarks.

Marketing and Distribution

We manage our business based on the principal business segments

described earlier. However, we have organized the marketing, selling

and distribution of our products and solutions according to geography

and channel type. We sell our products and solutions directly to

customers through our worldwide sales force and through a network of

independent agents, dealers, value-added resellers, systems integrators

and the Web. In the U.S., GIS continues to expand its network of office

technology suppliers to serve an ever-expanding base of small and

medium-size businesses. We utilize our direct sales force to address

our customers’ more advanced technology, solutions and services

requirements, and use cost-effective indirect distribution channels for

our basic product offerings.

In large enterprises, we follow a services-led approach that enables

us to address two basic challenges facing large enterprises:

• How to optimize infrastructure to be both cost effective and

globally consistent.

• How to improve the value proposition and communication with

their customers.

In response to these needs, we offer a go-to-market approach that

leads with the largest direct sales and service delivery force in the

industry available in a globally consistent manner. This can range

from hardware, software or services in whatever combination is

necessary to meet the needs of that customer.

To ensure our success, we have aligned our R&D investment portfolio

with our growth initiatives of accelerating the transition to color,

enhancing customer value by building on our services leadership

and by strengthening our leadership in digital production printing.

The decrease in RD&E spending for 2009 reflects our successful

integration of the Production and Office development and engineering

infrastructure, which optimizes platform development and time to

market. 2009 R&D spending focused primarily on the development

of high-end communication solutions in digital production printing,

extending our enterprise product portfolio for more-affordable color

and supporting a new generation of workplace solutions, expanding

our services offerings and delivering lower-cost platforms and customer

productivity enablers. With our R&D investments we have continued

to expand the capability of the Xerox® iGen family with both higher

throughput and image quality and high-value solutions to deliver

customized and 1:1 marketing materials. We have also extended

the market reach of our proprietary solid ink technology through the

ColorQube family of products that offer breakthrough running cost

for workgroup color applications. Coupled with our Extensible Interface

Platform, Xerox multifunction devices can now help our customers

streamline document workflows, integrating paper-based documents

into their enterprise applications. Sustaining engineering expenses,

which are the hardware engineering and software development costs

we incur after we launch a product, are included in our RD&E expenses.

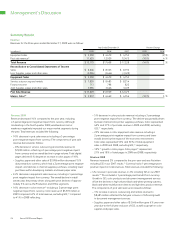

Patents, Trademarks and Licenses

Xerox and its subsidiaries were awarded 706 U.S. utility patents in

2009. On that basis, we would have ranked 24th on the list of companies

that were awarded the most U.S. patents during the year. Including

our research partner Fuji Xerox, we were awarded over 1,130 U.S.

utility patents in 2009. Our patent portfolio evolves as new patents are

awarded to us and as older patents expire. As of December 31, 2009,

we held approximately 9,437 design and utility U.S. patents. These

patents expire at various dates up to 20 years or more from their

original filing dates. While we believe that our portfolio of patents and

applications has value, in general no single patent is essential to our

business or any individual segment. In addition, any of our proprietary

rights could be challenged, invalidated or circumvented or may not

provide significant competitive advantages.

In the U.S., we are party to numerous patent-licensing agreements

and, in a majority of them, we license or assign our patents to others,

in return for revenue and/or access to their patents. Most patent licenses

expire concurrently with the expiration of the last patent identified in

the license. In 2009, we added 10 new agreements to our portfolio of

patent-licensing and sale agreements, and Xerox and its subsidiaries

were licensor or seller in seven of the agreements. We are also a party

to a number of cross-licensing agreements with companies that hold

substantial patent portfolios, including Canon, Microsoft, IBM, Hewlett-

Packard, Océ, Sharp, Samsung and Seiko Epson. These agreements

vary in subject matter, scope, compensation, significance and time.

Our brand is a valuable resource and

continues to be ranked among the

top percentile of the most valuable

global brands.